3 Winning Bank Stocks That Still Have Room to Run in 2023

Stubbornly high inflation for the most part of the year did compel the Federal Reserve to apply an aggressive rate-hike policy. In fact, the Fed raised its interest rates by 75 basis points for the fourth consecutive time this year to curb inflationary pressure. Now, the interest rate stands at a range of 3.75% to 4%, the highest in 14 years.

However, signs of inflation moderating in the month of October to a certain extent made market pundits believe that the Fed may slow down the pace of rate hikes in the forthcoming months. According to the Bureau of Labor Statistics, the consumer price index (CPI) advanced 7.7% compared to year-ago levels in October. This was less than September’s annual rise of 8.2%.

In fact, Fed Chairman Jerome Powell also specified that the central bank might lessen the pace of interest rate increases in the December meeting, with many analysts projecting a rate hike of 50 basis points as a replacement for 75 basis points. But, recent robust growth in the service sector coupled with a solid increase in wages fueled expectations that the Fed may continue to remain hawkish, and that pausing interest rate hikes at the moment seems a far-fetched idea.

The Institute of Supply Management’s Services PMI Index climbed to 56.5% in November from 54.4% in October, indicating exceptional growth. Similarly, wages jumped more than 5% last month from a year ago, and that could easily fuel inflation, eventually leading to a more aggressive Fed.

A hawkish Fed, actually, stands to benefit banks. This is because a hike in interest rates boosts a bank’s profit margin by increasing the spread between what banks earn by funding long-term assets such as loans, with short-term liabilities, including deposits. Therefore, it is judicious to invest in shares of banks that have not only gained from a hawkish environment this year but are also expected to capitalize on further rate hikes next year as well.

Meanwhile, consumer loan growth, particularly in the United States, remains stable. To top it, the household wealth of high net-worth individuals is poised to grow significantly in the near future, which should benefit banks’ wealth management division.

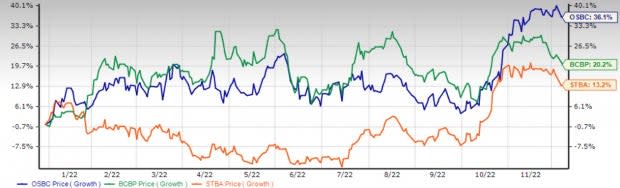

Banking on such positives, we have highlighted three bank stocks, namely, Old Second Bancorp OSBC, BCB Bancorp NJ BCBP and S&T Bancorp STBA, whose shares have gained considerably so far this year, and are further poised to gain traction in the near term. These stocks boast a solid Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Old Second Bancorp’s full-service banking businesses include the customary consumer and commercial products and services that banks provide.

The Zacks Consensus Estimate for its current-year earnings has moved up 4.7% over the past 60 days. OSBC’s expected earnings growth rate for the current year is 15.4%. It’s projected earnings growth rate for the next year is 28.7%.

BCB Bancorp operates as the holding company for BCB Community Bank, a state-chartered commercial bank that provides banking products and services to businesses and individuals in the United States.

The Zacks Consensus Estimate for its current-year earnings has moved up 5.8% over the past 60 days. BCBP’s expected earnings growth rate for the current year is 43.8%. It’s projected earnings growth rate for next year is 3.6%.

S&T Bancorp is a bank holding company engaged in the general banking business.

The Zacks Consensus Estimate for its current-year earnings has moved up 9.1% over the past 60 days. STBA’s expected earnings growth rate for the current year is 19.6%. It’s projected earnings growth rate for the next quarter is 14.7%.

Shares of Old Second Bancorp, BCB Bancorp and S&T Bancorp, by the way, have soared 36.1%, 20.2% and 13.2%, respectively, on a year-to-date basis.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Old Second Bancorp, Inc. (OSBC) : Free Stock Analysis Report

S&T Bancorp, Inc. (STBA) : Free Stock Analysis Report

BCB Bancorp, Inc. NJ (BCBP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance