3 Top Ranked Stocks with Substantial Share Buyback Programs

Stock buybacks, also known as share repurchase programs, are one of several ways for companies to return cash to shareholders. By absorbing a portion of the outstanding shares, a company effectively reduces the share count implicitly boosting the share price.

Companies will do this when the stock is undervalued, or there are limited reinvestment opportunities currently available. Buybacks aren’t without limitations though as there are plenty of ways for companies to enact them in a poor way. However, many of the best companies have a long history of strategically buying back shares at the benefit of investors.

Seeing a chart of declining shares outstanding can be one strong indicator of responsible management, and a stock that has likely been trending higher. To further improve the likelihood of buying a good stock, investors can utilize Zacks proprietary research, which identifies stocks with an elevated probability of moving higher in the near term.

In this article I will cover three stocks that have considerably reduced their outstanding shares over the last decade, have a strong performing stock, and a high Zacks Rank. Pulte Group PHM, Steel Dynamics STLD, and W.W. Grainger GWW fit all those criteria.

Image Source: Zacks Investment Research

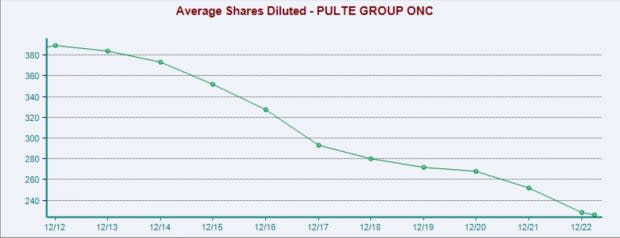

Pulte Group

Pulte Group is a homebuilder and financial services company based in the US. The Homebuilding segment offers a wide variety of home designs including single family detached, townhouses, condominiums, and duplexes at different prices. The financial services segment is just 2% of total revenues and offers mortgage banking and title services.

Pulte Group has been a persistent buyer of its own shares over the last decade. Over that time the number of shares outstanding has been reduced by 40%. Also in the last decade, PHM shares have compounded at an annual rate of 12.6%, slightly edging out the returns of the S&P 500.

Image Source: Zacks Investment Research

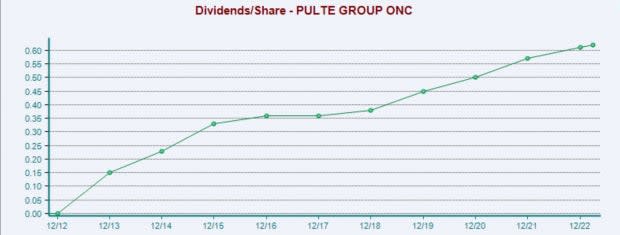

Revenues over the last ten years have grown tremendously as well, nearly tripling from $5.8 billion in 2014, to $16.8 billion today. PHM has been extremely generous to its shareholders, significantly increasing dividends over that period as well. With growing revenues, and dividends in addition to the share buybacks, PHM’s stock price appreciation is clearly more than just financial engineering.

Image Source: Zacks Investment Research

Pulte Group is trading at a one-year forward earnings multiple of 7.5x, which is below the industry average of 10x, and below its 10-year median of 10.4x. PHM also boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions.

Image Source: Zacks Investment Research

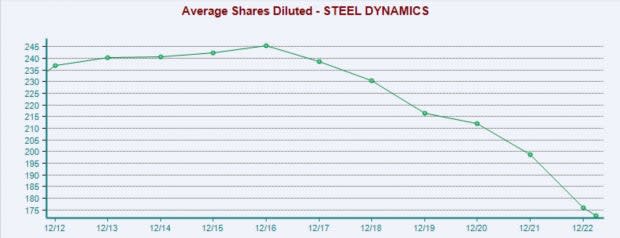

Steel Dynamics

Steel Dynamics is among the leading steel producers and metal recyclers in the US. It currently has steelmaking and coating capacity of around 16 million tons. STLD is one of the most diversified steel companies in the country with a vast range of specialty products. The company makes and markets steel products, processes and sells recycled ferrous and nonferrous metals, and fabricates and sells steel joist and decking products internationally.

Steel Dynamics is another company that has made huge efforts to consistently buy back shares. Between 2016 and today, total shares outstanding have been reduced by 30%. Also, over that period revenues have tripled from $7.7 billion to $21.6 billion, and dividends per share have also tripled.

Image Source: Zacks Investment Research

Like Pulte Group, Steel Dynamics stock has clearly rallied for reasons other than its share buybacks, namely the marked growth in revenues and investor friendly dividend payouts. Since 2016 STLD has compounded at an annual rate of 24%, doubling the annual returns of the broad market index.

Image Source: Zacks Investment Research

STLD is trading at a one-year forward earnings multiple of 5.9x, which is below the industry average 6.6x, and below its 10-year median of 12x. With such a relatively low valuation as well as a Zack Rank #2 (Buy), STLD is a worthy consideration for investors looking at stocks buying back shares.

Image Source: Zacks Investment Research

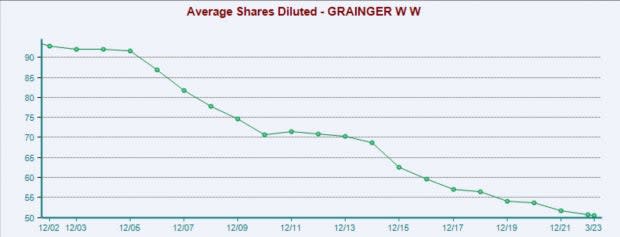

W.W. Grainger

W.W. Grainger is a business-to-business distributor of maintenance, repair and operating (MRO) products and services. Its operations are primarily in North America, Japan, and the U.K. Its customers represent a wide array of industries including government, manufacturing, transportation, commercial and contractors. Its products include material-handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, and metalworking tools.

W.W. Grainer’s 20-year buyback campaign has reduced its outstanding shares by 45% over that time. Over that period revenues have tripled from $5 billion to $15 billion and earnings per share have 10x’d $3.02 to $32.21 per share.

Image Source: Zacks Investment Research

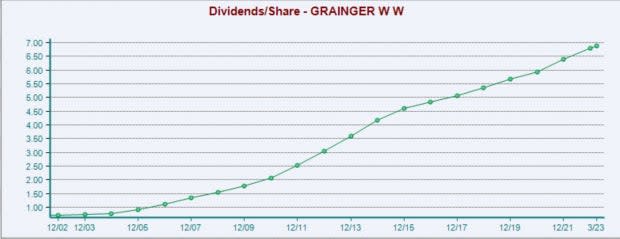

GWW clearly loves its investors as dividends have also been trending higher over the last 20 years. Dividends per share have climbed from $0.79 in 2004 to $6.88 per share today.

Image Source: Zacks Investment Research

GWW is trading at a one-year forward earnings multiple of 19x, which is in line with the industry average and just below its 10-year median of 20. W.W. Grainger also has a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions.

Image Source: Zacks Investment Research

Bottom Line

These three stocks have shown a history of returning huge amounts of money to investors through both stock buybacks and dividends. Actions like this are typical of stocks with strong long-term returns. Additionally, with the current high Zacks Ranks, they have good chances of good returns in the near-term as well.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance