What Wall Street expects from earnings season

Over the next several weeks, America’s biggest companies will announce their third quarter financial results. And while, analysts expect there to be some earnings growth, their estimates vary greatly and their analysis of the earnings drivers conflict a bit.

According to a recent Factset survey, analysts estimate the S&P 500 (^GSPC) will have a meager 2.8% earnings per share (EPS) growth for Q3. The insurance industry is expected to be the biggest drag as hurricane related losses mean billions of dollars worth of payouts that won’t hit their bottom lines. Excluding the insurance industry, Factset says EPS growth estimates would be closer to 4.9%.

Here’s a look at what Wall Street’s top strategists are telling clients:

JPMorgan: Operating profit margins will expand. Strategist Dubravko Lakos-Bujas is bullish, and he expects closer to 8% EPS growth. A key driver of this EPS surprise is his expectation for 5% sales growth on fatter profit margins. He explained: “This ramp up in sales growth comes at a time when US capacity utilization rate is still low by historical comparison (76.1% vs. >80% prior cycle) and wage growth remains below expectation. The convergence of these factors bodes well for operating margin expansion (EBITDA margin has shown little expansion during this cycle).” He has a 2,550 year-end target for the S&P.

Bank of America: “Guidance better be great.“ Strategist Savita Subramanian expects EPS growth of 4%, which is just modestly stronger than the consensus. From her perspective, the stock market has fully priced this in. In other words, expectations are already high. And for the rally to continue, companies will have to say something very bullish about the future. She said: “A solid earnings season may not be enough to move the market higher — Valuations are lofty, focus has increasingly shifted to policy, and last quarter, for the first time since the peak of the tech bubble, beats were not rewarded. We would again expect guidance—which has remained the strongest in nearly seven years—could once be the swing factor.” She has a 2,450 year-end target for the S&P.

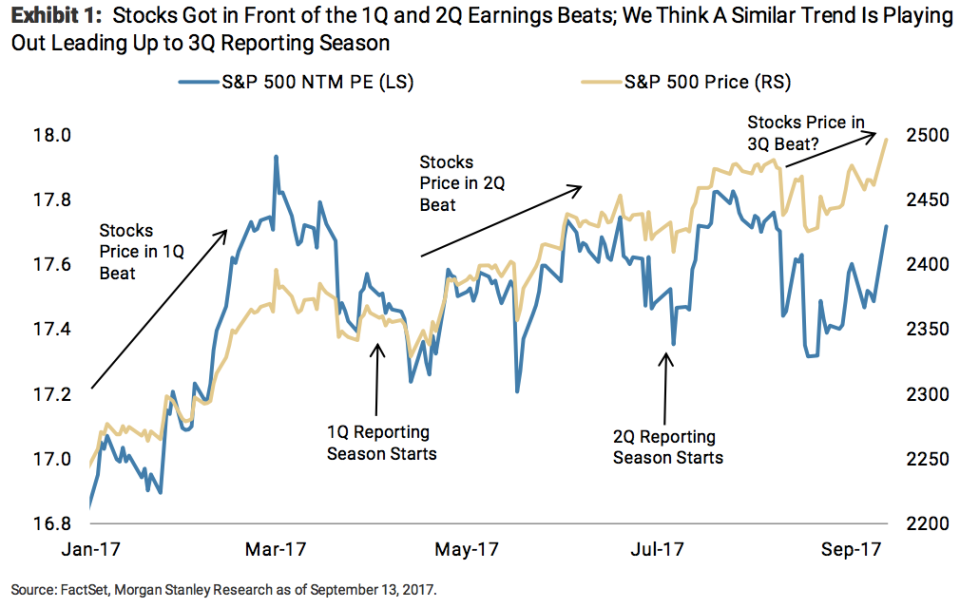

Morgan Stanley: Expect a pullback. Strategist Michael Wilson does not expect earnings growth of less than 3%. And so, he agrees with Subramanian in that stocks have already priced in what’s expected to be better-than-expected growth in Q3 EPS. However, he’s more cautious and warns stocks will actually dip as the news comes out, repeating a pattern we saw during Q1 and Q2 earnings season (see chart below). He said: “We would expect to see a pull back or consolidation as earnings are actually reported—i.e. a sell the news event—before it can make its next surge toward our 1Q18 2700 target.”

Goldman Sachs: It’s all about tax reform. Strategist David Kostin splashed it across the top of his latest weekly note: “Tax reform enthusiasm will trump deceleration in EPS growth.” Kostin agrees that this round of earnings will be plagued by one-time hurricane-related distortions, though he expects EPS growth to beat expectations, coming in at 5%. It’s worth noting that he is the most bearish of the big strategists: He expects the S&P to fall to 2,400 by the end of the year.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Yahoo Finance

Yahoo Finance