3 Transportation Stocks With a Dividend Hike in May to Watch

The U.S. equity markets are hard hit by a tough operating landscape in 2022. Headwinds ranging from the prolonged Russia-Ukraine war, high oil price, spread of the coronavirus, especially in China, the sky-high domestic inflation and the resultant Fed Rate hike (with the possibility of more) rendered volatility to the stock market, characterized by a high degree of uncertainty.

Evidently, the Dow Jones and the S&P 500 lost 4.6% and 4.8%, respectively, while the Nasdaq Composite Index shed 8.9% of value in the first quarter. What is worse is that this downside shows no signs of ending or subsiding. However, such an unpredictable scenario in no way means that investors should dodge parking their money in equities. In fact, they should now be more on the lookout for stocks that offer a steady flow of income (in the form of dividends), irrespective of the surrounding market conditions.

In this write-up, we focus on the widely-diversified transportation sector. With oil price being northbound, this sector too has not escaped the overall market downturn. Now, as the dividend-paying companies are usually in high demand, particularly amid the current market volatility, investors interested in the said category would do well to keep stocks with a solid payout trend on their radar. Stocks like Union Pacific Corporation UNP, Werner Enterprises WERN and Expeditors International of Washington EXPD should fit the bill and stay on their watchlist.

Key Challenges Confronting This Sector

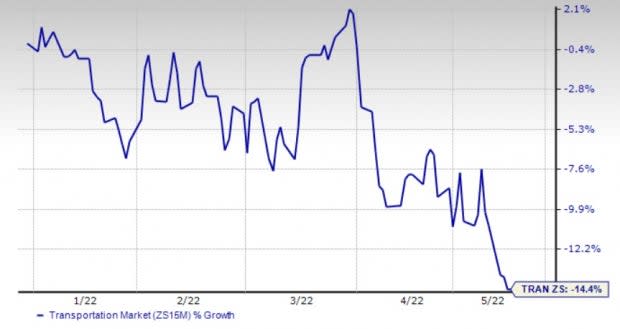

As stated earlier, the oil price upsurge (up 33% in first-quarter 2022) is a huge blow to the bottom lines of the sector participants. Notably, fuel expenses represent a major input cost for any transportation player. Consequently, the Zacks Transportation sector has declined 14.4% year to date.

Image Source: Zacks Investment Research

This spike in oil price was induced by supply concerns emanating from the Russia-Ukraine war. Supply-chain woes and the associated issues like congestion at the ocean ports due to labor and equipment shortages arealso hurting this sector as reflected in the recently released March-quarter results.

Dividend-Growth Stocks to the Rescue

Given the above downsides, which are unlikely to die out any time soon, having dividend-paying stocks in one’s portfolio appears prudent. As investors prefer an income-generating stock, a high dividend-yielding one is much coveted. Needless to say, they are always on the lookout for companies with a consistent and incremental dividend history.

Below, we present three transportation stocks, each presently carrying a Zacks Rank #3 (Hold) and announcing a dividend hike this month. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Union Pacific is an Omaha, NE-based railroad operator. Strong freight demand is supporting growth at UNP. However, supply-chain issues are a bother.

In a shareholder-friendly move, UNP’s board cleared a 10% hike in its dividend payout on May 12. The move underscores its sound financial health as it utilizes free cash flow for enhancing its shareholders’ returns. Union Pacific raised its quarterly cash dividend to $1.30 per share ($5.20 annually) from $1.18. The new dividend will be paid out on Jun 30, 2022, to its shareholders of record as of May 31, 2022. Notably, UNP hiked dividend twice in 2021.

Werner, based in Omaha, NE, is primarily focused on transporting the truckload shipments. Improvement in the freight scene in the United States is a positive for WERN.

Werner has a consistent track record of paying out quarterly dividends since Jul 1987. WERN, like UNP, hiked quarterly dividends twice in 2021. Maintaining its pro-shareholder stance, on May 13, WERN’s board announced an 8% increase in its quarterly dividend to 13 cents per share. The hiked dividend will be paid out on Jul 19, 2022, to its stockholders of record at the close of business on Jul 5, 2022.

Expeditors is a Seattle, WA-based freight forwarder. EXPD is being aided by upbeat airfreight revenues. Despite the cyber-attack in February, Airfreight Services revenues increased 20.6% year over year to $1.59 billion in the first quarter of 2022.

Highlighting its shareholder-friendly approach, on May 3, Expeditors’ board approved a 15.5% increase in semi-annual cash dividend to 67 cents per share. The amount is payable Jun 15 to its shareholders of record as of Jun 1. EXPD has an impressive history of paying out dividends to its shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance