4 Reasons Athletic Apparel Stocks May Have More Room to Run

The retail industry has had its ups and downs in recent years, but the standout of the industry has been athletic apparel. Shares of Nike (NYSE: NKE), Adidas (NASDAQOTH: ADDYY) (NASDAQOTH: ADDDF), and lululemon athletica (NASDAQ: LULU) have significantly outperformed the SPDR S&P Retail index over the last 10 years. The one exception has been Under Armour (NYSE: UA) (NYSE: UAA), which has had its share of issues lately.

While top athletic wear stocks are not cheap and could have limited upside potential in the short term, there is tremendous long-term growth potential for the leading brands.

Here are four reasons why athletic apparel stocks have further room to run over the next 10 years.

IMAGE SOURCE: GETTY IMAGES.

1. Innovation driving growth

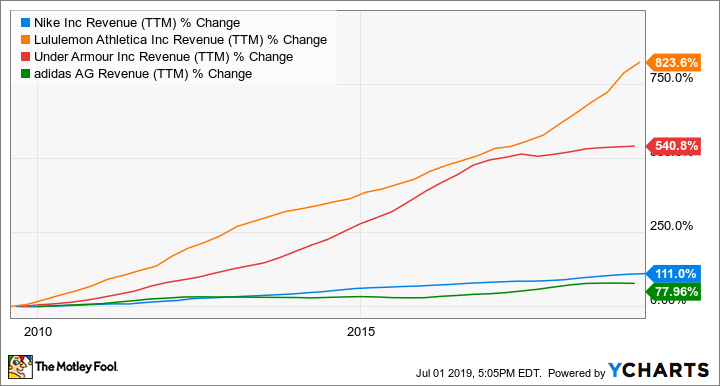

The top athletic brands have seen steadily rising revenue over the last decade, thanks to increasing interest in healthy lifestyles and the athleisure trend.

NKE revenue (TTM). Data by YCharts.

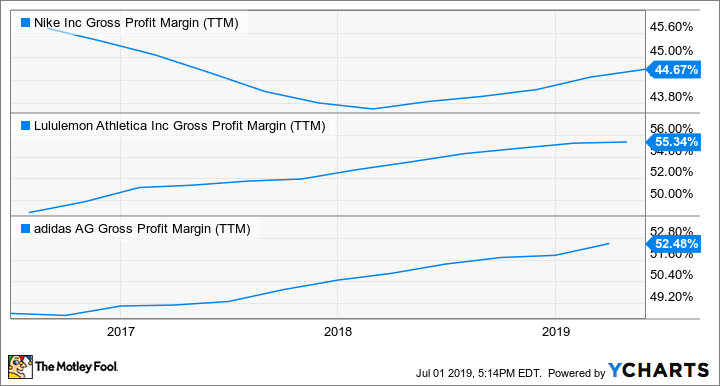

Athletic brands are using their increased scale to get faster at releasing new styles to the marketplace, which allows them to sell more merchandise at full price while avoiding markdowns. Additionally, the increased focus on e-commerce channels is starting to push margins higher for Nike, while Lululemon and Adidas have already been reaping the benefits, as you can see here:

NKE gross profit margin (TTM). Data by YCharts.

The rising demand for lifestyle athletic wear (or athleisure), and the effort by the top brands to release new styles at a faster pace throughout the year seems to be reinforcing their brand power in a crowded apparel industry. Because of social media, fashion styles are changing faster than ever, so the apparel brands that can respond to those shifts in the timeliest manner stand to win in the long run.

One survey found that Nike, Adidas, and Under Armour rank as the top three apparel brands among millennials -- ahead of Ralph Lauren, Levi Strauss, and L Brands' Victoria's Secret -- which may signal that the athletic brands are already winning the battle.

2. Athleisure is likely here to stay

One of the defining fashion trends of this decade has been athleisure, and it seems only to be gaining momentum. Sneakers have been featured during Paris Fashion Week of all places, which is not surprising, given that women's sneaker sales soared last year while sales of high heels fell. Nike, in particular, sees a significant long-term opportunity to grow sales of women's apparel, as sales in the women's category have started to pick up recently.

Fashion trends come and go, but the growth in footwear and athletic apparel in recent years is consistent with the secular shift in everyday dress. Over the last century, clothing styles have been getting more and more casual, and that is playing into the hands of the apparel brands that are in business to make the most comfortable and functional clothing available. This partly explains why Lululemon, and its "science of feel" approach to design, has seen exploding sales over the last 10 years.

IMAGE SOURCE: GETTY IMAGES.

3. The sneaker market is gaining steam

The most important indicator that athletic apparel stocks still have room to run is the forecast for footwear sales. The sneaker market is expected to reach $95 billion by 2025, representing an annual growth rate of 5%, according to Grand View Research. This would provide a tailwind for Nike and Adidas, since both companies derive most of their revenue from footwear.

There are a few reasons why sneaker sales should keep growing. For one, there is the growing interest in fitness around the world, particularly in China, which is the fastest-growing market for Nike and Lululemon.

A second reason is customization. Nike and Adidas are investing in a variety of colors and materials options for best-selling styles. Nike credited the expanding variety of choices for its growth last quarter.

Also, Adidas and Nike are continuing to effectively use celebrities and well-known apparel designers to craft unique sneaker styles in limited quantities that drive brand heat. One of the more noteworthy collaborations in recent years was Adidas' partnership with music artist Kanye West, which was very effective in creating the Yeezy Boost 350 v2, one of the best-selling sneakers of 2018.

Adidas just recently announced a collaboration with pop star Beyonce to create an exclusive line of sneakers and apparel that could be huge for the brand.

4. Exploding sneaker resale market

The growth of the sneaker market has created a healthy resale market, which suggests that there is much more demand for lifestyle sneakers that Nike and Adidas are not fully capturing. Three resale sites have emerged during the sneaker boom: StockX, Stadium Goods, and GOAT. It's common to see unique pairs of Air Jordans or Yeezys sell above the original retail price on these marketplaces.

StockX alone is estimated to be worth $1 billion, but the whole sneaker resale market is projected to reach $6 billion by 2025, according to research firm Cowen. The growth of the resale market is a positive sign that there is a long tailwind of demand to drive sneaker sales at Nike and Adidas, as well as potential new entrants like Lululemon, for a long time.

More From The Motley Fool

John Ballard owns shares of Lululemon Athletica. The Motley Fool owns shares of and recommends Lululemon Athletica, Nike, Under Armour (A Shares), and Under Armour (C Shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance