These 4 Measures Indicate That BNK Petroleum (TSE:BKX) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that BNK Petroleum Inc. (TSE:BKX) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for BNK Petroleum

What Is BNK Petroleum's Net Debt?

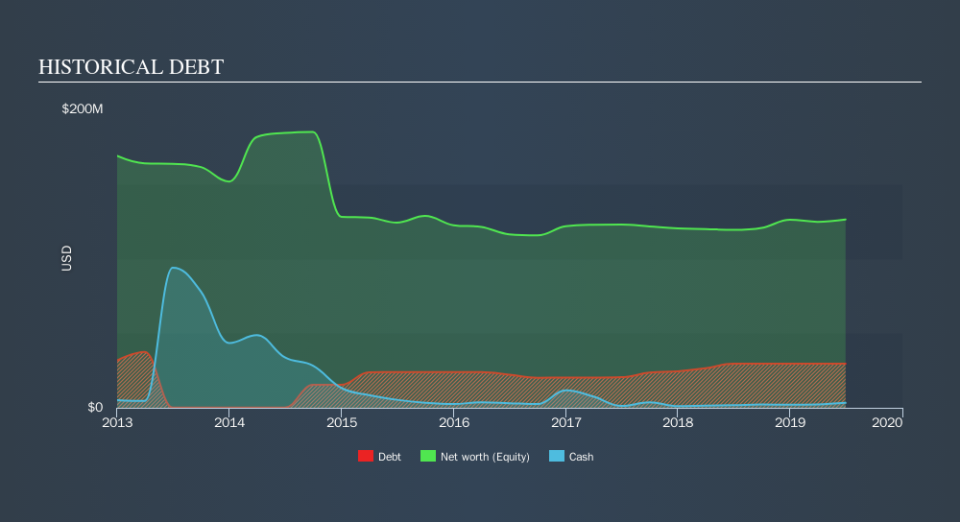

The chart below, which you can click on for greater detail, shows that BNK Petroleum had US$29.6m in debt in June 2019; about the same as the year before. However, it also had US$3.31m in cash, and so its net debt is US$26.3m.

How Strong Is BNK Petroleum's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that BNK Petroleum had liabilities of US$6.21m due within 12 months and liabilities of US$30.8m due beyond that. On the other hand, it had cash of US$3.31m and US$2.30m worth of receivables due within a year. So its liabilities total US$31.4m more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$17.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we definitely think shareholders need to watch this one closely. After all, BNK Petroleum would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

BNK Petroleum's net debt is sitting at a very reasonable 1.7 times its EBITDA, while its EBIT covered its interest expense just 4.2 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably, BNK Petroleum made a loss at the EBIT level, last year, but improved that to positive EBIT of US$8.9m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is BNK Petroleum's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. In the last year, BNK Petroleum created free cash flow amounting to 7.9% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

We'd go so far as to say BNK Petroleum's level of total liabilities was disappointing. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Overall, it seems to us that BNK Petroleum's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of BNK Petroleum's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance