3 Utilities Assuring Return Via Dividends in a Choppy Market

Regulated and domestic-focused utility companies enjoy a stable demand for their services, which generates steady earnings. Stable earnings allow utilities to ensure steady income for the investors through distribution of regular dividends. In a low-interest environment, utility investments are often considered as bonds substitute.

All the major U.S market indexes witnessed a fall in the first half of September. Month to date, Dow Jones Industrial Average fell 1.4%, while NASDAQ composite dropped 0.5% and S&P 500 was down 0.9%. The decline in value of the indexes was caused by the negative sentiments of analysts stemming from increasing risk of the Delta variant of coronavirus. During choppy market conditions, investment in defensive utilities makes sense as a majority of the utilities distribute dividend for shareholders even during difficult business conditions.

Amid the ongoing uncertainty in the market, appropriate spending in utilities is one of the safest investment decisions. The utility stocks have a long legacy of dividend payments. However, historical payout of dividends cannot be the only criteria to select a stock, as it does not guarantee any future dividend payment. Thus, investors need to look into other factors before selecting the stocks.

Utility operation is capital intensive business and a company operating in this space should make regular investments to strengthen and upgrade infrastructure as well as undertake restoration work during natural disasters to provide uninterrupted services. The current low-interest-rates scenario is also supporting the industry players’ capital plans.

3 Utility Picks

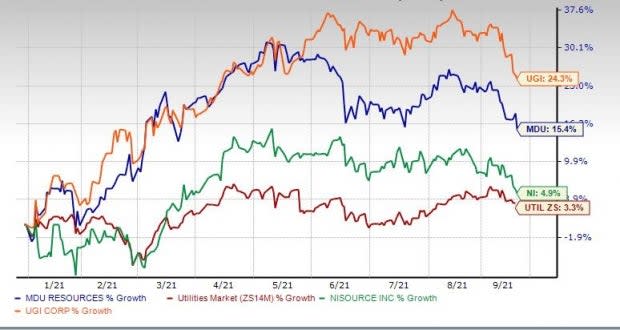

While the sector has a weak Zacks Rank of 14 of 16 sectors (bottom 13%), we picked a few stocks that have returned more than the sector’s 3.3% growth so far this year. These stocks carry a Zacks Rank #2 (Buy) or 3 (Hold) at present, and have a favourable Zacks VGM Score. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks heree.

These companies make regular dividend payments to their shareholders and have outperformed the S&P 500’s dividend yield of 1.24%. MDU Resources MDU has been paying out dividends for the past 83 years, with the 30th consecutive increase made in November 2020. UGI Corp.’s UGI current year’s dividend payment marks the 137th consecutive year and 34th straight year of annual dividend raise. An electric utility, NiSource NI has been distributing dividends since 1972. We added some more criteria for the selection of utilities from our proprietary Zacks Stock Screener.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

MDU Resources is a utility natural gas distribution company. It provides value-added natural resource products and related services that are essential for energy transportation, regulated energy delivery as well as construction materials and services business. It expects to invest $3,027 million during the 2021-2025 period. The company has a Zacks Rank #2 and a VGM score of A, at present.

YTD Return = 15.4%

Dividend Yield = 2.80%

Average Earnings Surprise (Last Four Quarters) = 12.2%

Estimate Movement = The Zacks Consensus Estimate for 2021 earnings has moved 1.9% north to $2.12 in the past 60 days.

Long-Term Earnings Growth Rate (three-five years) = 6.94%

UGI Corp. is a holding company, which distributes, stores, transports and markets energy products and related services through its subsidiaries. It is a domestic and international retail distributor of propane and butane liquefied petroleum gases. The utility has been investing substantially to achieve the long-term annual earnings per share growth target of 6-10%. In fiscal 2020, it spent $665 million and invested $438 million in the first three quarters of fiscal 2021. The company has a Zacks Rank #3 and a VGM score of B at present.

YTD Return = 24.3%

Dividend Yield = 3.18%

Average Earnings Surprise (Last Four Quarters) = 24.4%

Estimate Movement = The Zacks Consensus Estimate for fiscal 2021 earnings has moved 0.7% north to $3.02 in the past 60 days.

Long-Term Earnings Growth Rate (three-five years) = 8%

NiSource is an energy holding company. Together with its subsidiaries, it provides natural gas, electricity as well as other products and services in the United States. Over the 2021-2024 time frame, the company aims to invest $9.6-$10.7 billion. The company has a Zacks Rank #3 and a VGM score of B at present.

YTD Return = 4.9%

Dividend Yield = 3.66%

Average Earnings Surprise (Last Four Quarters) = 87.3%

Estimate Movement = The Zacks Consensus Estimate for 2021 earnings has moved 0.7% north to $1.35 in the past 60 days.

Long-Term Earnings Growth Rate (three-five years) = 6.16%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

UGI Corporation (UGI) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance