3 Retail Stocks Primed for a Santa Claus Rally

Are you wondering whether the stock market will witness a Santa Claus rally this time around? Well, the month of December has been a favorable one for investors as stocks tend to gain momentum just before the curtains draw on a year. But for now, market pundits are keeping their fingers crossed as 2022 has not been benevolent enough toward investors.

Investors seem to be nervous and are treading Wall Street with utmost caution as worries about a possible recession loom large. Experts fear that the Fed’s hawkish stance to tame inflation might push the economy into a recession.

However, Fed Chairman Jerome Powell’s recent comment about lowering the magnitude of the rate hike from December has come as a breather. Meanwhile, a favorable reading on the Consumer Price Index front as well as a better-than-expected jobs report in November have added to the positive sentiment. Nonfarm payrolls climbed 263,000 last month. Also, average hourly earnings rose 5.1% from a year ago and 0.6% on a month-on-month basis.

Such favorable economic data might bring the mojo back on Wall Street and rekindle hopes of a Santa Claus rally this year. Well, the S&P 500 index is down 17.3% so far in the year. Truly speaking, soaring inflation, higher cost of borrowings and geopolitical headwinds have kept investors on their toes.

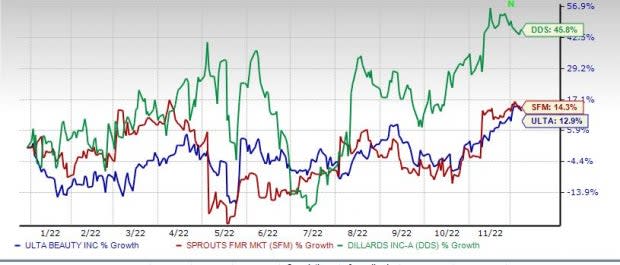

So, as you reassess your portfolio, we have identified three retail stocks, namely Dillard's, Inc. DDS, Sprouts Farmers Market, Inc. SFM and Ulta Beauty, Inc. ULTA that are primed for a Santa Claus Rally.

Notwithstanding inflationary pressure, the retail sector takes center stage with the arrival of the holiday season. We believe that stimulus savings from last year, steady wage gains and a lower unemployment rate should help keep the demand alive. Per the National Retail Federation holiday retail sales during the November and December period are anticipated to improve in the band of 6-8% over the last year to $942.6-$960.4 billion.

Image Source: Zacks Investment Research

3 Prominent Picks

Dillard's, which operates retail department stores, is worth betting on. The company has been benefiting from strong consumer demand, effective inventory management and cost-containment measures. During third-quarter fiscal 2022, total retail sales increased 3%, while earnings per share improved 11.7% from the year-ago period. Cosmetics, men’s apparel and accessories, home and furniture and shoes were robust performing categories.

Dillard's sports a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. The company has a trailing four-quarter earnings surprise of 144.2%, on average. The Zacks Consensus Estimate for Dillard's current financial year sales and EPS suggests growth of 6.6% and 3.4%, respectively, from the year-ago period. The stock has rallied 45.8% year to date. You can see the complete list of today’s Zacks #1 Rank stocks here.

Investors can count on Sprouts Farmers. The company’s focus on product innovation, emphasis on e-commerce, expansion of private label offerings and targeted marketing with everyday great pricing bode well. It has been lowering operational complexity, optimizing production, improving in-stock position and updating to smaller format stores. Sprouts Farmers posted better-than-expected third-quarter 2022 results, wherein both the top and the bottom lines grew year over year. While net sales grew 5%, earnings per share rose 8.9%.

Sprouts Farmers has a long-term earnings growth expectation of 10.4% and a VGM Score of A. This Zacks Rank #2 stock has a trailing four-quarter earnings surprise of 10%, on average. The Zacks Consensus Estimate for Sprouts Farmers’ current financial year sales and EPS suggests growth of 4.6% and 9.5%, respectively, from the year-ago period. Shares of Sprouts Farmers have increased 14.3% so far in the year.

Ulta Beauty is another potential pick. The company has been strengthening its omni-channel business and exploring the potential of both physical and digital facets. It has been implementing various tools to enhance guests' experience, like offering a virtual try-on tool and in-store education, and reimagining fixtures, among others. Ulta Beauty focuses on offering customers a curated and exclusive range of beauty products through innovation. Ulta Beauty posted splendid third-quarter fiscal 2022 results, with the top and the bottom lines cruising past the Zacks Consensus Estimate and increasing year over year. While net sales grew 17.2%, earnings per share soared 35.5%.

This beauty retailer and the premier beauty destination for cosmetics, fragrance, skincare products, hair care products and salon services has a trailing four-quarter earnings surprise of 26.2%, on average. This Zacks Rank #2 (Buy) company has an estimated long-term earnings growth rate of 13.8% with a VGM Score of B. The Zacks Consensus Estimate for Ulta Beauty’s current financial year sales suggests growth of 15.2% from the year-ago period. Shares of ULTA have risen 12.9% so far in the year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance