The 4.1% return this week takes Light & Wonder's (NASDAQ:LNW) shareholders three-year gains to 342%

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Light & Wonder, Inc. (NASDAQ:LNW) share price, which skyrocketed 342% over three years. And in the last week the share price has popped 4.1%. This could be related to the recent financial results, released less than a week ago -- you can catch up on the most recent data by reading our company report.

Since it's been a strong week for Light & Wonder shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Light & Wonder

Given that Light & Wonder didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Light & Wonder actually saw its revenue drop by 2.3% per year over three years. So it's pretty amazing to see the stock price has zoomed up 64% per year in that time. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

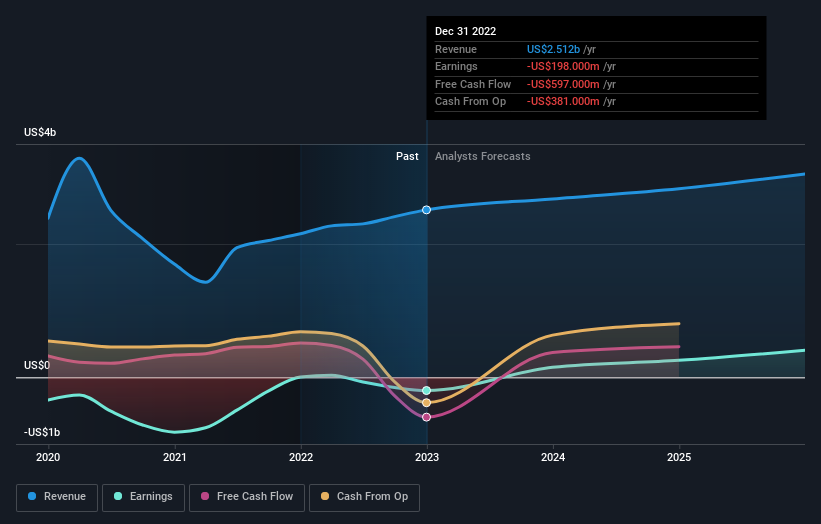

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Light & Wonder shareholders have received a total shareholder return of 6.3% over the last year. However, that falls short of the 8% TSR per annum it has made for shareholders, each year, over five years. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Light & Wonder is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance