3 High Growth Stocks You Could Regret Not Buying

Long-term investing has been shown to outperform short-term trading, and while buying high-growth stocks means suffering through periods that will test every investor's patience, I think it will be well worth owning Shopify Inc. (NYSE: SHOP), Exact Sciences (NASDAQ: EXAS), and Zendesk, Inc. (NYSE: ZEN).

It's all about options

Want to run a traditional bricks-and-mortar retail store but still sell online? Want to accept credit cards in-store and online and track inventory seamlessly? No problem. Shopify is your solution.

IMAGE SOURCES: GETTY IMAGES.

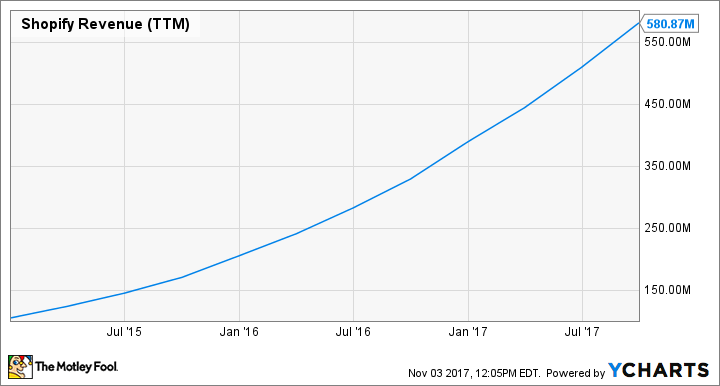

Shopify is a fast-growing retail solutions provider, sporting 72% year-over-year sales growth. It offers plans that cost as little as $29 per month that establishes your online retail presence. Need more service, tools, and analytics? It has more expensive but feature-rich subscription options, too. You can blog, sell to consumers using smartphones, manage shipping, and more with Shopify.

Even better, Shopify doesn't lock you into one sales ecosystem, either. Sellers can use their Shopify site to sell on eBay (NASDAQ: EBAY), Amazon.com (NASDAQ: AMZN), and other partners, including Instagram.

Shopify isn't profitable yet, but the addressable market for e-commerce is big enough that I believe it's only a matter of time before that happens. According to the U.S. Census Bureau, online retail still represents less than 9% of the $1.1 trillion quarterly U.S. retail sales market. Given that backdrop and Shopify's rapid sales growth, this company appears to have a long runway ahead.

SHOP Revenue (TTM) data by YCharts

Simpler. Cheaper. What's not to like?

Exact Sciences fills a big, poorly met need.

Colon cancer is the second deadliest cancer because too many people skip getting a colonoscopy, and as a result, it gets detected in the later stages, when it's harder to treat.

Given the over-65 population is set to double over the coming decades, it's going to be important to change people's attitudes about colon cancer screening and get them to stick to a screening schedule. Exact Sciences' easy-to-use and cost-effective Cologuard may be the answer.

Cologuard is a stool-sample test. Patients send a sample from home to Exact Sciences for evaluation. The test costs less than $500 -- a fraction of the cost of a colonoscopy -- and it doesn't require the preparation necessary for a colonoscopy. It can detect colon cancer with a high level of sensitivity, and if patients get a positive reading, they can get a colonoscopy for confirmation and to remove dangerous polyps.

Exact Sciences believes Cologuard can become the standard first-screening option, and it may very well be on its way to achieving that goal. Cologuard test volume is growing by triple-digit percentages, and in 2017, the company expects to complete at least 568,000 tests.

If it can hit that target, then it's forecasting sales of at least $250 million this year, which would be up significantly from the $99 million in sales reported in 2016.

EXAS Revenue (TTM) data by YCharts

The company isn't making a profit yet, but Exact Sciences thinks Cologuard represents a $4 billion per year market opportunity. If they're right, getting into the black might not take too long.

Unleash the bots

Years ago, I worked part-time as a customer-service representative in a call center, and frankly, I can say with a high degree of certainty that there was then, and there probably still is today, a big need to disrupt how companies help their customers.

IMAGE SOURCE: GETTY IMAGES.

Zendesk's software could be the solution to improving customer service. The company's software is built from the ground up to support customers better, regardless of how they want to communicate with companies. It enables web and mobile chat, phone, email, and social media communication. It also provides self-help-guide software, and using machine learning, its bots can answer easy customer questions so that call centers can focus on customers with more complex questions.

Zendesk's solutions already help approximately 114,000 paid customer accounts (up from 94,000 in December 2016) in over 160 countries to deliver better customer service. That number should grow as its solutions get increasingly better at serving customers the information they want or need.

Last quarter, Zendesk's sales grew 40% to $112.8 million from Q3, 2016 and over the past nine months, Zendesk's revenue has increased to $307 million from $223 million year over year. The company's sales are benefiting from growing traction with larger enterprises that pay more, and new products that embed Zendesk more deeply into these relationships should support even greater future sales growth. Based on the company's third-quarter results, management expects sales of at least $425 million in 2017, up about 36% from 2016.

ZEN Revenue (TTM) data by YCharts

Like the previous two companies, Zendesk's investing heavily in support of worldwide growth (ex-U.S. sales were 46% of revenue last year), so it's still losing money. However, those investments are giving it more scale that can help it get into the black. For instance, Zendesk's non-GAAP operating loss improved to $0.02 in Q3 from $0.04 last year, and its GAAP operating margin improved to negative-25.2%, from negative-32.5% one year ago.

Overall, in a world of instant communication, customer loyalty is necessary, and achieving that loyalty requires quick-responses that answer customers questions before they ask them. Technology like that sold by Zendesk can help companies get to that point, and that's why I think this growth stock is worth stashing away.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Todd Campbell owns shares of Amazon and Shopify. His clients may have positions in the companies mentioned. The Motley Fool owns shares of and recommends Amazon, eBay, and Shopify. The Motley Fool recommends Zendesk. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance