3 Things Ford Motor Company Wants You to Know

Ford Motor Company (NYSE: F) closed out 2017 on a somewhat sour note. Its pre-tax profit for the year was down 18% from its 2016 result, as rising costs and the discounts required to keep its aging product line competitive squeezed its margins.

It was a stark contrast to the result from Ford's old cross-town rival, General Motors (NYSE: GM). GM's pre-tax profit matched its record 2016 result, and GM executives spelled out an optimistic vision for the next few years.

Following Ford's earnings report, CEO Jim Hackett, CFO Bob Shanks, and other senior executives held a conference call for investors in which they explained that they expect things to improve -- but not right away.

Here are three highlights from that call.

CEO Jim Hackett says Ford needs to improve its "fitness." Image source: Ford Motor Company.

1. Ford knows it has a "fitness" problem

I and my team are not satisfied with this level of performance, and we see 2018 as the opportunity to prove to you that we can sharpen operational execution, dramatically improve the fitness we're talking about and continue making the big decisions strategically on where to play and how to win, and of course, properly allocate capital. -- CEO Jim Hackett

Hackett, who played football in college, is fond of the "fitness" metaphor to describe a business's efficiency and profitability. Since taking Ford's top job last May, he has made it clear that he thinks Ford needs to be spending a lot more time in the financial gym.

The problem in a nutshell: Ford's revenue has risen nicely over the last several years, but as Hackett points out, Ford's spending has kept pace, limiting its bottom-line gains. Reining in rising costs, focusing on higher-profit opportunities, and making the most of Ford's vast global scale are all part of his vision for making Ford a fitter company.

While demand for compact SUVs has been soaring, U.S. sales of the Ford Escape were up just 0.4% last year. Image source: Ford Motor Company.

2. Much-needed new products are on the way

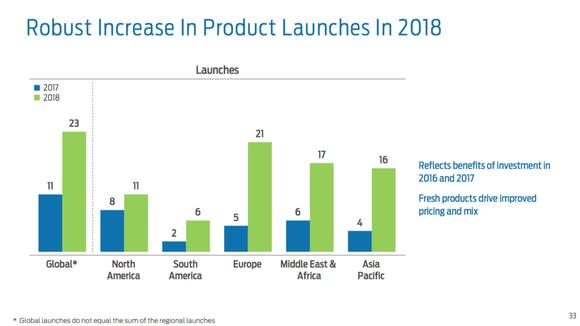

The good news is that our investment in new product in recent years will really start to come to fruition in 2018. We have 23 global vehicle launches planned for this year, more than twice as many as 2017. -- Hackett

In the second half [of 2018], we start a new wave of product launches in China, and we believe that freshness is going to be a really important part of our growth story in China again. -- Jim Farley, EVP and president of Global Markets

Ford's profitability in 2015 and 2016 was driven largely by its "crown jewels," the F-Series pickups. Ford has lavished its huge-selling trucks with investments and updates over the last few years, and there's no question that those efforts have paid off in a big way.

But in the meantime, other important Ford products that were once very competitive have fallen behind newer entries from rivals. Models like the Escape and the Explorer SUVs compete in white-hot (and very profitable) market segments, but they're dated models that have lost ground to rivals over the last year.

That has been an especially big problem in China, a fast-moving market where Ford lost significant share in 2017. But as Hackett and Farley explained, that situation is set to change: Ford has a slew of new and refreshed products headed to market in 2018. Those new products should help give Ford's sagging profit margins a boost.

Image source: Ford Motor Company.

3. Hackett still isn't ready to reveal his fitness plan

Two related questions have hung in the air since Hackett took over as Ford's CEO last May: How will he improve Ford's "fitness," and when will those efforts pay off?

Hackett has talked generally about his goals for Ford and has said there are six initiatives under way that he expects will yield significant improvements over time:

We've identified these 6 work streams. They're up and running. And the benefits, we're talking about '18 and '19, some of them. The bulk of [the benefits] from what I see comes a little later [than 2019] because some of these are substantial redesigns [of Ford's processes].

But much to the consternation of the Wall Street analysts who cover Ford, he hasn't yet said what those six initiatives are, or when (and how) they'll pay off. That'll happen soon, Hackett said, but he sees good reasons for holding off.

I also want to emphasize something here, which is in the design of fitness, one of the things you have to do, in addition to having you understand where we're going and our people understanding that, is you can't disrupt the flow of the business. I can tell you legendary stories where certain enterprise systems were put in prematurely and the business was disrupted.

So what you'd be witnessing now in the way that we started this work is we've long identified where we want to work. We're now in the redesign phase. We're now dimensioning the value. We've assigned responsibilities. I'm meeting with teams weekly. I just had a big meeting Friday with people in the company. And it's getting close to the point where I think we can start to bring you under the tent. But it's not tonight. -- Hackett

Hackett closed out the call by saying that he is "really confident" that investors will be happy with the plan once it's announced. We'll see.

More From The Motley Fool

John Rosevear owns shares of Ford and General Motors. The Motley Fool owns shares of and recommends Ford. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance