4 Oversold Technology Stocks to Buy Amid Market Uncertainties

Technology has been among the most-battered sectors amid a broader market sell-off this year so far on growing fears of an impending negative turn in the economy. Technology Select Sector SPDR Fund, which seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the Technology Select Sector Index, has lost approximately 28% of its value year to date (YTD).

However, this sell-off in the broader equity market has led to a massive correction in several technology companies’ stock prices. These companies were considered to be widely overvalued at the sector’s peak in 2021. With this correction, several tech stocks are currently trading way below their 52-week high, despite their strong fundamentals.

In addition, the long-term growth prospects of tech companies look promising owing to the continued digital transformations. The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Apart from this, artificial intelligence (AI), blockchain, Internet of Things (IoT), autonomous vehicles, Augmented Reality/Virtual Reality and wearables offer significant growth opportunities.

In our opinion, Zscaler, Inc. ZS, Pure Storage, Inc. PSTG, Coupa Software Incorporated COUP and RingCentral, Inc. RNG are among the most beaten-down stocks in the technology space currently. Given the strength of their fundamentals and solid prospects, it seems wise to add these stocks to your portfolio.

Why Should You Invest in These Stocks?

Amid the financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, accruing profits in established markets. These stocks, with their solid fundamentals, allow investors to hedge their funds from any economic downturn. Moreover, these fundamentally strong stocks are likely to outshine again once the current macro headwinds subside and market sentiments improve.

Apart from having solid fundamentals, the long-term earnings growth rate for the aforementioned stocks is more than 10%. These stocks also have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or #2 (Buy).

Per Zacks’ proprietary methodology, stocks with such a favorable combination offer solid investment opportunities.

Additionally, these stocks are currently trading way below their 52-week high and are now available at attractive valuations.

4 Tech Stocks to Bet On

Pure Storage provides software-defined all-flash solutions that are uniquely fast and cloud-capable for customers. The company is the pioneer of the Evergreen Storage business model of hardware and software innovation, support and maintenance. The model eliminates the 3–5 year forklift refresh cycle of legacy storage systems.

Pure Storage is benefiting from the rapidly increasing adoption of flash storage, particularly across enterprises, due to inherent advantages of speed (i.e., responsiveness), portability, efficiency and reliability over legacy storage systems. The ongoing data explosion has become a major driver for flash storage systems. Strength in FlashArray and FlashBlade businesses as well as strong growth prospects in the data-driven markets of AI and machine learning bode well.

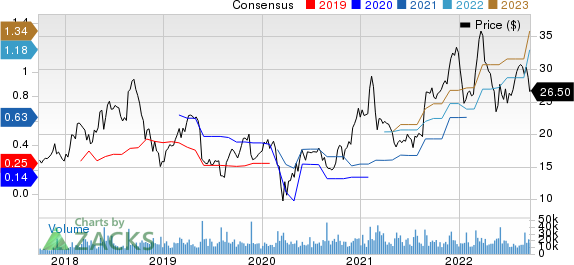

PSTG currently sports a Zacks Rank #1 and has a Growth Score of A. Shares of the company have plunged 17.8% YTD and are currently trading 27.8% lower than its 52-week high of $36.71 attained on Mar 28, 2022. Moreover, the stock trades at a one-year forward price-to-sales of 2.6X compared with its three-year high of 4.27X. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pure Storage’s fiscal 2023 earnings has improved to $1.18 per share from 95 cents over the past 30 days, implying a year-over-year increase of 63.9%. For fiscal 2024, the consensus mark for earnings has been revised upward by 20.7% to $1.34 per share over the past 30 days, indicating year-over-year growth of 13.1%. The long-term earnings growth rate for the stock is pegged at 35.5%.

Pure Storage, Inc. Price and Consensus

Pure Storage, Inc. price-consensus-chart | Pure Storage, Inc. Quote

Zscaler is one of the world’s leading providers of cloud-based security solutions. It offers a full range of enterprise network security services, including web security, Internet security, antivirus, vulnerability management, firewalls, and control over user activity in mobile, cloud computing, and IoT environments.

Zscaler is benefiting from the rising demand for cyber-security solutions owing to the slew of data breaches. The increasing demand for privileged access security on digital transformation and cloud-migration strategies is a key growth driver. Zscaler’s portfolio strength boosts its competitive edge and helps add users. Also, the recent acquisitions of Smokescreen and Trustdome are expected to enhance its portfolio.

ZS currently carries a Zacks Rank #2 and has a Growth Score of A. Shares of the company have plunged 49.5% YTD and are currently trading 56.8% lower than its 52-week high of $376.11 attained on Nov 19, 2021. Moreover, the stock trades at a one-year forward price-to-sales of 14.82X compared with its three-year high of 51.19X.

The Zacks Consensus Estimate for Zscaler’s fiscal 2023 earnings has improved to $1.17 per share from $1.03 over the past 30 days, indicating a year-over-year increase of 69.8%. For fiscal 2024, the consensus mark for earnings has been revised upward by seven cents to $1.67 per share over the past 30 days, suggesting year-over-year growth of 43%. The long-term earnings growth rate for the stock is pegged at 45.1%.

Zscaler, Inc. Price and Consensus

Zscaler, Inc. price-consensus-chart | Zscaler, Inc. Quote

Coupa Software is one of the leading providers of Business Spend Management (BSM) solutions. The company is evolving its cloud-based platform on the back of continuous product innovations to offer customers increased spending visibility, aid them in mitigating supply chain risk, and increase business agility to adapt to changes in spending trends.

Coupa Software is benefiting from the robust adoption of Coupa Pay offerings and cloud-based BSM solutions. Momentum in Coupa Advantage Express, Strategic Sourcing, Risk Assess and Source Together solutions is likely to boost revenues. During its recently reported second-quarter results, the company increased revenue guidance for fiscal 2023 on solid demand trends.

COUP currently carries a Zacks Rank #2 and has a Growth Score of B. Shares of the company have plunged 60.7% YTD and are currently trading76.1% lower than its 52-week high of $259.90 attained on Oct 20, 2021. Moreover, the stock trades at a one-year forward price-to-sales of 5X compared with its three-year high of 46.82X.

The Zacks Consensus Estimate for Coupa Software’s fiscal 2023 earnings has improved 76% to 44 cents per share over the past 30 days. For fiscal 2024, the consensus mark for earnings has been revised upward by 14 cents to 71 cents per share over the past 30 days, indicating year-over-year growth of 62.1%. The long-term earnings growth rate for the stock is pegged at 22.6%.

Coupa Software, Inc. Price and Consensus

Coupa Software, Inc. price-consensus-chart | Coupa Software, Inc. Quote

RingCentral is a leading provider of Unified Communications as a Service (UCaaS) solutions, including global enterprise cloud communications, collaboration, and customer engagement solutions that enable businesses to communicate, collaborate, and connect. The company’s cloud-based business communications and collaboration solutions are designed to provide a single user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones. This makes remote working and collaboration easy.

RingCentral has been benefiting from strong subscription revenue growth owing to the improvement in the hybrid work environment due to the COVID-19 pandemic. Its increasing international presence is a key catalyst. A strong partner base that includes the likes of Microsoft, AT&T, BT, Atos and Vodafone is expected to act as a major catalyst.

RNG currently carries a Zacks Rank #2 and has a Growth Score of A. Shares of the company have plunged 77.8% YTD and are currently trading 86.8% lower than its 52-week high of $315 attained on Nov 10, 2021. Moreover, the stock trades at a one-year forward price-to-sales of 1.71X compared with its three-year high of 27.24X.

The Zacks Consensus Estimate for RingCentral’s 2022 earnings has improved by seven cents to $1.93 per share over the past 60 days, implying a year-over-year increase of 44%. For 2023, the consensus mark for earnings has been revised upward by a penny to $2.51 per share over the past 30 days, indicating year-over-year growth of 29.8%. The long-term earnings growth rate for the stock is pegged at 34.7%.

Ringcentral, Inc. Price and Consensus

Ringcentral, Inc. price-consensus-chart | Ringcentral, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coupa Software, Inc. (COUP) : Free Stock Analysis Report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance