4 Stocks to Buy as Utilities Brave Coronavirus Bloodbath

With no vaccine available yet, the coronavirus pandemic continues to wreak havoc on human lives, communities and industries. According to a Johns Hopkins University data, the number of infected people across the world has crossed 1,350,520, with more than 74,850 deaths and 285,320 recoveries. Confirmed cases in the United States have gone past 368,440, with more than 10,990 deaths and fortunately, 19,900 recoveries.

Industries Crippled, Investors Spooked

Since there is no cure available for COVID-19 right now, the only option is to prevent contamination by practicing social distancing and self isolation. Strict imposition of these measures is in place across countries around the world under lockdowns.

Efforts to contain the virus have distorted supply chains of almost every business, with several industries coming to a near standstill and many other witnessing massive slowdowns. Leisure and hospitality, professional and business services, retail and construction are among those hit hardest in the United States this March.

The Labor Department on Friday reported a 701,000 payroll plunge — marking the first decline since 2010 and the worst since March 2009. The unemployment rate surged 0.9 percentage point to 4.4%, marking the highest over-the-month increase since January 1975.

Major indices have nosedived on a year-to-date basis, that’s from around the time when the outbreak initiated. The Dow Jones Industrial Average has declined 19.7% year to date, while the S&P 500 and Nasdaq Composite depreciated 22% and 16.4%, respectively. The Russell 2000 and FTSE 100 slid 36.2% and 24.1%, respectively.

With too much uncertainty about the duration and extent to which the mayhem can weigh on the economy and the market, Wall Street experts have warned investors for a bumpy road ahead.

What Makes Utilities Investment Options Amid this Crisis

This mounting uncertainty might force investors to remain on the sidelines but they shouldn’t avoid equities altogether.

Domestic-focused Utilities are good options now as their products are in constant demand irrespective of the market volatility. Utilities are believed to be defensive stocks as not many people will be willing to live without electricity, gas and water.

Moreover, rate cuts help utilities get funds from the market at a cheaper rate and boost their infrastructure-strengthening initiatives. The demand for utility services does not fluctuate much even during weak economic conditions.

Here’re Some Great Picks

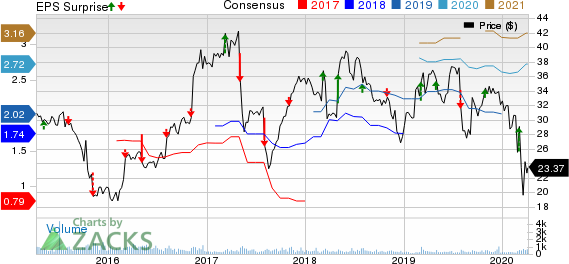

MYR Group Inc. MYRG provides electrical construction services in the United States and Canada. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate calls for the company’s 2020 earnings to grow 20.4% year over year to $2.72. The consensus estimate for the year moved 5% upward over the past two months.

MYR Group, Inc. Price, Consensus and EPS Surprise

MYR Group, Inc. price-consensus-eps-surprise-chart | MYR Group, Inc. Quote

TransAlta Corporation TAC is a non-regulated electricity generation and energy marketing company that operates in the United States, Canada and Western Australia. The company flaunts a Zacks Rank #1, at present.

The Zacks Consensus Estimate for the company’s current-year earnings suggests more than 100% year-over-year improvement. The consensus estimate for this year climbed 50% in two months’ time.

TransAlta Corporation Price, Consensus and EPS Surprise

TransAlta Corporation price-consensus-eps-surprise-chart | TransAlta Corporation Quote

American States Water Company AWR provides water and electric services in the United States. The company currently carries a Zacks Rank #1.

The Zacks Consensus Estimate for the company’s ongoing-year earnings suggests 4.7% year-over-year improvement. The consensus mark moved 3.2% north in two months’ time.

American States Water Company Price, Consensus and EPS Surprise

American States Water Company price-consensus-eps-surprise-chart | American States Water Company Quote

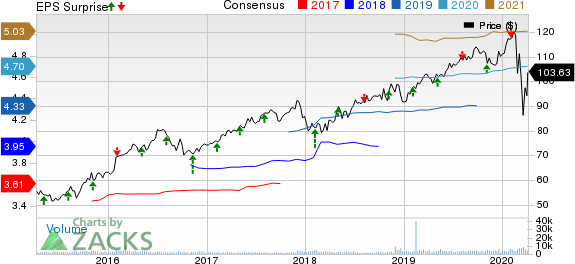

Atmos Energy Corporation ATO is involvedin the regulated natural gas distribution, and pipeline and storage businesses in the United States. Currently, the stock carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for the company’s fiscal 2020 earnings indicates a year-over-year increase of 8.1%. The consensus mark moved up 0.2% in the past two months.

Atmos Energy Corporation Price, Consensus and EPS Surprise

Atmos Energy Corporation price-consensus-eps-surprise-chart | Atmos Energy Corporation Quote

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American States Water Company (AWR) : Free Stock Analysis Report

MYR Group, Inc. (MYRG) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance