These 3 S&P 500 Companies Are Cash-Generating Machines

Let’s face it - searching for stocks is difficult, especially with so many options available.

One way to cut out the bad apples is by focusing on stocks with strong free cash flow.

But what is free cash flow, and why is it so important?

In its simplest form, free cash flow is the amount of cash a company keeps after paying for operating costs and capital expenditures.

A high free cash flow allows for more growth opportunities, a greater potential for share buybacks, consistent dividend payouts, and the ability to pay off debt easily.

Three stocks – Exxon Mobil XOM, Microsoft MSFT, and Pfizer PFE – all reported strong free cash flow in their latest quarterly prints.

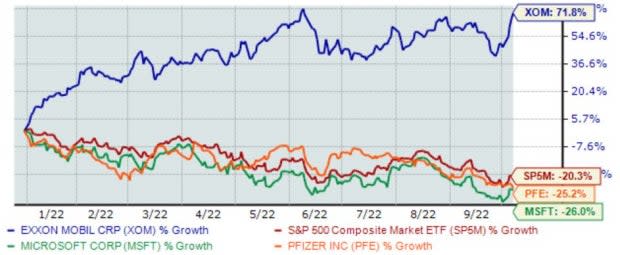

Below is a chart illustrating the share performance of all three companies in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, the energy boom has massively benefitted XOM shares.

While PFE and MSFT shares have experienced adverse price action, their free cash flow is hard to ignore.

Let’s take a closer look at each one.

Exxon Mobil

Exxon Mobil has massively benefitted from soaring energy costs in 2022, causing analysts to significantly up their earnings outlook and push the stock into a highly-favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

In its latest earnings release, XOM reported quarterly free cash flow of a mighty $17.3 billion, penciling in a sizable 60% sequential uptick and a massive 151% year-over-year increase.

Image Source: Zacks Investment Research

As we can see in the chart, the company’s free cash flow growth has been commendable off 2020 lows, in a visibly strong uptrend.

Of course, the company rewards its shareholders handsomely; XOM’s annual dividend yields a sizable 3.6% paired with a sustainable payout ratio sitting at 36% of earnings.

Image Source: Zacks Investment Research

While XOM’s annual dividend yield is lower than its Zacks Sector, the company’s 2.4% five-year annualized dividend growth rate helps to pick up the slack.

Pfizer

Pfizer, a titan in the Zacks Medical Sector, reported quarterly free cash flow of a rock-solid $7.4 billion in its latest release, reflecting an inspiring 26% sequential increase.

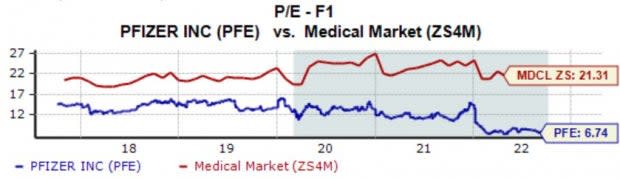

Image Source: Zacks Investment Research

PFE shares look more than reasonably priced; the company’s 6.7X forward earnings multiple is nearly half its 12.6X five-year median and reflects a sizable 68% discount relative to its Zacks Medical Sector.

Pfizer sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

In addition, it’s hard to ignore PFE’s dividend metrics; the company’s annual dividend yields a sizable 3.6%, much higher than its Zacks Medical Sector average of 1.5%.

Further, the company has upped its dividend payout five times over the last five years and carries a rock-solid 4.4% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Investors should keep an eye out for PFE’s next quarterly print – the Zacks Consensus EPS Estimate of $1.64 suggests a stellar 22% Y/Y uptick in earnings.

Microsoft

Microsoft, a mega-cap tech titan, is one of the biggest cash-generating machines within the S&P 500. MSFT posted quarterly free cash flow of a steep $17.8 billion in its latest quarter, reflecting Y/Y growth of nearly 10%.

Image Source: Zacks Investment Research

On top of tech exposure, MSFT pays out an annual dividend that yields 1%, nicely above its Zacks Computer and Technology Sector average of 0.9%.

Impressively, Microsoft has upped its dividend payout six times over the last five years, carrying a 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

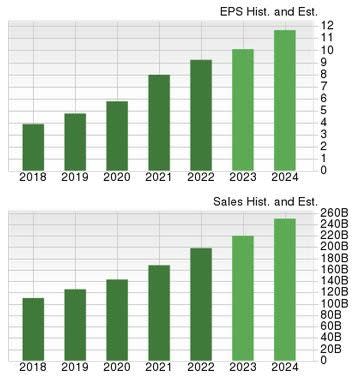

Although a hawkish Federal Reserve has played spoilsport for many tech stocks in 2022, MSFT is still forecasted to grow at a solid pace; earnings are forecasted to climb 9.2% in FY23 and a further double-digit 16% in FY24.

The earnings increase comes on top of projected revenue growth of 11% and 13.4% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

Bottom Line

While selecting stocks is always challenging, a good filter would be focusing on companies with healthy free cash flow.

A solid free cash flow speaks volumes about a company’s financial state, telling us if it has sufficient funds to wipe out debt, pay dividends, or buy back stock.

For those looking to target stocks with free cash flow strength - Exxon Mobil XOM, Microsoft MSFT, and Pfizer PFE – would all be great places to start.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance