3 Security Stocks to Buy Amid Robust Industry Trends

The Zacks Security industry is benefiting from solid demand for cybersecurity offerings as well as the heightening need for secure networks and cloud-based applications amid growing hybrid working trends. Companies in this space are benefiting from the rising demand for IT security solutions owing to a surge in the number of data breaches. Increasing requirements for privileged access security on the back of digital transformation and cloud migration strategies are also fueling the demand for cybersecurity solutions.

Industry participants like Fortinet, Inc. FTNT, Check Point Software Technologies Ltd. CHKP and Qualys, Inc. QLYS are gaining from the aforementioned trends. However, the industry’s near-term growth prospects are likely to be hurt as organizations push back their investments in big and expensive technology products on growing global slowdown concerns amid the current macroeconomic challenges and geopolitical tensions. Supply-chain disruptions, component shortages, product cost inflation and a tight labor market are some of the headwinds that players in the space have been encountering lately. These, along with elevated operating expenses related to hiring new employees and sales and marketing strategies to capture more market share, are likely to strain margins in the near term.

Industry Description

The Zacks Security industry comprises companies offering on-premise and cloud-based security solutions. The solutions can be used for identity access management, infrastructure protection, integrated risk management, malware analysis and Internet traffic management, to name a few. Industry participants offer different types of security solutions, most of which can be used interchangeably. These solutions can be roughly categorized into three types — Computer Security, Cybersecurity and Information Security. Computer Security solutions provide protection from vulnerabilities in both the software and hardware of a computer system. Cybersecurity includes sections like web security, network security, application security, container security and information security. Information Security is concerned with any form of data-security issue, be it physical or digital data.

Major Trends Shaping the Future of the Security Industry

Rising Cyber Threats Boost Demand for IT Security: Frequent cyberattacks are spurring demand for security solutions. This trend has not only affected certain companies but also threatened the national security of some countries. Notably, the prevailing global health crisis has given rise to newer forms of hacking and cybercrimes, which are difficult for firms and individuals to deal with. The firms operating in the security industry are working hard to address these concerns. These companies are positioned to benefit as protection against spear phishing, credential-based attack, account takeover and ransomware attacks, among others, has become the need of the hour.

Accelerated Digital Transformation Aiding Growth: Increasing the requirement for privileged access security on the back of digital transformation and cloud migration strategies is fueling the demand for cybersecurity solutions. The COVID-19 pandemic has further increased cyber onslaughts as businesses of all sizes are transitioning their operations to various online platforms. From education to entertainment, working to shopping, and even healthcare has gone virtual, causing high technology percolation in everyday lives. This puts not only businesses but also schools, hospitals and other organizations at risk of online assaults. While public institutions and large companies have always been the target of hackers, smaller organizations with lower security standards are also on their radars. Further, the advent of 5G will enable other devices to connect to the Internet, thereby expanding the scope of Internet of Things (IoT) and artificial intelligence (AI). While IoT and AI will simplify things, these will also aggravate the rate of cybercrime, given the increased reliance on technology.

Macroeconomic Headwinds Might Hurt IT Spending: Enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues as evident from Gartner’s latest report on IT spending. The research firm’s report highlights that 2022 IT spending growth will be much slower than 2021 due to spending cutbacks across devices, software, IT services and communication services areas. Furthermore, considering the recessionary situation hovering around the world, we do not expect any strong rebound in IT spending at least in the first half of 2023. This does not bode well for IT security market’s prospects in the near term.

Elevated Operating Expenses to Hurt Profitability: To survive in the highly competitive IT security market, each player is continuously investing in broadening its capabilities. The players in the space are aggressively investing in research and development to enhance their product portfolio and enhance their capabilities to provide a complete security solution to clients. Moreover, companies are investing heavily to enhance their sales and marketing capabilities, particularly by increasing their sales force. Therefore, elevated operating expenses to capture more market share are likely to dent margins in the near term.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Security industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #42, which places it among the top 17% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

The industry’s earnings estimate for 2022 has moved up to earnings of $1.07 from earnings of 92 cents as of Dec 31, 2021. Similarly, the industry’s earnings estimate for 2023 has been revised upward by 31 cents to $1.41 from $1.10 as of Dec 31, 2021.

Before we present a few stocks that you may want to consider for your portfolio, considering bright prospects, let us look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Sector and S&P 500

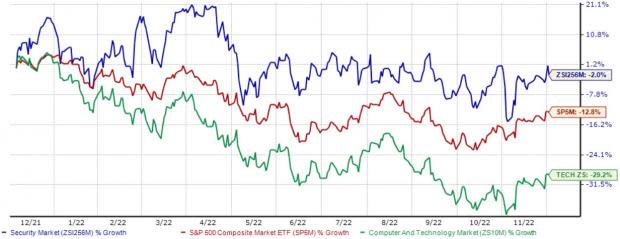

The Zacks Security industry has outperformed the broader Zacks Computer and Technology sector as well as the S&P 500 composite over the past year.

The industry has declined 2% during this period compared with the S&P 500’s 12.8% decline and the broader sector’s 29.2% depreciation.

One-Year Price Performance

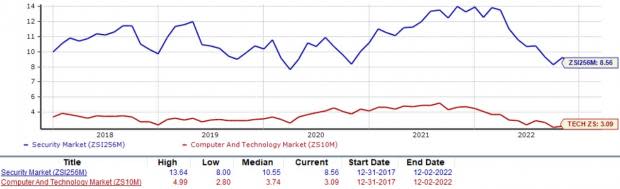

Industry's Current Valuation

On the basis of the trailing price-to-sales ratio (P/S), which is a commonly-used multiple for valuing Security stocks, the industry is currently trading at 8.56, higher than the S&P 500’s 3.51 and the sector’s 3.09.

Over the last five years, the industry has traded as high as 13.64X, as low as 10.55X and recorded a median of 8.00X, as the charts below show.

Price-to-Sales Ratio (Industry Vs. S&P 500)

Price-to-Sales Ratio (Industry Vs. Sector)

3 Stocks to Buy

Qualys: The company offers cloud security and compliance solutions that enable organizations to identify security risks to their information technology infrastructures, thus helping protect their IT systems and applications from cyber-attacks.

Qualys is gaining from the surging demand for security and networking products amid the growing hybrid working trend. Accelerated digital transformations by organizations are also fueling demand for the company’s cloud-based security solutions.

Currently, Qualys sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for 2022 earnings has revised upward to $3.62 per share from $3.55 per share over the past 30 days. Qualys’ shares have fallen 3.7% in the past year.

Price and Consensus: QLYS

Fortinet: This Zacks Rank #2 (Buy) company is a provider of network security appliances and Unified Threat Management (UTM) network security solutions to enterprises, service providers and government entities worldwide.

Fortinet is benefiting from robust growth in Fortinet Security Fabric, cloud and Software-defined Wide Area Network (SD-WAN) offerings. Moreover, continued deal wins, especially those of high value, act as key drivers. Higher IT spending on cybersecurity is further expected to aid Fortinet in growing faster than the security market. Also, FTNT’s focus on enhancing its UTM portfolio through product development and acquisitions is a tailwind.

The consensus mark for Fortinet’s 2022 earnings has been revised upward by 7 cents to $1.15 per share over the past 30 days. Shares of FTNT have plunged 8.2% over the past year.

Price and Consensus: FTNT

Check Point Software Technologies: This Zacks Rank #2 company has evolved into a well-known provider of IT security solutions across the world. The company offers a comprehensive range of software and combined hardware and software products aimed at IT security.

Check Point Software Technologies is benefiting from growth in security subscriptions, aided by strong demand for its advanced solutions, primarily CloudGuard, Harmony, Sandblast Zero-day threat prevention and Infinity solutions. Increased demand for network security gateways to support higher capacities is aiding the adoption of the company’s remote access VPN solutions.

Several Infinity deals in various industries, including government, telecommunication and industrial, are positives. Acquisitions have helped it to broaden its portfolio and enter newer markets, which have eventually driven its revenues. The company continues to win new customer accounts, which is boosting revenues.

The Zacks Consensus Estimate for 2022 earnings has been revised a penny northward to $7.32 per share over the past 30 days. Check Point Software Technologies’ shares have risen 18.9% in the past year.

Price and Consensus: CHKP

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

Qualys, Inc. (QLYS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance