3 Value Picks From the Undervalued Multiline Insurance Space

The Zacks Multiline Insurance industry is currently undervalued compared with the Zacks S&P 500 composite as well as the Zacks Finance sector. The industry’s price-to-book ( the best multiple for valuing insurers because of their unpredictable financial results) of 1.64 was less than the Zacks S&P 500 composite’s P/B of 7 and the sector’s P/B of 3.3. Such below market positioning hints at room for upside in the days ahead.

Industry vs Zacks S&P 500 composite

Image Source: Zacks Investment Research

Industry vs Sector

Image Source: Zacks Investment Research

Thus, before their valuation increases, it is wise to take position in some undervalued stocks with growth potential.

Driving Forces

The industry experienced a tumultuous 2020 due to the coronavirus pandemic. However, it has started regaining momentum. Though the concerns over the Delta variant loom large, increased vaccinations offer some respite.

As evident from the name, these insurers provide a single insurance coverage, combining automobile, homeowner, long-term care, life and health insurance into one policy for individuals and businesses. Thus, it stands to benefit from a diversified portfolio, which lowers concentration risk. The industry is well poised to benefit from growth in niches, improved pricing, prudent underwriting, increased exposure, greater penetration in untapped markets, in turn increasing premium volume, the main component of the top line.

Given that the low rate environment is here to say until 2023, these insurers are directing their funds into alternative investments like private equity, hedge funds, and real estate among others, to improve their investment income.

Though property and casualty operations are likely to be affected by the above-average hurricane season, continued price hikes should limit downward pressure on its underwriting profitability. According to Willis Towers Watson’s 2021 Insurance Marketplace Realities report, except for one, 29 lines of business are expected to witness a price rise this year.

The life insurance operations should continue to benefit from the increasing demand for protection products. Per a report by IBISWorld, the $886.7 billion U.S. Life Insurance & Annuities Market reflects 4.2% growth in 2021. Thus, this operation is well poised to capitalize on the opportunities, given its comprehensive portfolio including annuities, whole and term life insurance, accidental death insurance, health insurance, Medicare supplements, long-term healthcare policies and wealth, and asset management solutions

Solid capital levels are aiding these insurers to engage in shareholder-friendly moves as well as pursue strategic mergers and acquisitions and organic initiatives to ramp up growth.

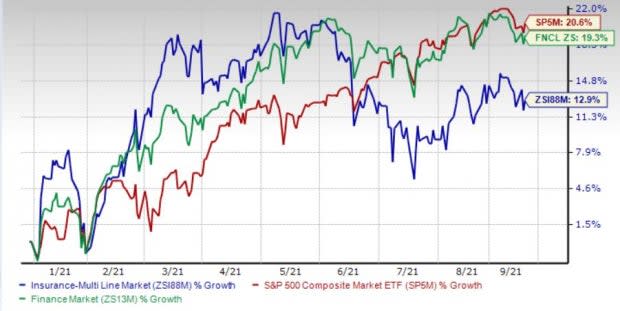

The industry has underperformed the Zacks S&P 500 composite as well as the Finance sector year to date. While the Zacks S&P 500 composite and the sector have increased 20.64% and 19.3%, respectively, the industry has risen 12.9% in the said time frame.

Price Performance

Image Source: Zacks Investment Research

Nonetheless, by leveraging solid fundamentals and adopting technological advancements to increase operational efficiency amid economic growth outlook by the Fed, these multiline insurers are well poised for the longer term.

Value Picks

With the help of the Zacks Stock Screener, we have selected three multiline insurance stocks with an impressive Value Score of A or B and a Zacks Rank #2 (Buy). Back-tested results have shown that stocks with a favorable Value Score coupled with a solid Zacks Rank are the best investment options. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

These stocks with growth potential have witnessed positive estimate revisions, reflecting analysts’ confidence in the companies’ operational efficiency, have outperformed its industry increase as well as have a cheaper valuation.

MetLife MET is an insurance-based global financial services company, providing protection and investment products to a range of individual and institutional customers. Its focus on businesses with growth potential and strategies to control cost and increase efficiency bode well for growth. Its expected long-term earnings growth is pegged at 7.5%.

MetLife acquired Versant Health that positioned it as the third largest vision care provider in the United States. The company has also forayed into the pet insurance space with the buyout of PetFirst.

It has a solid track record of beating earnings estimates in the trailing four quarters, the average surprise being 33.35%.

Since 2011, the company has been successfully raising its quarterly dividend at a CAGR of 10%. In April 2021, it increased its quarterly dividend by 4.3%. Its dividend yield of 3.2% is higher than the industry’s average of 2.1%. The company also has a $3 billion share buyback program in place.

MetLife’s P/B ratio is 0.77. Its shares have gained 32.5% year to date.

Image Source: Zacks Investment Research

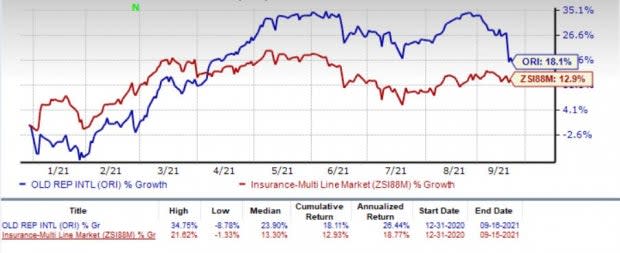

Old Republic International Corporation ORI is the third-largest title insurance provider to residential and commercial markets, having a niche market focus. Better segmentation, improved risk selection, pricing precision, and increased use of analytics should drive General Insurance segment. The Title insurance business will continue to benefit from an expanding presence in the commercial real estate market.

It has a stellar track record of beating earnings estimates in the trailing eight quarters, the average surprise being 48.11%.

The insurer increased its dividend for 40 straight years. It has paid out dividend for the last 80 years. Its dividend yield of 3.8% betters the industry average.

Old Republic’s total market return has been exceeding the S&P 500 total market return for more than five decades. Return on equity in the trailing 12 months was 13.1%, better than the industry average of 9.8%. This highlights its unique combination of specialty property and casualty and Title franchises that offers diversification.

Old Republic International’s P/B ratio is 1.05. Shares have gained 18.1% year to date.

Image Source: Zacks Investment Research

The Hartford Financial Service Group HIG is one of the major multi-line insurance and investment companies in the country, providing investment products, group life and group disability insurance, property and casualty insurance, and mutual funds in the United States. Expanded product offerings, efforts to strengthen commercial business, underwriting strength in products, capital appreciation, and cost-curb initiatives bode well for growth. Its expected long term earnings growth rate is pegged at 7%.

Divesting non-core businesses to concentrate on its U.S. operations in turn is enhancing operating leverage and financial flexibility by freeing up more capital..Its focus on cutting down costs by $540 million within 2022 and $625 million in 2023 should continue to drive profitability.

It has a decent track record of beating earnings estimates in three of the trailing four reported quarters, the average surprise being 37.53%.

It has an intelligent capital management strategy increasing dividend each year since 2013 at an eight-year CAGR of 15.9%. With the $1 billion buyback approval, the company can repurchase $2.5 billion worth share through 2022. It also boasts industry leading ROE.

Hartford Financial’s P/B ratio is 1.37. Shares have gained 44% year to date.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance