3 Top Financial Tips for Early Retirement

Early retirement means different things to different people.

The freedom to work when you want, or not at all, is one popular goal of early retirement. Work isn’t that bad when you have the option to do it on your own terms. Many people work well into their 60s or even 70s after they officially retire.

Building the financial bridge

Quitting work early requires a bit of planning. The general objective is to have enough cash set aside to serve as an income bridge between the time you retire and when you decide to start taking company pensions, CPP, and even OAS.

CPP is available as early as age 60 at a discounted amount and pays 100% of the value at 65. The OAS pension kicks in at 65. Both pay you more for every year you defer starting the pensions. Corporate pensions might be available as early as age 55 but also normally require a cut to the payout if started before the target age, which, again, is often 65.

So, a person who wants to quit work completely at 55 would need enough savings to carry them for 10 years until the full values of various pensions become available.

Top tips for early retirement

The first step involves defining an annual budget for your retirement years. This requires analyzing all the essential living costs, including housing, utilities, food, and transportation. Determining a value for annual holidays is also a good idea. When you have a number that appears reasonable, add another 10% for surprises or special treats.

The second step involves making sure debt is under control. It is difficult to retire early if you still carry a large mortgage, home equity line of credit, or high credit card balances. Ideally, you want to be debt-free the day you send in your resignation letter.

The third step to hitting the early retirement goal involves saving the funds needed to serve as an income bridge from your official retirement day to the day you start collecting CPP, OAS, and the company pension. This number could be $100,000 or $1 million, depending on your personal circumstances and lifestyle.

Top stocks for a TFSA

A popular strategy for building a self-directed savings fund for early retirement involves buying top dividend stocks for a TFSA portfolio.

The TFSA allows you to reinvest the full value of the distributions and all dividends and capital gains are tax-free. This means you can pull the money without having to set some aside for the CRA. In addition, the CRA does not count TFSA income when determining possible OAS clawbacks.

The top stocks to own tend to raise their distributions every year and have solid businesses that perform well in all economic situations. Companies such as Fortis, Royal Bank, and Canadian National Railway might be good picks to get you started.

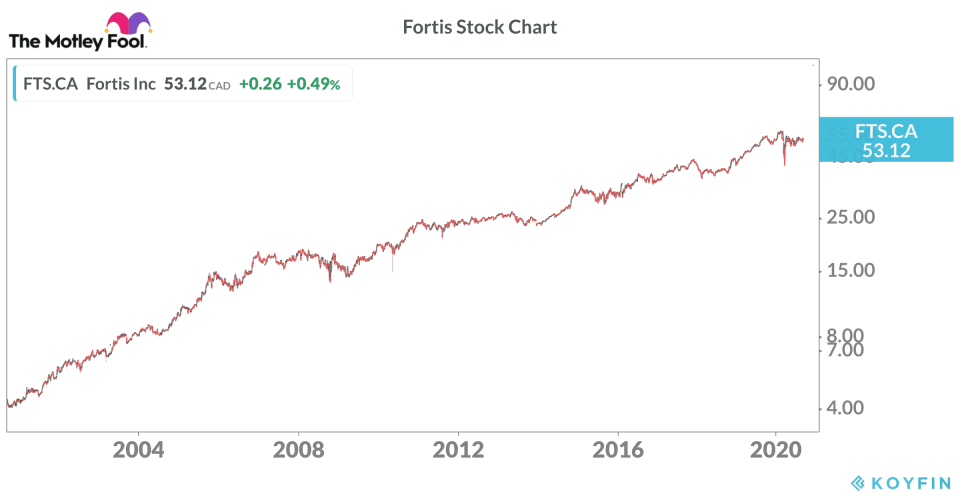

If you only buy one today, I would make Fortis the first choice.

Why?

Fortis has raised its dividend in each of the past 46 years. The board intends to hike the payout by an average annual rate of 6% through 2024.

Fortis operates more than $50 billion in regulated utility assets including power generation, electricity transmission, and natural gas distribution. Revenue is predictable and reliable and the businesses tend to be recession-resistant.

A 10,000 investment in Fortis just 20 years ago would be worth $125,000 today with the dividends reinvested. The stock might be boring, but the returns are fantastic.

Can you hit your early retirement goal?

Early retirement is all about freedom. With some careful planning and focused investing, many people should be able to trim a few years off the daily grind.

The post 3 Top Financial Tips for Early Retirement appeared first on The Motley Fool Canada.

More reading

The Motley Fool recommends Canadian National Railway and FORTIS INC. Fool contributor Andrew Walker owns shares of Fortis.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance