3 Tech Stocks That Can March into April

As the first quarter of 2023 comes to an end, the rebound in the technology sector has been more resilient than many might have expected. To that point, the Nasdaq is now up +13% year to date to easily top the broader S&P 500’s +4%.

Here are three tech stocks that were recently added to the Zacks Rank #1 (Strong Buy) list this week and could rise going into April.

Allegro MicroSystems (ALGM)

The rally among many semiconductor stocks has boosted the broader technology sector this year and Allegro MicroSystems is a chip-maker investors may want to consider at the moment.

Allegro’s Electronics-Semiconductors Industry is currently in the top 35% of over 250 Zacks Industries and the company is poised to benefit as an integrated circuit provider to the automotive and industrial markets.

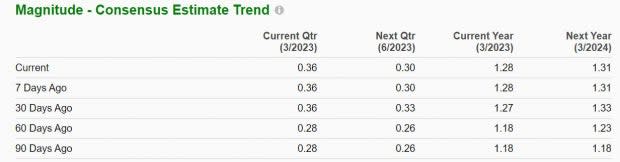

Earnings estimate revisions remained higher throughout the first quarter with Allegro expected to see stellar top and bottom-line growth this year. This has been a catalyst for the strong performance in ALGM shares.

Image Source: Zacks Investment Research

Allegro’s fiscal 2023 earnings are now expected to leap 64% to $1.28 per share compared to $0.78 a share in 2022. Fiscal 2024 earnings are forecasted to rise another 2%. On the top line, sales are projected to climb 33% this year and rise another 1% in FY24 to $983.70 million.

Trading at $46 per share Allegro stock is now up +53% year to date to largely outperform the S&P 500, Nasdaq, and the Electronic-Semiconductors Markets +25%. Even better, Allegro stock has soared+162% over the last three years to also outperform the broader indexes, and its Zack Subindustries +137% which is reason to believe its strong performance in 2023 could continue.

Image Source: Zacks Investment Research

Microchip Technology (MCHP)

Another semiconductor company that was recently added to the Zack Rank #1 (Strong Buy) list is Microchip Technology. Microchip’s Semiconductor-Analog and Mixed Industry is in the top 32% of all Zacks Industries.

Microchip develops and manufactures microcontrollers, memory, analog, and interface products for embedded control systems which are small, low-power computers designed to perform specific tasks.

What makes Microchip Technology stock stick out at the moment is its price-to-earnings valuation. With EPS estimates on the rise, Microchip stock trades at $77 per share and 13.2X forward earnings. This is nicely below the industry average of 17.6X and the S&P 500’s 18.3X.

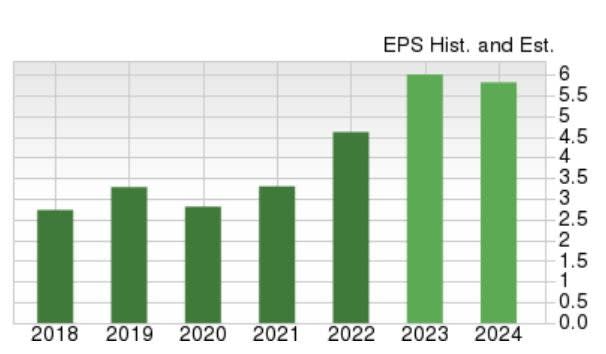

Image Source: Zacks Investment Research

Plus, Microchip stock trades 52% below its decade-long high of 27.8X and at a 27% discount to the median of 18.2X. Microchip’s fiscal 2023 earnings are forecasted to jump 30% to $6.00 per share compared to $4.61 a share in 2022. Fiscal 2024 earnings are expected to rise another 2%.

Image Source: Zacks Investment Research

Microchip stock is up +12% YTD to roughly match the Nasdaq and top the S&P 500 but slightly trail the Semi-Analog & Mixed Markets +16%. Shares of MCHP are now up +124% over the last three years near its Zack Subindustry’s +142% and more upside could certainly be in store given the company’s valuation and growth prospects.

Momo (MOMO)

Outside of the two domestic chip makers, Momo stock could start to have a strong performance as we head into the spring. Formerly Momo, Hello Group provides a mobile social and entertainment platform primarily in China.

The Internet-Software Industry is in the top 25% of all Zacks Industries and Momo’s earnings estimate revisions are very intriguing. Fiscal 2023 earnings estimates have climbed 29% throughout the quarter with FY24 EPS estimates jumping 25%. Momo’s earnings are now expected to pop 19% this year and jump another 11% in FY24 at $1.75 per share.

Image Source: Zacks Investment Research

Even better, Momo stock trades at $8 per share and just 5.2X forward earnings which is well beneath its industry average of 45.1X. This is also well below its historical high of 209.7X and a 69% discount to the median of 16.7X since going public in 2014.

Momo stock is down -7% year to date but the reopening of China’s economy in December appears to be boosting the company’s outlook and should continue to boost investor sentiment as well.

Takeaway

The rising earnings estimate revisions offer further support to the valuation of these tech stocks and could certainly make them top performers in the broader technology sector as we progress through 2023.

With the impressive year-to-date rebound in the Nasdaq attracting investors, Allegro MicroSystems, Microchip Technology, and Momo are stocks to keep an eye on.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Hello Group Inc. Sponsored ADR (MOMO) : Free Stock Analysis Report

Allegro MicroSystems, Inc. (ALGM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance