40% of Americans say recession has already begun

By most commonly used measures, the U.S. economy is robust. But nearly 40% of Americans say they feel like the next recession is already here or will start in the next 12 months, according to a new Bankrate.com survey.

Some of that is because the fruits of the 10-plus-year bull market and strong job market hasn’t reached all Americans.

“If you haven’t had a raise in a few years, if you’re still living paycheck-to-paycheck not making any headway, it’s tough to feel like the economy is doing great,” says Bankrate’s chief financial analyst Greg McBride. “The unemployment is the lowest in 50 years – doesn’t mean that everybody’s got a job, doesn’t mean that everybody’s doing great.”

Despite the fact that many Americans (39%) say that the economy is “not so good,” only 35% of average consumers actually have the minimum 3-5 months of emergency savings that many experts advocate for as a safety net.

In fact, 28% of Americans have no emergency savings at all, up from 23% last year, the highest level in three years. Only 18% of Americans can manage to get by for six months or more in case of an emergency, according to Bankrate, which surveyed over 1,000 people.

“Six months is a guideline for people, it’s a destination, but it’s not a one-size-fits-all answer. And the fact is whether the goal is six months in expenses or more than that, the vast majority of Americans are far short of that marker,” says McBride. “In the last recession we had at one point seven million people who had been out of work longer than six months, so even an adequately funded emergency cushion could be stretched pretty thin during a period of prolonged joblessness.”

Full-steam economy

May’s unemployment rate stayed at 3.6%, a 49-year low. The GDP’s 2.9% growth in 2018 was its best annual performance since the Great Recession; and Q1 GDP growth was 3.1%. Major stock indexes are near all-time highs. Inflation is low.

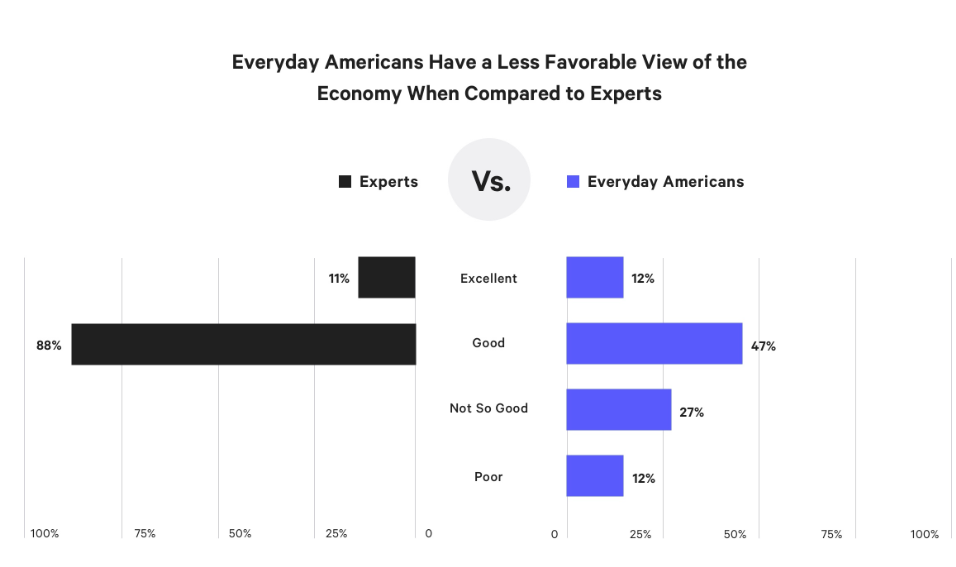

Bankrate’s survey found that 88% of “experts” say the economy is “good,” and 11% say it’s “excellent.

Nevertheless, McBride highlights the risk of “talking ourselves into a recession.”

“Consumers that feel the economy is weak, they’re going to be more hesitant to spend and that can be a headwind to the economy,” he said. “Business owners that see the economy as weak – they’re not going to hire people, they’re not going to make capital investments and all of that could add up to a collective headwind to economic growth that’s enough to stall out the expansion.”

Political views and household income brackets are also impacting Americans views of the economy. More than three-quarters of Republicans rate the economy as “excellent,” but only 49% of Democrats share that rosy view.

Among households with income below $30,000, half rate the economy as “not so good.” Just 31% of households share that take when their income is above $30,000.

“Regardless of whether you believe the economy is chugging along or on the brink of collapse, most of us aren’t ready to face another slowdown,” Bankrate says.

Follow Sibile Marcellus on @SibileTV

More from Sibile:

Here’s what graduates regret the most about college

Women are about to reach a new workplace milestone

Southern states that voted for Trump see lower incomes than rest of U.S.

Trump is to blame for strong dollar, not the Fed: Economist

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance