4 Reasons Why Tractor Supply (TSCO) Looks Poised for Growth

Tractor Supply Company TSCO appears to be a lucrative pick with solid growth prospects. The company has been in investors’ good books, owing to robust product demand, steady progress on its Life Out Here strategy, e-commerce strength and its Neighbor's Club loyalty program.

Sturdy demand for everyday merchandise, including consumable, usable and edible products, as well as year-round products, bodes well for TSCO’s comparable sales (comps) growth.

The company boasts a robust sales surprise trend, which continued in second-quarter fiscal 2022. Tractor Supply’s top line surpassed the Zacks Consensus Estimate, marking the ninth straight quarter of a sales beat. Meanwhile, the bottom line was in line. Both metrics grew year over year.

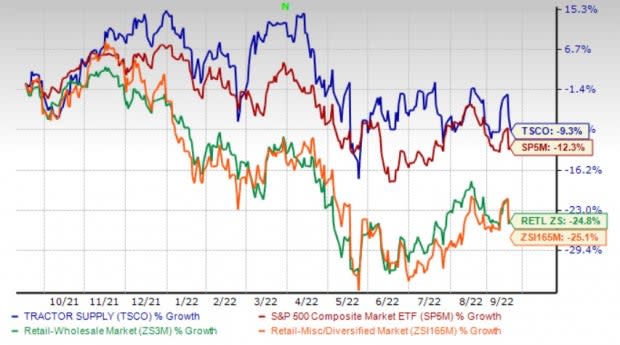

The solid sales trend has supported the Zacks Rank #3 (Hold) company’s performance in the past year, which has outperformed the industry and the sector. Although TSCO lost 9.3% in a year, it fared better than the industry’s decline of 25.1% and the sector’s fall of 24.8%. The stock also compares favorably with the S&P 500’s decline of 12.3% in the same period.

Image Source: Zacks Investment Research

However, TSCO has been witnessing rising inflationary and supply-chain issues. Higher product cost inflation and transportation costs have been hurting Tractor Supply’s gross margin.

Let’s look into some aspects that are likely to keep the stock going in the long run.

Life Out Here Strategy

The company has been progressing well with its Life Out Here Strategy, which is based on five key pillars — customers, digitization, execution, team members and total shareholder return. Earlier, TSCO launched the Field Activity Support Team and implemented various technology and service enhancements across the enterprise.

As part of the plans, it revised the long-term financial growth targets for 2022-2026. Management envisions net sales growth of 6-7%, while comps are expected to grow 4-5%. The operating margin is expected to be 10.1-10.6%, up from the earlier mentioned 9-9.5%. Earnings per share are likely to grow 8-11%, up from the previously stated 8-10%.

Store Initiatives

Tractor Supply is persistently focusing on its growth initiatives, which include the expansion of its store base and the incorporation of technological advancements to induce traffic and drive the top line. The company is on track with Project Fusion remodels and Side Lot transformation to remain nationally strong and locally relevant. This will also help improve store productivity by bringing the latest merchandising strategies to life. Management anticipates transforming the side lots into 100 locations in 2022. These have been significant investments in stores.

‘ONETractor’ Plan

Tractor Supply is focused on integrating its physical and digital operations to offer consumers a seamless shopping experience. The company’s ‘ONETractor’ strategy, aimed at connecting store and online shopping, has been a key driver. TSCO’s omni-channel investments include curbside pickup, same-day and next-day delivery, a re-launched website and a new mobile app.

The company’s e-commerce business grew 7% year over year in the second quarter, driven by double-digit sales for May and June. The mobile app witnessed double-digit growth, accounting for 15% of the total e-commerce sales in the quarter. Tractor Supply exited the second quarter with 26 million Neighbor's Club members. Management is likely to reach more than $2 billion in sales by 2026.

Upbeat Outlook

Management remains optimistic about its growth prospects in 2022, driven by continued momentum in sales, cost-control measures and better inventory. The company expects net sales of $13.95-$14.05 billion for 2022, with comps growth of 5.2-5.8%. The operating margin is anticipated to be 10.2%. Net income is expected to be $1.07-$1.09, with earnings per share of $9.48-$9.60. The view does not include the impacts of the Orscheln Farm acquisition as it is currently subjected to customary closing conditions.

Wrapping Up

Given the aforementioned strengths, Tractor Supply looks well-placed despite inflationary product costs, supply-chain issues, transportation costs and an unfavorable product mix. The company is likely to retain momentum in the long term, backed by its focus on improving the shopping experience.

The Zacks Consensus Estimate for TSCO’s 2022 sales and earnings suggests growth of 10.7% and 11.3%, respectively. It has a trailing four-quarter earnings surprise of 10.2%.

Stocks to Consider

Here are three better-ranked stocks to consider — Ulta Beauty ULTA, Kroger KR and Designer Brands DBI.

Ulta Beauty, a leading beauty retailer in the United States, currently sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 32.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ulta Beauty’s current financial-year sales suggests growth of 13.7% from the year-ago period’s reported figures. ULTA has an expected EPS growth rate of 11.9% for three-five years.

Kroger, which provides an array of goods ranging from household essentials, groceries and electronics to toys and apparel for men, women and kids, currently carries a Zacks Rank #2 (Buy). KR has a trailing four-quarter earnings surprise of 15.7%, on average.

The Zacks Consensus Estimate for Kroger’s current financial-year sales and EPS suggests growth of 7.8% and 9.2%, respectively, from the year-ago period’s reported figures. KR has an expected EPS growth rate of 11.7% for three-five years.

Designer Brands, a retailer of footwear and accessories for women, men, and kids primarily in North America, currently carries a Zacks Rank #2. DBI has a trailing four-quarter earnings surprise of 55.1%, on average.

The Zacks Consensus Estimate for Designer Brands’ current financial-year sales and earnings suggests growth of 6.9% and 23.5%, respectively, from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance