3 of the Highest Growth Stocks in the Market Today

Hitch your ride to a high-growth stock and your family's financial situation can change -- for the better -- for generations to come. But what, exactly, does it mean to be a "high-growth stock"?

For the purposes of this article, it has nothing to do with share price appreciation, and everything to do with the performance of the underlying companies. And when it comes to companies that are winning over customers in droves, few are doing a better job than e-commerce platform Shopify (NYSE: SHOP), digital payment specialist Square (NYSE: SQ), or food delivery guru GrubHub (NYSE: GRUB).

As you can see, all three have demonstrated remarkable growth rates over not just the past quarter, but the past three years as well.

Company | Q2 2018 Sales Growth | 3-Year Sales Growth (CAGR) |

|---|---|---|

Shopify | 61% | 86% |

Square | 51% | 39% |

GrubHub | 60% | 38% |

Data source: Fool.com, E*Trade. Q2 sales growth presented by year-over-year basis. Three-year sales growth presented as compounded annual growth rate.

Unsurprisingly, when the underlying companies put up numbers like this, their stocks respond in kind. That's why a basket of these three stocks would have almost quadrupled over the last two years alone.

Here's how each got there, and where they stand today.

Image source: Getty Images.

Shopify: helping merchants of all sizes build an e-commerce presence

Shopify started out when founder/CEO Tobi Lutke tried to start a snowboarding business and found no easy solutions to help sell them online. Rather than get discouraged, he built his own platform. Before he knew it, the e-commerce solution eclipsed the snowboards in demand.

Today, over 600,000 merchants -- ranging in size from mom-and-pop stores trying their hand at e-commerce to behemoths like Tesla -- use Shopify's platform. The company has two lines of business: a tiered software-as-a-service (SaaS) subscription plan that gathers all the data you need in one interface, and a success-based merchant solutions program that helps ease shipping and payment for goods.

While the SaaS side offers great gross margins -- meaning that once the platform is set up, each additional user costs almost nothing to service, the merchant solutions cost almost nothing for Shopify to market or develop -- even though gross margins are significantly narrower.

As you can see, both lines of business have enjoyed robust growth.

Chart by author. Data: SEC filings. 2018 figures only include the effects of the first two quarters of the fiscal year.

On a non-GAAP basis, the company has earned $0.26 per share over the past year. That makes the stock look very expensive -- trading for over 600 times that figure. But it's important to remember that Lutke is focused on spending to grab market share right now, and locking customers into the Shopify ecosystem via high switching costs.

While it's difficult to know how prodigious that might be, it should create strong free cash flows in the future. I have given the stock an outperform rating on my own CAPS profile, while allowing it to grow to over 5% of my real-life holdings.

Square: heading the charge in the war on cash

Perhaps you're familiar with Square founder and CEO Jack Dorsey. He also developed -- and still runs -- a social media site known as Twitter. But those dual roles haven't stopped him from turning Square into a force to be reckoned with.

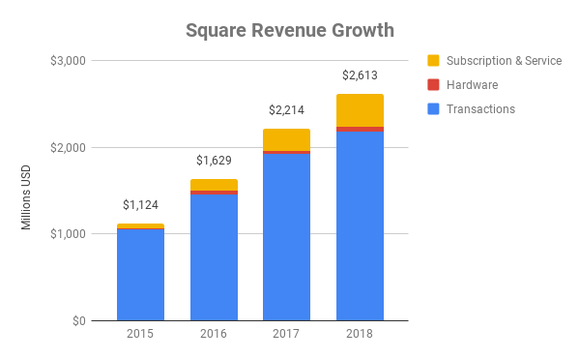

The company has three different revenue streams: transaction-based costs that charge users a certain percentage of a sale, hardware costs for things like chip readers, and subscription and service-based revenue that allows for instant deposits into accounts and also collects data for vendors to use to help better run their operations.

Over time, the combination of these three solutions has proven very popular.

Chart by author. Data: SEC filings. Data backs out revenue from Starbucks transactions to create apples-to-apples comparison. Does not include bitcoin revenue. 2018 figures are for the trailing 12 months as of the end of the second quarter.

Obviously, transaction revenue is the most important aspect of sales growth, but the service and subscription revenues are important for two reasons: They introduce high switching costs, and they enjoy gross margins over twice as large as transaction revenue.

As with Shopify, shares appear very expensive -- trading for over 270 times non-GAAP earnings. But -- as with Shopify -- the company is also spending to capture long-term market share in the cashless society. While I don't own shares personally, I have given the stock an outperform rating on my own profile.

GrubHub: making ordering and delivery easy for mom-and-pops

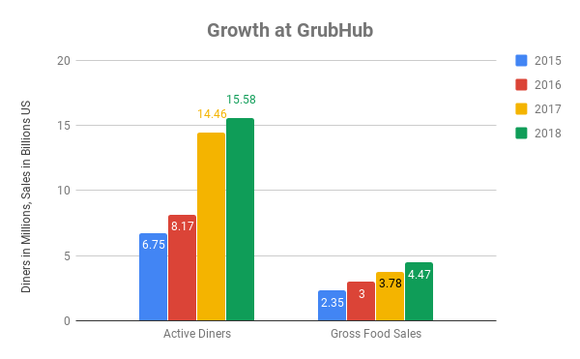

There are lots of tiny restaurants out there. Setting up an app, a delivery, and a payment system would require a small army of tech specialists none of them could likely afford. Enter GrubHub, which provides a single platform to handle all of these needs.

Restaurants typically pay a flat rate for each transaction processed on GrubHub's platform. That rate can vary depending on the additional marketing or placement they wish to receive from GrubHub. Instead of focusing on revenue growth -- which we've already demonstrated at the beginning has been impressive -- here's how the company has performed on some other crucial metrics.

Chart by author. Data source: SEC filings. 2018 figures represent trailing 12 months as of the end of the fiscal second quarter.

The key here is that GrubHub benefits from two moats. There are high switching costs for restaurants that don't want to deal with the time and headaches of switching to a different ordering and payment operator, and there are also network effects at play. As more customers come to GrubHub to find food they want, restaurants know that they need to list on the site to gain access to the customers. It creates a virtuous cycle that keeps adding both diners and food providers to the ecosystem.

Like the other two stocks, GrubHub has a hefty 82-time-trailing-earnings price tag. But like the other two, you shouldn't overlook the fact that it is grabbing market share and will likely keep that share over time -- thanks to the aforementioned moats. That's why I'm considering adding shares to my own portfolio -- and already have given it an outperform rating.

Think long-term with these stocks

Investors need to remember that any investment in these stocks needs to take the long-term view. Because shares are priced expensively, the slightest blip -- whether company-specific, or macroeconomic in nature -- could send shares reeling. Investments like these are only for those who can stomach such moves.

If you count yourself as such an investor, all three represent great starting points in your own growth investing journey.

More From The Motley Fool

Brian Stoffel owns shares of Shopify and Twitter. The Motley Fool owns shares of and recommends Shopify, Square, Tesla, and Twitter. The Motley Fool has the following options: short January 2019 $80 calls on Square. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance