4 Growth-Rated Tech Stocks to Own Amid Coronavirus-Led Sell Off

The U.S. stock market has suffered steep declines in the past few weeks due to uncertainty stemming from the novel coronavirus outbreak. Investors withdrew money from stock investments fearing the financial implications of the rapidly spreading coronavirus. The Dow Jones, the S&P 500, and the Nasdaq have plunged more than 10% each over the past month in a sharp reversal of the solid uptrend witnessed at the beginning of 2020.

Tech Sector Weathers Coronavirus Impact

Though the coronavirus outbreak impacted every sector, the U.S. tech sector has been more resilient compared with others. The Technology Select Sector SPDR Fund (XLK) is down 4.4% year to date, while Energy Select Sector SPDR Fund, Financial Select Sector SPDR Fund, and Industrial Select Sector SPDR Fund have lost 40.8%, 21.5%, and 15.1%, respectively.

The sector’s resiliency can be attributed to the massive long-term growth prospects of tech companies. The sector remains attractive owing to continuous digital transformations. Rapid adoption of cloud computing, along with ongoing integration of AI and machine learning, has been a major growth driver.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to spur further growth. Moreover, blockchain, IoT, autonomous vehicles, AR/VR, and wearables also offer significant growth opportunities.

Buying Growth-Focused Tech Stocks Makes Sense

Considering the long-term growth prospects of tech companies, we believe the recent sell-off provides a solid buying opportunity for investors. In the current scenario, investors can look for beaten-down tech stocks that have strong fundamentals and can drive growth once the impact of coronavirus cools off.

Amid the financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, accruing profits in established markets. These stocks, with their solid fundamentals, allow investors to hedge their investments from any economic downturn.

Here, we have zeroed in on four tech stocks that could enrich your portfolio in 2020 and beyond.

These stocks also have favorable combination of a Growth Score of A and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks’ proprietary methodology, stocks with such a favorable combination offer solid investment opportunities.

Our Picks

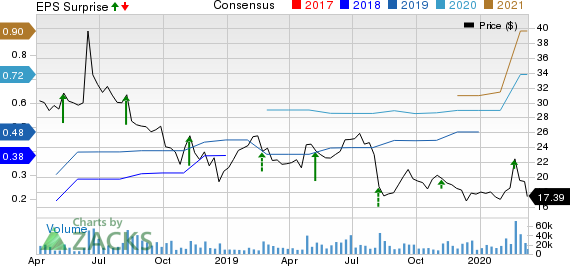

Dropbox, Inc. DBX offers a platform that enables users to store and share files, photos, videos, songs and spreadsheets. A strong focus on product innovation and introduction of features like Dropbox Spaces, Paper and Extensions are anticipated to boost its user base. Further, integration with leading applications like Zoom Video, Slack and Atlassian will likely expand the Dropbox paying user base, which reached 14.3 million in third-quarter 2019.

Dropbox currently sports a Zacks Rank #1 and has a Growth Score of A. Additionally, the expected EPS growth rate for 2020 is pegged at 46.6%. The stock has declined 2.9% year to date.

Dropbox, Inc. Price, Consensus and EPS Surprise

Dropbox, Inc. price-consensus-eps-surprise-chart | Dropbox, Inc. Quote

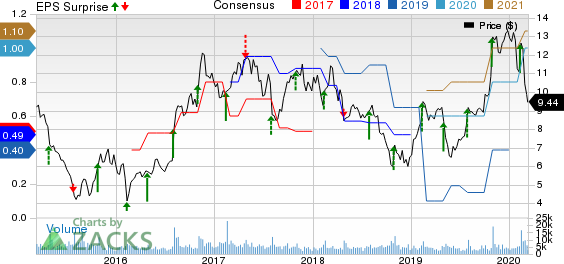

Amkor Technology, Inc. AMKR is expected to benefit from solid demand for advanced packaging technologies in the consumer and mobile markets. Moreover, accelerated deployment of 5G is expected to strengthen the company’s position in the communications market. Additionally, momentum across RF module, ADAS infotainment applications and power management areas is encouraging.

The Zacks Rank #1 stock has a Growth Score of A. The company’s earnings are anticipated to jump 78.6% this year. Shares of Amkor Technology have declined 27.4% year to date.

Amkor Technology, Inc. Price, Consensus and EPS Surprise

Amkor Technology, Inc. price-consensus-eps-surprise-chart | Amkor Technology, Inc. Quote

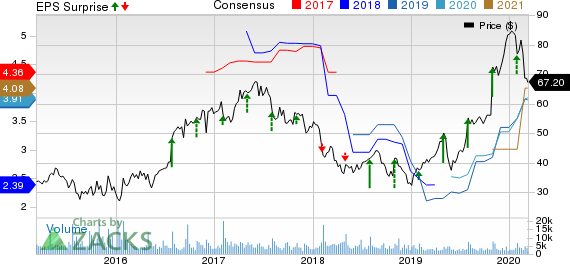

Mellanox Technologies, Ltd. MLNX is benefiting from robust demand for its interconnect products across data centers, storage, and server markets. Mellanox currently sports a Zacks Rank #1 and has a Growth Score of A. Moreover, the expected EPS growth rate for 2020 is pegged at 34%. The stock has declined 1.7% year to date.

Mellanox Technologies, Ltd. Price, Consensus and EPS Surprise

Mellanox Technologies, Ltd. price-consensus-eps-surprise-chart | Mellanox Technologies, Ltd. Quote

Cirrus Logic CRUS has been benefiting from robust demand for smartphone components, as well as smart codecs and amplifiers in wired and wireless headphones. Rising demand for boosted amplifiers in tablets and laptops is also a tailwind for this Zacks Rank #1 stock.

Cirrus Logic has a Growth Score of A. The expected EPS growth rate for fiscal 2020 is pegged at 46.8%. Additionally, the stock has declined 18.5% year to date.

Cirrus Logic, Inc. Price, Consensus and EPS Surprise

Cirrus Logic, Inc. price-consensus-eps-surprise-chart | Cirrus Logic, Inc. Quote

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance