3 Stocks Putting Their Defensive Nature on Full Display

The Zacks Consumer Staples sector has been notably defensive year-to-date, declining 12% vs. the general market’s roughly 23% decline.

Image Source: Zacks Investment Research

Companies in the sector have the ability to generate revenue in the face of both good and bad economic situations, helping explain why investors have respected it in 2022.

As a matter of fact, several highly-ranked stocks in the realm are even outpacing the sector, such as PepsiCo PEP, Constellation Brands STZ, and The Hershey Company HSY. This is shown in the chart below.

Image Source: Zacks Investment Research

For those looking to beef up their portfolio’s defense, let’s dive deeper into each one.

The Hershey Company

The Hershey Company is the largest chocolate manufacturer in North America and a global leader in chocolate and non-chocolate confectionery.

Over the last few months, analysts have upped their bottom-line outlook marginally across several timeframes.

Image Source: Zacks Investment Research

HSY carries strong dividend metrics – the company has upped its dividend payout five times over the last five years, paired with a robust 7.4% five-year annualized dividend growth rate.

Hershey’s 1.9% annual dividend yield comes in under its Zacks sector average of 2.9%.

Image Source: Zacks Investment Research

Further, it’s hard to ignore the company’s projected growth; earnings are forecasted to climb a double-digit 14.4% in FY22 and a further 9% in FY23.

HSY’s displaying remarkable top-line strength as well, with revenue forecasted to increase 14% and 6% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

PepsiCo

PepsiCo is a long-established company engaged in the manufacturing, marketing, and distribution of grain-based snack foods, beverages, and other products. We see their snacks and drinks at seemingly every stop.

Analysts have raised their earnings outlook marginally across several timeframes over the last several months, undoubtedly a positive.

Image Source: Zacks Investment Research

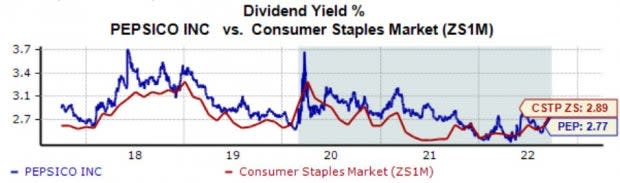

It's been a very positive 2022 for PepsiCo, which recently joined the elite Dividend King group, demonstrating an exceptional commitment to shareholders through 50 consecutive years of increased dividend payouts.

PEP’s annual dividend sits at a respectable 2.8%, marginally below its Zacks Consumer Staples sector average of 2.9%.

Still, the company’s 6.7% five-year annualized dividend growth rate is undoubtedly the major highlight.

Image Source: Zacks Investment Research

Further, PEP carries a favorable growth profile, with earnings forecasted to climb 6.4% and 8.5% in FY22 and FY23, respectively.

Top-line growth is also very apparent; revenue looks to climb nearly 6% in FY22 and a further 3.6% in FY23.

Image Source: Zacks Investment Research

Constellation Brands

Constellation Brands produces and markets beer, wine, and spirits, claiming the spot of the third-largest beer company and a leading, high-end wine company in the United States. A few of its brands include Corona, Modelo, and SVEDKA Vodka.

Earnings estimates have gone up across the board over the last several months.

Image Source: Zacks Investment Research

Like PEP and HSY, Constellation Brands sports a robust growth profile; the company’s bottom-line is projected to expand 8.7% in FY23 and a further double-digit 15% in FY24.

Revenue growth is also impressive, with estimates calling for 7.5% top-line growth in FY23 and 7% in FY24.

Image Source: Zacks Investment Research

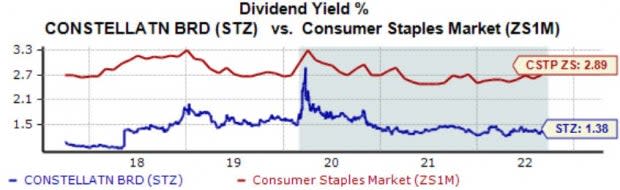

Further, STZ rewards its shareholders via its annual dividend yielding a respectable 1.4%, below its Zacks sector average.

Still, what the company lacks in yield is made up with its dividend growth – STZ has upped its dividend payout four times over the last five years, paired with a strong 6.6% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Injecting defensive stocks into portfolios in 2022 has undoubtedly been a great idea, seen as a way to combat a hawkish Federal Reserve that’s spoiled the fun for technology and other high-growth stocks.

All in all, it comes down to this – companies in the Zacks Consumer Staples sector know how to make money in all environments, even under a dark fiscal cloud.

All three stocks above – PepsiCo PEP, Constellation Brands STZ, and The Hershey Company HSY – carry a favorable Zacks Rank, telling us that analysts have confidence in their near-term earnings performance.

Further, all three stocks pay investors handsomely, undoubtedly a significant perk that all investors love.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance