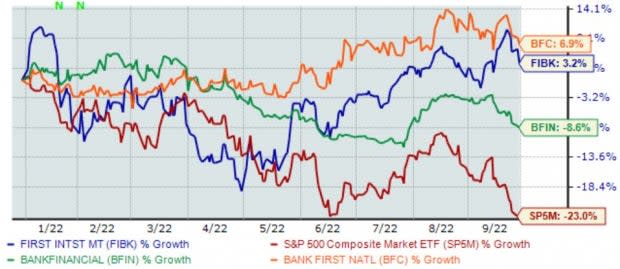

3 Finance Stocks Crushing the S&P 500 in 2022

The Zacks Finance Sector has shown slightly more resiliency than the general market in 2022, down roughly 21% vs. the S&P 500’s 23% drop.

Image Source: Zacks Investment Research

Any sign of relative strength in today’s historically volatile market is undoubtedly a positive.

In fact, there are several highly-ranked low-beta stocks in the sector displaying remarkable relative strength, including Bank First National Corporation BFC, BankFinancial Corp. BFIN, and First Interstate BancSystem, Inc. FIBK.

Below is a year-to-date chart of all three stocks with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have been notably more bullish than the general market YTD, indicating that buyers have defended the shares at a much higher level than others.

Let’s take a deeper dive into each one.

Bank First National Corporation

Bank First National Corporation offers demand, time, savings, deposits, checking, certificates of deposit, money market accounts, loan products, treasury management services, credit cards, electronic banking services, and ATM processing.

BFC’s earnings outlook has turned visibly bright over the last several months, helping push it into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Shares trade at solid multiples; the company’s 12.1X forward earnings multiple resides below its 12.9X median since January of 2020 and represents a slight 8% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Further, BFC carries a strong earnings track record – the company has exceeded the Zacks Consensus EPS Estimate in eight of its last ten quarters. Just in its latest print, BFC penciled in a 5.5% bottom-line beat.

Top-line results tell us the same positive story; Bank First National Corporation has missed revenue estimates in just two of its last ten quarterly releases. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

BankFinancial Corp.

BankFinancial Corp. is the holding company for BankFinancial, F.S.B., a full-service, community-oriented savings bank providing financial services to individuals, families, and businesses through eighteen full-service banking offices.

Like BFC, analysts have been bullish on their earnings outlook over the last several months.

Image Source: Zacks Investment Research

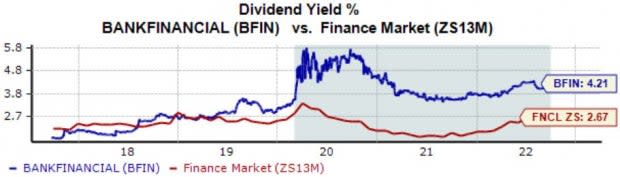

Who doesn’t love getting paid? Fortunately for those seeking an income stream, BFIN’s got that covered; the company carries a sector-beating annual dividend yield of a sizable 4.2% paired with a strong 4.7% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

In addition, BankFinancial’s growth projections would thrill any investor – the company’s earnings are expected to climb a double-digit 70% in FY22 and a further 28% in FY23.

Top-line growth is also impressive, with revenue forecasted to climb 17% and 14% in FY22 and FY23, respectively.

First Interstate BancSystem, Inc.

First Interstate BancSystem, Inc. is a financial and bank holding company. Through its wholly-owned subsidiary, First Interstate Bank, it delivers a range of banking products and services to individuals, businesses, municipalities, and other entities throughout its market.

Analysts have upped their earnings outlook across the board over the last 60 days with a 100% revision agreement.

Image Source: Zacks Investment Research

Further, First Interstate BancSystem, Inc rewards its shareholders handsomely; FIBK’s annual dividend yields a sizable 3.9% paired with a stellar 12.7% five-year annualized dividend growth rate.

FIBK has upped its dividend payout five times over the last five years.

Image Source: Zacks Investment Research

The company’s shares trade at respectable valuation multiples as well, with its 13.7X forward earnings multiple just below its 14.0X five-year median.

Image Source: Zacks Investment Research

Bottom Line

While the price action in 2022 has undoubtedly been disappointing, some stocks are displaying relative strength paired with a strengthening earnings outlook, a bullish signal.

For those looking for stocks that meet the criteria, all three stocks above - Bank First National Corporation BFC, BankFinancial Corp. BFIN, and First Interstate BancSystem, Inc. FIBK – precisely meet those parameters.

In addition, all three are classified as low-beta, providing a further shield for market participants and making them worthy of a watchlist spot.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Interstate BancSystem, Inc. (FIBK) : Free Stock Analysis Report

BankFinancial Corporation (BFIN) : Free Stock Analysis Report

Bank First National Corporation (BFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance