3 Stocks to Buy When the Market Crashes

Stocks go down faster than they go up, but they always go up more than they go down. -- David Gardner

This simple statement by Motley Fool co-founder and investing legend David Gardner has two powerful lessons. The first is that, since stock market drops happen so quickly, it's very hard to avoid them. Frankly it's more than just hard: It's basically impossible to successfully sell "at the top" and avoid market drops. But the second lesson more than makes up for this: Time in the market beats timing it. Owning great stocks for the long term means the ups will more than make up for the downs.

But that doesn't mean there's not a way to profit from market crashes. To the contrary, being nimble and ready to act quickly during a market correction -- but to buy, not to sell -- can pay off with huge long-term returns. This is because even the best stocks get pummeled during a market crash, when investors let fear take control and sell.

Image source: Getty Images.

Three stocks that should be at the top of your shopping list during the next market crash are American Express (NYSE: AXP), Starbucks (NASDAQ: SBUX), and Brookfield Infrastructure Partners L.P. (NYSE: BIP). They've all proven to be market-crushing investments for people who bought the last time there was a big market crash, and they retain the same characteristics that make them ideal long-term investments.

A top-notch financial company

Two things will make American Express a likely sell target for many investors during the next market crash: its heavy reliance on consumer spending and business lending. And if a big market crash is related to weak jobs numbers, slowing economic growth, or even a recession, then AmEx is almost certainly going to feel some impact.

But even with that short-term risk, American Express remains an excellent company to own for the long term. To start, its management has done a solid job managing the risk that its loan portfolio and charge card lending creates. Last quarter, the company reported a 1.6% loss rate on charge transactions and 2% on loans. These rates would likely increase during a recession, but with a strong balance sheet and substantial cash flows, AmEx should be able to easily ride out any short-term shocks.

And it would emerge from the other side still positioned to profit from a very big trend: the shift to cashless economies around the world. On a global basis, cash remains king, making up the vast majority of transactions. But the confluence of a burgeoning global middle class and mobile connectivity is changing that dynamic quickly. Over the next couple of decades, the global middle class will add more than 1 billion new members, many of whom will become AmEx cardholders. This should continue to drive years of growth, even with the occasional market hiccup along the way.

AXP Total Return Price data by YCharts.

Since the market bottom in 2009, American Express investors have enjoyed total returns of over 840%, more than double the S&P 500 over the same time. With a solid foundation and wonderful prospects, it's an ideal stock to target during a market drop.

A powerful consumer brand with more growth ahead

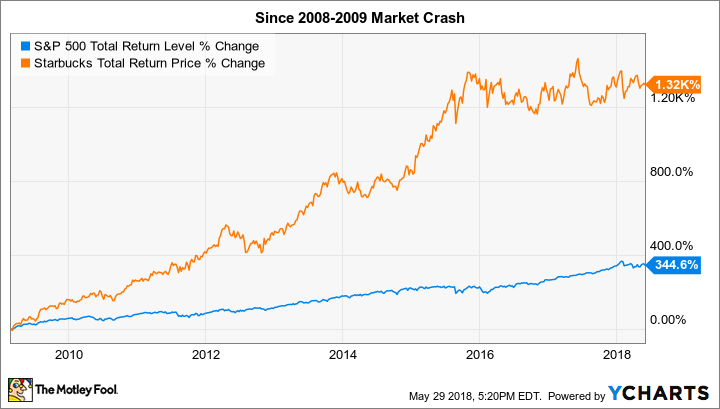

Like American Express, Starbucks' prospects are also dependent on a healthy, growing economy. Also like AmEx, it has made for an incredible investment for anyone who took advantage of the market drop back in 2009 to buy shares.

That's right: Starbucks investors have been rewarded with nearly fourfold better gains than the market over the past decade.

A big part of this was Starbucks' stock price falling 75% during the worst of the financial crisis, as investors became convinced that the company couldn't return to the high-growth years it had enjoyed before. Here we stand a decade later, and Starbucks has never been bigger or more profitable.

And I think there's still plenty of coffee left in the carafe. Starbucks has a dominant position in the U.S. and many other Western countries, but its opportunity for years of growth in developing economies is staggering. China, for instance, is the company's second-largest market with about 3,000 stores. But that's less than half the size of the U.S., which it is expected to eventually surpass. Over the next four years, the company plans to double its store count in China, while also growing distribution of its bottled beverages in non-Starbucks retail locations. This is expected to more than triple sales in this potentially massive market in less than four years.

If a market crash gives investors a chance to buy this top-notch brand at a big discount, it's worth buying to hold.

A recession-proof business that throws off cash

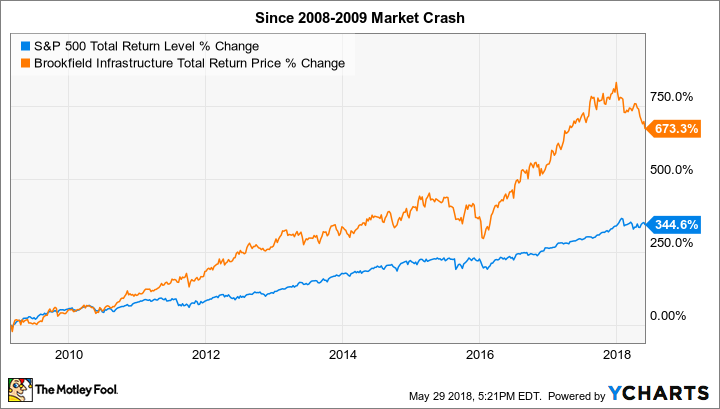

While American Express and Starbucks are consumer-spending-oriented, Brookfield Infrastructure Partners is almost entirely recession-proof. This is because it owns the sorts of infrastructure a society relies on no matter the market or economic environment: water supply, telecommunications connections, energy and utility distribution, and transportation assets such as roads and ports.

While you may forgo a stop at Starbucks (paid for with your AmEx) if the economy is faltering, you won't cancel the water or gas service to save money. By owning and operating these critical infrastructure systems, Brookfield is able to generate steady, predictable cash flows. Furthermore, it also has substantial geographical diversity, which helps insulate it from weakness in any single country or region, while also utilizing currency hedges to keep its cash flows from getting caught up in foreign exchange woes and structuring its contracts to allow for inflation adjustments to avoid that risk.

This has paid off with steady cash flow growth for years, and Brookfield's management has done a wonderful job of reinvesting that cash for more growth, while also paying a solid dividend that yields 4.9% at recent prices.

It's also set to benefit from global population growth, especially urban expansion. Trillions of dollars will be spent to modernize and expand global infrastructure in the years ahead. Brookfield Infrastructure Partners is one of the best-positioned investments you can make to profit from this trend today. If it goes on sale even more during a market crash, I'd say investors would do well to load up.

More From The Motley Fool

Jason Hall owns shares of American Express, Brookfield Infrastructure Partners, and Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance