3 Top Growth Stocks to Buy Right Now

If you're looking to supercharge your investing returns, growth stocks can make a big difference. That's particularly true if you can find -- and buy -- them on sale. When it happens, those opportunistic buys can lead to tremendous gains.

Three Motley Fool contributors have identified leading Chinese e-commerce services provider Baozun Inc. (NASDAQ: BZUN), renewable energy equipment supplier SolarEdge Technologies Inc. (NASDAQ: SEDG), and high-growth entry-level homebuilder LGI Homes Inc. (NASDAQ: LGIH) as growth stocks worth buying right now.

Image source: Getty Images.

So far this year, the market has been negative on all three, which are down between 27% and 38% from their highs. Here's why we think this short-term sell-off has created a wonderful long-term opportunity.

A Chinese e-commerce star on sale

Jeremy Bowman (Baozun): The last few months have been tough on Chinese stocks. The SPDR S&P China ETF has fallen 14% over the last three months on growing concerns about a trade war between the U.S. and China and that has pressured stocks like Baozun, which has lost 26% during that time.

However, Baozun's exposure to a potential trade war seems limited as the company resembles Shopify, by helping multinationals and other businesses with their e-commerce operations, including software and IT and warehousing and distribution. The company calls itself the leading brand e-commerce solutions provider in China and has a 22% share of the market. Baozun is also growing quickly, with revenue up 30.5% to $175.2 million in its most recent quarter. However, services revenue surged 51% in the period to $88.5 million. The company should become more profitable as it pivots to higher-margin services and away from direct selling. Adjusted profits increased 34% last quarter to $0.15 per share, and the stock looks like a steal after the recent sell-off. Based on next year's expected earnings per share of $1.74, the stock is trading at a P/E of 28, which looks awfully cheap for a company with Baozun's growth potential.

The Chinese e-commerce space continues to grow at a brisk pace with compound annual growth of 38% over the last three years, and Baozun should continue to be a beneficiary due to its leading positions and contracts with companies like Microsoft, Starbucks, and Nike.

After the recent slide, now looks like a great time to grab some shares of Baozun.

Prospects for this solar star are still bright

Rich Smith (SolarEdge): With California on the cusp of passing a law requiring 100% renewable energy in its electric grid by 2045, I think solar is a great place to look for top growth stocks to buy right now.

And one of my favorites in this industry is SolarEdge.

A leading manufacturer of solar inverters -- the electronic widgets that convert the direct current created by solar panels into alternating current that electronic devices can use -- SolarEdge stock has been hard hit by worries over President Trump's talk of a trade war with China, and the impact that might have on America's solar industry. Because so many of our solar panels are made in China, any decline in those imports has the potential to depress demand for solar inverters from SolarEdge.

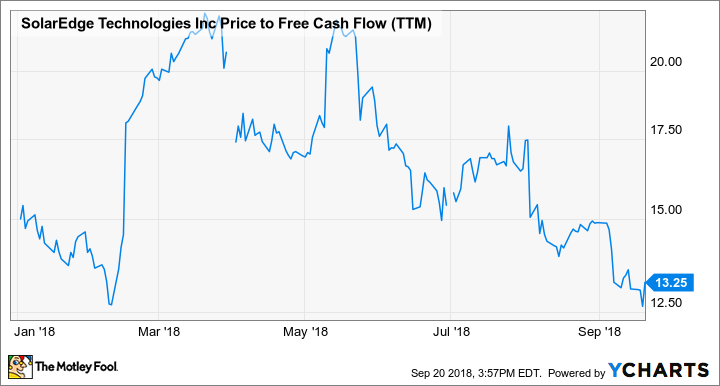

SEDG Price to Free Cash Flow (TTM) data by YCharts.

Still, I suspect both that investors' concerns are overblown, and that this controversy will blow over in time -- and I'm not alone. On Wall Street, analysts estimate SolarEdge will grow its earnings at 22% annually over the next five years, despite all the trade war talk. Considering that SolarEdge stock sells for just 13 times free cash flow (less when you take its cash position into account), I think it offers a very cheap way to buy into a market trend with a lot of potential for growth.

This hypergrowth homebuilder is too cheap to ignore

Jason Hall (LGI Homes): So far this year, this small Texas-based homebuilder has reported two great quarters, and is on track to deliver by far its best year ever. Home sales were up 44% in the first half of the year, while net income surged 70%.

Things are going so well that management even raised its full-year guidance for home closings and earnings per share. But its stock price is down 38% since early 2018.

So what gives?

In short, higher interest rates and higher home prices have spooked investors, who fear a housing downturn is approaching. And so far in the second half of the year, LGI Homes hasn't given investors anything favorable. The company reported home sales declined in July and August from last year.

But while this has spurred many investors to the exits, I think it's created a buying opportunity for long-term-minded folks. Entry-level housing is set to be in high demand for years to come as millennials enter the market and baby boomers downsize, and the upside from that trend should prove far bigger than the temporary weakness we are seeing today. This is particularly the case, considering that weak supply of affordable housing is the problem, not weak demand.

Furthermore, LGI Homes is cheap, trading for 8.4 times trailing earnings and 6.7-7.5 times company guidance for 2018. Shares might fall more in the short term as the market sorts itself out, but they should be worth substantially more in a few years, considering the company's strong prospects as a leader in entry-level housing.

More From The Motley Fool

Jason Hall owns shares of Baozun and LGI Homes. Jeremy Bowman owns shares of Baozun. Rich Smith owns shares of Baozun and SolarEdge Technologies. The Motley Fool owns shares of and recommends Baozun. The Motley Fool owns shares of LGI Homes. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance