These 4 Measures Indicate That Whitecap Resources (TSE:WCP) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Whitecap Resources Inc. (TSE:WCP) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Whitecap Resources

How Much Debt Does Whitecap Resources Carry?

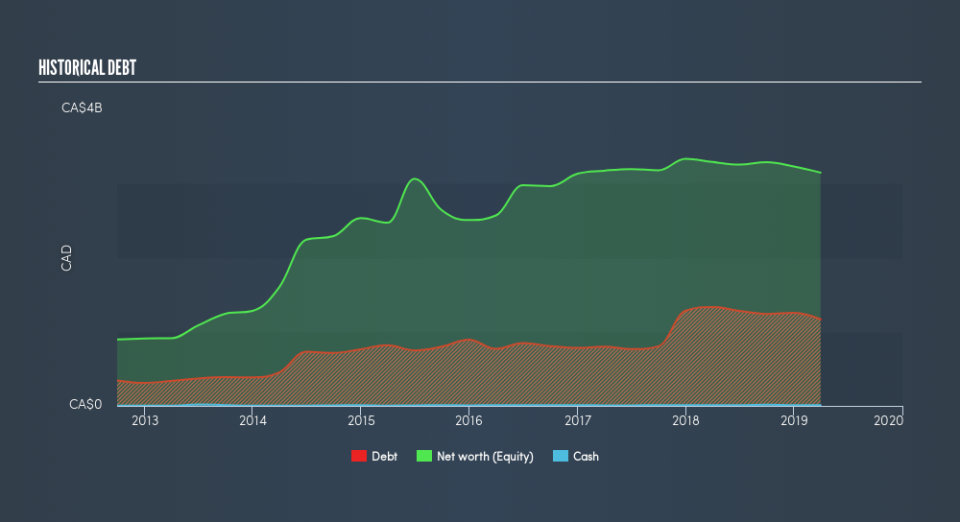

The image below, which you can click on for greater detail, shows that Whitecap Resources had debt of CA$1.26b at the end of March 2019, a reduction from CA$1.33b over a year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Whitecap Resources's Balance Sheet?

The latest balance sheet data shows that Whitecap Resources had liabilities of CA$249.3m due within a year, and liabilities of CA$2.72b falling due after that. Offsetting this, it had CA$10.2m in cash and CA$160.6m in receivables that were due within 12 months. So its liabilities total CA$2.80b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CA$1.70b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Whitecap Resources would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Even though Whitecap Resources's debt is only 1.5, its interest cover is really very low at 1.7. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. We also note that Whitecap Resources improved its EBIT from a last year's loss to a positive CA$93m. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Whitecap Resources's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Whitecap Resources actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

On the face of it, Whitecap Resources's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Whitecap Resources stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Whitecap Resources insiders have sold any shares recently. You click here to find out if insiders have sold recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance