3 Hot TSX Stocks Are on Fire

Written by Kay Ng at The Motley Fool Canada

Landing wins in the stock market can help you push ahead your retirement. But you need to be on top of the game. It would be smart to not place all your eggs in one basket. Here are three hot TSX stocks that have been on fire lately and that are outperforming the stock market big time!

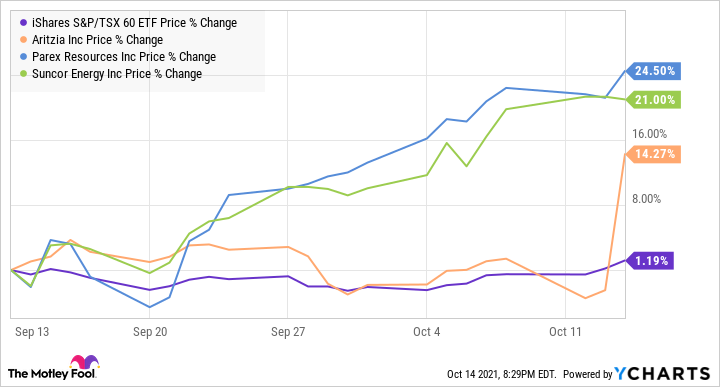

Data by YCharts

Aritzia

Seeing as Aritzia (TSX:ATZ) stock just popped 17%, we’ll begin with the retailer. The surge had everything to do with its fiscal 2022 second-quarter report. It witnessed net revenue climbing 75% from a year ago to $350 million.

Aritzia is a luxury brand that designs and sells apparels and accessories for women in North America. Its quarterly results show that women prefer to shop in store rather than online, but both its e-commerce channel and brick-and-mortar stores are doing incredibly well. Specifically, for the quarter, it boosted online sales by 49% year over year to $130 million, which made up 37% of net revenue. Retail revenue was boosted by a whopping 95% to $220 million compared with a year ago.

In the last 12 months, the growth stock has experienced a massive rally, appreciating roughly 149%, as it made a super comeback from economic reopenings. The growth stock is red hot right now. Investors are urged to stay cool-headed for this hot stock. If you like the stock, put it on your watchlist and wait for a consolidation or pullback.

Management gave Q3 net revenue guidance of $350 to $375 million. However, it noted that supply chain disruptions, labour shortages, and COVID-19 impacts could affect its results. Any pullbacks from these issues could be your opportunity to get in.

Suncor stock

Energy stocks like Suncor Energy (TSX:SU)(NYSE:SU) are also on a growth spurt thanks to the latest oil price rally. At writing, the WTI oil price was flirting with US$82 per barrel, the Brent oil price was over US$84 per barrel, while the WCS was close to US$66 per barrel.

Suncor stock, specifically, has been trading at a bigger discount than its large-cap peers, because of its dividend cut last year. Today, investors do not need to worry about any dividend cut threats. Its free cash flow should improve materially from higher oil prices. For reference, in the trailing 12 months, Suncor stock paid out close to $1.3 billion in dividends, equating to a free cash flow payout ratio of approximately 52%. At about $29 per share, it provides a safe yield of almost 2.9%.

Another energy stock to explore

If you’re considering Suncor stock, another energy stock that could be a better bet is Parex Resources (TSX:PXT). The mid-cap value energy stock provides more secure upside potential. Because it operates in Colombia, it enjoys premium Brent oil pricing.

Moreover, Parex is prepared to continue buying back shares. For example, in 2020, management primarily allocated its free cash flow — $173 million worth — to repurchase its common stock, which meaningfully boosted existing shareholders’ stake in the company. Additionally, it recently started paying a dividend, which boosts total returns. The stock yields close to 2%, at $25 and change per share.

If you’re bullish on oil, look into Parex Resources.

The post 3 Hot TSX Stocks Are on Fire appeared first on The Motley Fool Canada.

This Tiny TSX Stock Could be Like Buying Tesla in 2001

Our team of diligent analysts at Motley Fool Stock Advisor Canada has identified one little-known public company founded right here in Canada that’s at the cutting-edge of the space industry and recently completed a transformational acquisition, all while making a handsome profit in the process!

The best part is that in a market where many stocks are selling at all-time-highs, this stock is trading at what looks like a VERY reasonable valuation… for now.

Click here to learn more about our #1 Canadian Stock for the New-Age Space Race

More reading

The Motley Fool has no position in any of the stocks mentioned. Fool contributor Kay Ng has no position in any of the stocks mentioned.

2021

Yahoo Finance

Yahoo Finance