3 Things to Watch in the Stock Market This Week

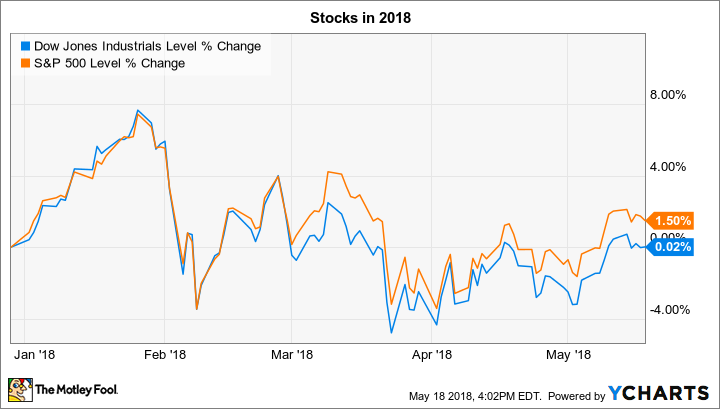

Stocks barely budged last week, to keep both the Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 (SNPINDEX: ^GSPC) in just modestly positive territory for the year.

Earnings reports still have the potential to steer indexes in one direction or the other, with retailers holding the spotlight over the next few trading days. Lowe's (NYSE: LOW), Target (NYSE: TGT), and Best Buy (NYSE: BBY) are each set to report their latest results this week. Here's what investors can expect from these announcements.

Lowe's seasonal traffic

Home-improvement retailer Lowe's will post its results before the market opens on Wednesday. And while it routinely trails its bigger rival Home Depot on important growth and profitability metrics, the bar has been lowered for this most recent sales period after the market leader revealed a rare decline in first-quarter customer traffic and operating profit margin.

Investors will be watching Lowe's comparable metrics -- especially customer traffic -- for signs that the retailer has stopped ceding market share to Home Depot. Outgoing CEO Robert Niblock and his team have predicted an overall growth slowdown to about 3.5% in 2018 compared to last year's 4% gain. That target might be harder to reach if the same industry struggles that impacted Home Depot also hurt Lowe's results at the start of the critical spring selling period.

Still, investors might get good news on the financial front this week. Given its conservative dividend payout ratio and the extra cash on the way from tax cuts, Lowe's could have room to raise its direct cash returns in the coming quarters, provided its modest sales pace holds up.

Target's profitability

Investors are finding a few good reasons to believe in Target's turnaround lately. The retailer surpassed its upgraded sales-growth guidance over the holiday sales period, for example, thanks to healthy customer traffic gains and surging e-commerce sales. As of early March, the company had been predicting that this positive growth momentum will continue into 2018.

Image source: Getty Images.

In addition to strong sales gains, investors will be following Target's profitability on Wednesday morning for clues as to where that figure might land after the retailer completes its transformation into a multichannel seller. Profit margin fell last year, and management warned shareholders to expect further declines as e-commerce becomes a bigger part of the business. That slight profitability dip will be a small price to pay for the other financial improvements that Target is hoping to achieve, including faster sales growth, surging free cash flow, and increased returns on invested capital.

Best Buy's outlook

Best Buy will announce its latest results on Thursday. After stunning investors by posting strong sales gains over the holidays, expectations are high for more good news this week.

Image source: Getty Images.

CEO Hubert Joly and his team have predicted modest sales gains of roughly 2% this year following last year's 5.6% spike. For the first quarter, the target range is between 1.5% and 2.5%, but the retailer could surpass that goal if positive demand trends continue in key product categories like gaming and smartphones.

The company has to strike a tough balance when seeking market-share gains at the expense of profitability. But operating income is expected to hold steady at 4.4% of sales this year, for example, compared to 4.7% two years ago.

At the same time, Best Buy's aggressive cost-cutting program has made it easier to protect earnings, and the company's strong financial position gives it plenty of flexibility as it navigates through a volatile time for brick-and-mortar retailers.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Home Depot. The Motley Fool has the following options: short May 2018 $175 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot and Lowe's. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance