5 Dividend-Paying Growth Stocks to Buy for a Stable Portfolio

U.S. stock markets are directionless at present as market participants remain clueless about a near-term recession and the Fed’s decision regarding the future movement of interest rate. Year to date, the Dow — the biggest gainer of 2022 — is up marginally by 0.5%.

The broad-market benchmark — S&P 500 Index — has advanced 7.6%. However, the tech-heavy Nasdaq Composite has rallied 17.8%, buoyed by a lower inflation rate and the Fed’s decision to reduce the magnitude of interest rate hike.

However, in the past month, Wall Street remained rangebound on concerns stemming from the regional banking turmoil. In its recently concluded May FOMC meeting, the Fed raised the benchmark interest rate by 25 basis points to the range of 5-5.25%, marking the highest Fed Fund rate since August 2007.

Fed Chairman Jerome Powell indicated that the ongoing rate hike cycle is perhaps reaching its end, although it will depend on the outcome of economic data. The Fed Chair acknowledged that the current banking turmoil in the United States has led to tighter credit conditions, and is likely to impact economic activities.

At this stage, it will be prudent to invest in growth stocks with a favorable Zacks Rank that pay regular dividend to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five dividend -paying growth stocks that have solid upside left for 2023. These stocks have also witnessed positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Growth Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

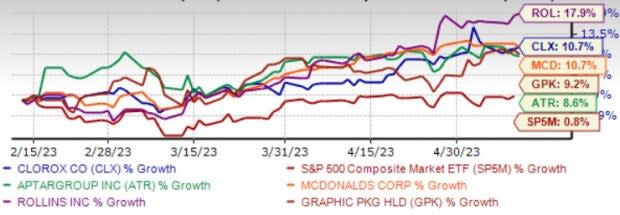

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

The Clorox Co. CLX manufactures and markets consumer and professional products worldwide. CLX benefited from solid demand, cost-saving efforts, strong execution, and pricing actions.

CLX has been on track with its IGNITE strategy and digital investments to transition to a cloud-based platform. Also, continued strength in the international segment bodes well. Fiscal 2023 organic sales are anticipated to be flat to up 3-4%, in sync with our estimate of 1.6% growth.

Clorox has an expected revenue and earnings growth rate of 1.7% and 8.3%, respectively, for the current year (June 2023). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last seven days. CLX has a current dividend yield of 2.8%.

McDonald's Corp. MCD continues to impress investors with robust comps growth. MCD’s increased focus on menu innovation and loyalty program expansion is commendable. MCD is also undertaking every effort to drive growth in international markets. Robust digitalization is likely to help McDonald's in driving long-term growth and capture market share. MCD plans to open more than 1,900 restaurants globally in 2023.

McDonald's has an expected revenue and earnings growth rate of 7.2% and 8.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.7% over the last 30 days. MCD has a current dividend yield of 2.05%.

AptarGroup Inc. ATR designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets. ATR operates through three segments: Aptar Pharma, Aptar Beauty, and Aptar Closures.

ATR’s Beauty segment will gain from the increased demand for beauty and personal care markets. The Pharma segment is witnessing steady demand growth for prescription and consumer healthcare. Reflecting these tailwinds, the 2023 earnings estimates for AptarGroup have lately moved north. The company’s strategic actions and strong balance sheet should also drive growth.

AptarGroup is well-poised to grow on innovative product launches. Backed by its efforts to bring new products into the market, ATR remains the preferred choice for renowned brands worldwide. Efforts to expand its business and invest in capacity expansion to capitalize on the growing demand will aid growth.

AptarGroup has an expected revenue and earnings growth rate of 4.1% and 8.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last seven days. ATR has a current dividend yield of 1.27%.

Rollins Inc. ROL provides pest and termite control services to residential and commercial customers. ROL offers protection against termite damage, insects and rodents to homes and businesses, including food manufacturers, food service establishments, hotels, transportation companies and retailers.

Rollins also offers pest management and sanitation products and services to food and commodity industries, consulting services on border protection related to Australia's biosecurity program and bird control and specialist services.

A balanced approach to organic and inorganic growth has enabled Rollins to achieve a decent revenue growth over the past several years. Organic revenue growth rate is being driven by strong technician and customer retention. ROL’s acquisitions drive led to global brand recognition, a bigger geographical footprint and higher revenues.

Rollins has an expected revenue and earnings growth rate of 10% and 12%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.7% over the last 30 days. ROL has a current dividend yield of 1.23%.

Graphic Packaging Holding Co. GPK provides fiber-based packaging solutions to food, beverage, foodservice, and other consumer products companies. GPK operates through three segments: Paperboard Mills, Americas Paperboard Packaging, and Europe Paperboard Packaging. GPK offers coated unbleached kraft, coated recycled paperboard, and solid bleached sulfate paperboard to various paperboard packaging converters and brokers.

Graphic Packaging has an expected revenue and earnings growth rate of 6% and 30%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.3% over the last seven days. GPK has a current dividend yield of 1.54%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

The Clorox Company (CLX) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance