3 Stocks to Build Your Portfolio Around

A rock. An anchor. A solid foundation. Does your portfolio have one? No matter your investing strategy or the size of your holdings, building your portfolio around businesses capable of delivering profitable operations in good times and bad can help you to weather financial storms and market pullbacks.

Considering most of the entire stock market's long-term gains come from just a handful of companies, identifying great companies with a track record of beating the return of the S&P 500 over long periods should play a central role in any wealth-building strategy. We asked three contributors at The Motley Fool for businesses that fit the bill. Here's why they decided on Atlassian (NASDAQ: TEAM), Visa (NYSE: V), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL).

Image source: Getty Images.

Collaboration software is big business

Maxx Chatsko (Atlassian): It's rare to see a $22 billion company grow as quickly as Atlassian. The collaboration software leader has consistently grown annual revenue at near a 40% clip in the last several years. Refreshingly, the tech company is growing while operating around the break-even line and generating boatloads of cash, unlike with the usual loss-accruing, cash-burning business models of fast-growing tech companies.

In the fiscal first quarter of 2019 (the period ended September 2018) the business grew revenue 37% from the prior-year period to $267 million, turned in an operating loss of just $0.2 million, and generated $84.9 million in cash from operations. It exited the quarter with $1.8 billion in cash, cash equivalents, and short-term investments.

Thanks to a healthy portfolio of leading brands and an insistence on building a strong developer community, the growth doesn't appear to be on the cusp of slowing down anytime soon. Atlassian ended the most recent quarter with 131,684 customers, which marked an increase of 5.6% from the fiscal fourth quarter of 2018. It made another acquisition, scooping up OpsGenie for $259 million in cash, and launched Jira Ops, a new product helping software teams tackle incidents in a timely and coordinated fashion.

When it announced the most recent quarterly results, Atlassian raised full-year fiscal 2019 guidance and now expects total revenue in the neighborhood of $1.179 billion and free cash flow of approximately $365 million. That compares to just $874 million in revenue and $281 million in free cash flow in fiscal 2018. Simply put, while shares are a little on the expensive side, this business should be able to continue growing into its valuation for the foreseeable future. And even when growth does stop or slow, it's well positioned to divert capital to shareholders through other means.

Image source: Getty Images.

Bet against cash, make money

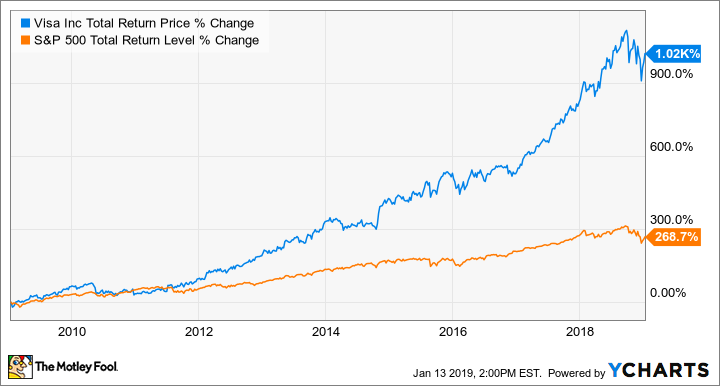

Neha Chamaria (Visa): Visa has everything you'd want in a stock to build your portfolio around. It's the leader in a high-growth industry, earns big margins, has a solid operational performance history, has trumped the S&P 500 returns by huge margins in the past, and is poised to ride the next wave of industry growth.

V Total Return Price data by YCharts.

Along with Mastercard, Visa rules the global payments processing industry, but it's the larger of the two, with nearly 3.3 billion co-branded credit and debit cards in circulation. By comparison, Mastercard had roughly 2.5 billion cards issued as of last count.

Strong consumer spending and an uptick in global digital transactions, largely driven by e-commerce, are fueling growth at Visa. As cashless modes of payment gather steam, more merchants are willing to accept cards in lieu of cash, encouraging banks to issue them in greater numbers. Visa, for its part, is watching its card base grow and its top line swell as it facilitates payments over its network and earns a fee every time its card is swiped to make a purchase anywhere in the world.

Visa is looking at opportunities that could be worth trillions of dollars even as it expands its footprint in nations like India where transactions are still predominantly in cash. There's massive growth potential for the company, and with management also visibly getting more generous with dividends, investors should be able to reap rich returns from the stock in the long run.

Image source: Getty Images.

A foundational stock that will dominate for decades

Chris Neiger (Alphabet): Alphabet is known for making moon shots on new markets, like its current bet on the autonomous vehicle space, but it's the company's core businesses like advertising and its cloud computing prospects that make this stock one to build your portfolio around.

Last year Alphabet's Google brought in 37% of all digital advertising in the U.S., outpacing Facebook, which held about 20%, and Amazon.com, which held just 4%. The company's online advertising reach is unparalleled, and that's not likely to change any time soon. In 2020, Google is expected to still have 35% of the market, according to eMarketer, and with the company's search engine and apps dominating the tech space, Google has access to all the data it needs to serve users relevant ads.

In addition to Alphabet's advertising dominance, the company has loads of potential from its cloud computing services. The company is behind both Amazon's and Microsoft's cloud computing market share right now, but Google has focused its efforts on the cloud recently, and even put in new leadership to help the segment grow.

Google's size and influence in the tech sector mean that even though it's behind Amazon and Microsoft in the cloud space, it certainly can't be counted out. The public cloud computing market will be worth an estimated $302.5 billion in 2021, up from $186.4 billion last year, and there's plenty of time for Google to snag more market share as cloud computing grows.

Investors looking for a great long-term bet on digital advertising, cloud computing, and a host of other growth opportunities would be wise to give Alphabet serious consideration. And with shares down 10% over the past six months, now may be a great time to get on board.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Chris Neiger has no position in any of the stocks mentioned. Maxx Chatsko has no position in any of the stocks mentioned. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Atlassian, Facebook, and Mastercard. The Motley Fool owns shares of Microsoft and Visa. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance