3 Transport Equipment & Leasing Stocks With Solid Dividend Yield

The Zacks Transportation - Equipment and Leasing industry is gaining from the healthy equipment and lease demand on the back of impressive consumer spending. Solid trade volumes and upbeat container demand are major tailwinds for the industry participants. The moderating inflation and the resultant slowdown in interest rate hikes bode well. Businesses keen on making capital investments to ramp up operations are adding stimulus to lease demand. The buoyancy in the industry is further confirmed by its Zacks Industry Rank #95, which places it in the top 38% of more than 250 Zacks industries.

Driven by the tailwinds,theindustry has gained 21.4% over the past three months, outperforming the S&P 500 Index’s 4.8% appreciation and 10.1% growth of the broader Zacks Transportation sector.

Image Source: Zacks Investment Research

Given this encouraging backdrop, it would be a wise decision to invest in some dividend-paying stocks, including Ryder System, Inc. R, Air Lease Corporation AL and Triton International Limited (TRTN), from the Transportation - Equipment and Leasing industry.

Why Dividend Growth Stocks?

Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market, and act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, these companies offer downside protection with their consistent increase in payouts.

Moreover, these stocks generally have good liquidity, strong balance sheets and impressive free-cash-flow-generating ability.

In view of the tailwinds mentioned, it can be safely said that dividend-paying stocks appear as preferred options over non-dividend-paying stocks amid high market volatility.

3 Transport Equipment & Leasing Stocks to Embrace Now

In order to choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%. All three companies mentioned below carry a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ryder: Headquartered in Miami, FL, Ryder operates as a logistics and transportation company worldwide. Ryder pays out a quarterly dividend of 62 cents ($2.48 annualized) per share, which gives it a 2.93% yield at the current stock price. This company’s payout ratio is 16%, with a five-year dividend growth rate of 3.51%. (Check Ryder’s dividend history here).

Ryder is benefiting from improving economic and freight market conditions in the United States. R’s raised outlook for 2022 is encouraging. For 2022, it expects total revenues and operating revenues to increase 23% and 18% (versus the previously mentioned increases of 22% and 16%), respectively. Adjusted EPS for 2022 is estimated to be $15.65-$15.85 (versus the prior stated $14.30-$14.80). R expects a free cash flow of $800-900 million (compared with the earlier mentioned $750-$850 million) for 2022. Adjusted return on investment is expected to be 26-27% (compared with the previously stated 25-26%).

Ryder System, Inc. Dividend Yield (TTM)

Ryder System, Inc. dividend-yield-ttm | Ryder System, Inc. Quote

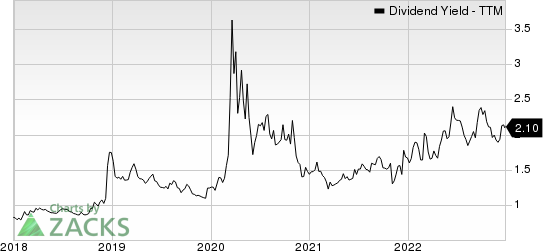

Air Lease: Headquartered in Los Angeles, CA, Air Lease operates asan aircraft leasing company engaged in the purchase and leasing of commercial jet aircraft to airlines worldwide. AL pays out a quarterly dividend of 20 cents ($0.08 annualized) per share, which gives it a 2.10% yield at the current stock price. This company’s payout ratio is 17%, with a five-year dividend growth rate of 14.84%. (Check AL’s dividend history here).

Air Lease’s top line isbenefiting from continuous growth in its fleet. Strong freight and cargo markets are supporting the demand for the company’s wide-body passenger aircraft. The continued recovery in airline operations is aiding Air Lease. AL’s efforts to reward its shareholders are encouraging. Concurrent with the third-quarter 2022 earnings release, Air Lease’s board approved a dividend hike of 8.1%, raising the quarterly cash dividend from 18.5 cents per share to 20 cents. This marks the company’s 10th dividend increase since February 2013, when it began distributing dividends.

Air Lease Corporation Dividend Yield (TTM)

Air Lease Corporation dividend-yield-ttm | Air Lease Corporation Quote

Triton: Headquartered in Hamilton, Bermuda, Triton engages in the acquisition, leasing, re-leasing, and sale of various types of intermodal containers and chassis to shipping lines, and freight forwarding companies and manufacturers. Triton pays out a quarterly dividend of 70 cents ($2.80 annualized) per share, which gives it a 4.06% yield at the current stock price. This company’s payout ratio is 23%, with a five-year dividend growth rate of 6.98%. (Check Triton’s dividend history here).

We are impressed with Triton's efforts to reward its shareholders through dividends and buybacks. Concurrent with its third-quarter 2022 earnings release, Trition's board of directors increased its quarterly cash dividend from 65 cents per share to 70 cents, indicating a dividend hike of 8%. The company repurchased 3.2 million shares in the third quarter and bought back an additional 0.9 million shares through Oct 26, 2022. In November, Triton's board boosted its share buyback plan. Such shareholder-friendly moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business. Strong trade volumes and container demand are driving the company’s top line.

Triton International Limited Dividend Yield (TTM)

Triton International Limited dividend-yield-ttm | Triton International Limited Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance