5 Dividend Growth Stocks to Buy Amid Looming Uncertainty

The U.S. stock market is recovering from the steep losses incurred in the previous year. However, its momentum has slowed recently due to uncertainty surrounding the Federal Reserve's plans to hike rates and concerns about a potential recession. As a result, investors are becoming more interested in dividend investing as a way to generate reliable income. While dividend stocks may not provide significant price appreciation, they offer a steady source of income that can help investors build wealth even when the equity market is volatile.

The stocks discussed in this article have the potential to gain more as they have a favorable Zacks Rank. Notably, stocks with a strong history of year-over-year dividend growth form a healthy portfolio, with a greater scope of capital appreciation than simple dividend-paying stocks or those with high yields. We have selected five dividend growth stocks — Barings BDC BBDC, Arbor Realty Trust ABR, Ares Capital ARCC, Hercules Capital HTGC and TriplePoint Venture Growth BDC TPVG — that could be compelling picks amid market volatility.

Why Dividend Growth?

Mature companies with a solid record of dividend growth are attractive investments due to their stability and capability to withstand market fluctuations, providing a hedge against economic and political uncertainty, as well as stock market volatility. They also offer consistent payouts, which provide downside protection.

These stocks possess strong fundamentals that make them promising long-term investment choices. These include sustainable business models, profitability over an extended period, rising cash flows, good liquidity, a robust balance sheet, and value characteristics. A history of consistent dividend growth suggests that there is a high likelihood of future dividend increases.

In addition, year-over-year dividend growth leads to a healthy portfolio, with a greater potential for capital appreciation than stocks that only pay dividends or those with high yields.

As a result, picking dividend growth stocks appears to be a winning strategy when some other parameters are also included.

5-Year Historical Dividend Growth greater than zero: This selects stocks with a solid dividend growth history.

5-Year Historical Sales Growth greater than zero: This represents stocks with a strong record of growing revenues.

5-Year Historical EPS Growth greater than zero: This represents stocks with a solid earnings growth history.

Top Zacks Rank: Stocks having a Zacks Rank #1 (Strong Buy) and 2 (Buy) generally outperform their peers in all types of market environments.

A portfolio of Zacks Rank #1 stocks has beaten the market in 26 of the last 31 years with an average annual return of 24.5% a year, more than double the S&P 500's 10.7% return. Then again, a portfolio of Zacks Rank #2 stocks has an average annual return of 18.3% a year.

Here are five stocks that fit the bill:

North Carolina-based Barings BDC is an externally managed business development company that primarily makes debt investments in middle-market companies. The company has seen a positive earnings estimate revision of 5 cents for 2023 over the past 60 days and has an expected earnings growth rate of 3.6%.

Barings BDC currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

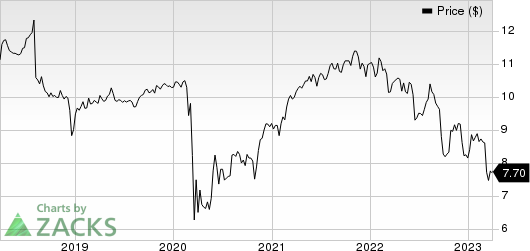

BARINGS BDC, INC. Price

BARINGS BDC, INC. price | BARINGS BDC, INC. Quote

New York-based Arbor Realty Trust is a specialized real estate finance company investing in real estate-related bridge and mezzanine loans, preferred equity, mortgage-related securities and other real estate-related assets. The company has seen a positive earnings estimate revision of 7 cents over the past 60 days for this year. It delivered an average trailing four-quarter earnings surprise of 24.51%.

Arbor Realty Trust flaunts a Zacks Rank #1 at present.

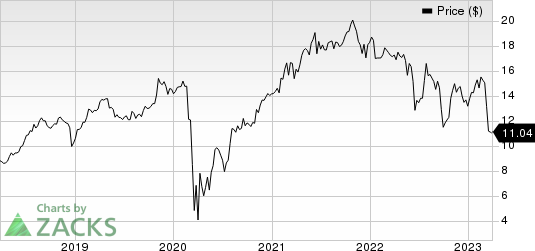

Arbor Realty Trust Price

Arbor Realty Trust price | Arbor Realty Trust Quote

Maryland-based Ares Capital is a specialty finance company, which primarily invests in U.S. middle-market companies. The company has witnessed a positive earnings estimate revision of 8 cents over the past 60 days for 2023, with an expected earnings growth rate of 16.8%.

Ares Capital currently has a Zacks Rank #2.

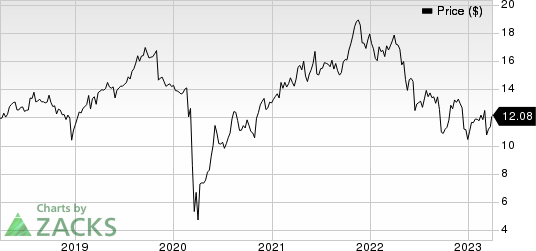

Ares Capital Corporation Price

Ares Capital Corporation price | Ares Capital Corporation Quote

California-based Hercules Capital is a specialty finance company that provides venture capital to technology and life science-related companies. The company has seen a positive earnings estimate revision of 10 cents over the past 60 days for this year, with an expected earnings growth rate of 25%.

Hercules Capital presently has a Zacks Rank #2.

Hercules Capital, Inc. Price

Hercules Capital, Inc. price | Hercules Capital, Inc. Quote

California-based TriplePoint Venture Growth BDC is an externally managed, closed-end, non-diversified management investment company. The company's investment objective is to maximize its total return to stockholders primarily in the form of current income and, to a lesser extent, capital appreciation. The company has seen a solid earnings estimate revision of 19 cents over the past 60 days for this year, with an expected earnings growth rate of 3.1%.

TriplePoint Venture Growth BDC currently sports a Zacks Rank #1.

TriplePoint Venture Growth BDC Corp. Price

TriplePoint Venture Growth BDC Corp. price | TriplePoint Venture Growth BDC Corp. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

Arbor Realty Trust (ABR) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

BARINGS BDC, INC. (BBDC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance