3 Reasons NVIDIA Is a Better Growth Stock Than AMD

NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD) recently posted solid fourth-quarter numbers that beat analyst estimates. But the market response to both chipmakers was tepid -- NVIDIA shares rose slightly, while those of AMD declined nearly 10% in the first half of February.

That lack of enthusiasm was exacerbated by the recent stock market correction. But as the markets settle down, investors might be wondering if either is worth buying.

Image source: Getty Images.

At first glance, AMD looks like the cheaper pick. It trades at 22 times forward earnings, compared to NVIDIA's forward P/E of 32. Its price-to-sales ratio of 2 is also much lower than NVIDIA's 14.

Yet NVIDIA shares doubled over the past 12 months, while AMD's fell about 14%. That's likely because more investors identify NVIDIA as a more promising growth play than AMD. I think that argument still rings true today for three simple reasons.

Higher revenue growth

NVIDIA's revenue climbed 41% to $9.7 billion in fiscal 2018, compared to 38% growth in 2017. Analysts expect its revenue to go up 27% this year and 14% next year. That growth is mainly fueled by robust demand for its GPUs across the gaming, professional visualization, and data center markets.

Meanwhile, AMD's revenue jumped 25% to $5.3 billion in fiscal 2017, compared to 7% growth in 2016. Wall Street anticipates 18% sales growth this year, followed by 8% growth in fiscal 2018.

AMD's recovery can be largely attributed to CEO Lisa Su, who turned the company's EESC (Embedded, Enterprise, and Semi-Custom) chip unit into a pillar of growth as it developed new GPUs and CPUs.

Though AMD's rebound over the past two years was admirable, it faces more headwinds than NVIDIA. AMD is the underdog in both discrete GPUs and x86 CPUs, which are dominated by NVIDIA and Intel (NASDAQ: INTC), respectively. It carved out a defensible niche in the EESC market -- thanks to the use of its APUs in the PS4 and Xbox One -- but it still lacks the scale or pricing power of its two biggest rivals.

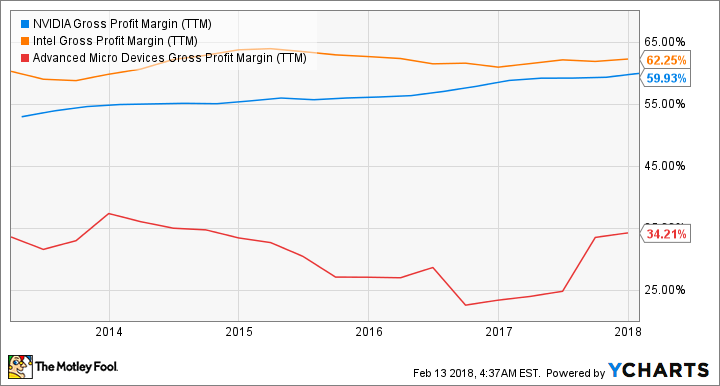

High margins and better profitability

That's why NVIDIA and Intel have consistently higher gross margins and profits than AMD.

Data source: YCharts.

NVIDIA full-year GAAP earnings rose 88% to $4.82 per share in 2018, while its non-GAAP EPS grew 61% to $4.82. Wall Street expects the latter figure to increase 34% this year and 15% next year.

However, NVIDIA also has its own headwinds. The recent decline in cryptocurrency prices might cause miners to quit and flood the market with cheap GPUs. It also faces fresh competition from AMD's new GPUs and APUs in the gaming market, as well as rising chipmakers in the automotive market.

For 2017, AMD squeezed out a GAAP profit of $0.04 per share and a non-GAAP profit of $0.17 per share -- compared to net losses by both metrics in 2016. Analysts think that profitability will continue, with its earnings growing 129% this year and another 41% next year.

AMD's annual earnings growth looks higher than NVIDIA's, but investors should note that it has much lower margins and actual profits. Looking ahead, used GPUs hitting the market, NVIDIA's newer low-end GPUs, or Intel's newer CPUs could throttle its profit growth.

More exposure to next-gen markets

NVIDIA is well diversified across several high-growth markets, including video games, AI-powered data centers, and connected/driverless cars. Its first-mover advantage helped it secure partnerships with market leaders like IBM in data centers, Tesla Motors in connected cars, and Baidu in driverless cars.

AMD is chasing NVIDIA into many of these markets, but it arguably lacks the "best-in-breed" reputation NVIDIA has cultivated over the past few years. AMD secured data center partnerships with Baidu and Microsoft, and there's been buzz about automotive partnerships, but most of AMD's revenue still comes from two aging core markets: PCs and gaming consoles.

The bottom line

I personally like both NVIDIA and AMD as semiconductor plays. But as a growth stock, NVIDIA is the better play, thanks to its stronger revenue growth, beefier margins, and better exposure to next-gen markets.

More From The Motley Fool

Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool's board of directors. LinkedIn is owned by Microsoft. Leo Sun owns shares of Baidu. The Motley Fool owns shares of and recommends Baidu, Nvidia, and Tesla. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance