3 Dividend-Paying Transport Equipment & Leasing Stocks to Watch

The Zacks Transportation - Equipment and Leasing industry appears to have been dented by rising recessionary fears, which may result in cooling demand for containers. The ongoing banking crisis has added further uncertainty to the already weak economy that is reeling under inflationary woes. High operating costs and supply-chain woes, too, act as major deterrents.

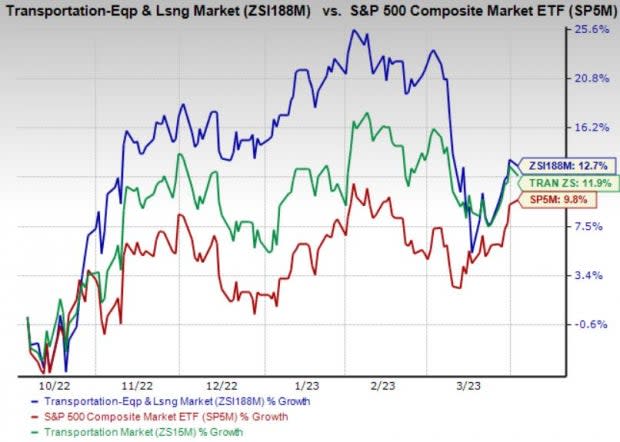

Despite the headwinds, the industry has gained 12.7% over the past six months, outperforming the S&P 500 Index’s 9.8% appreciation and 11.9% growth of the broader Zacks Transportation sector.

Image Source: Zacks Investment Research

Given this encouraging backdrop, it would be a wise decision to invest in some dividend-paying stocks, like Ryder System, Inc. R, GATX Corporation (GATX) and Air Lease Corporation AL, from the Transportation - Equipment and Leasing industry.

Why Dividend Growth Stocks?

Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market, and act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, these companies offer downside protection with their consistent increase in payouts.

Moreover, these stocks generally have good liquidity, strong balance sheets and impressive free-cash-flow-generating ability.

In view of the positives mentioned, it can be safely said that dividend-paying stocks appear as preferred options over non-dividend-paying stocks amid high market volatility.

3 Transport Equipment & Leasing Stocks to Embrace Now

In order to choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%.

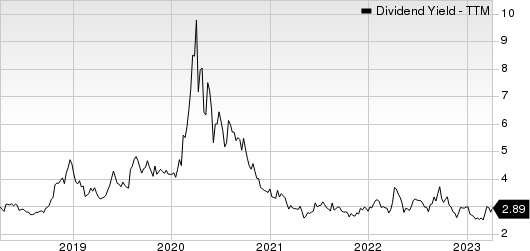

Ryder: Headquartered in Miami, FL, it operates as a logistics and transportation company worldwide. Ryder pays out a quarterly dividend of 62 cents ($2.48 annualized) per share, which gives it a 2.83% yield at the current stock price. This company’s payout ratio is 15%, with a five-year dividend growth rate of 3.07%. (Check Ryder’s dividend history here).

Ryder is benefiting from strong rental demand and favorable pricing. The company’s measures to reward its shareholders are encouraging. In July 2021, the company announced a 3.6% hike in its quarterly dividend to 58 cents per share. In July 2022, Ryder announced a further 7% hike in its quarterly dividend, taking the total to 62 cents per share (annualized $2.48). Further, Ryder’s 2023 outlook is encouraging. For 2023, Ryder expects total revenues and operating revenues to increase 2% and 4%, respectively. Adjusted EPS is estimated to be $11.05-$12.05. Ryder carries a Zack Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ryder System, Inc. Dividend Yield (TTM)

Ryder System, Inc. dividend-yield-ttm | Ryder System, Inc. Quote

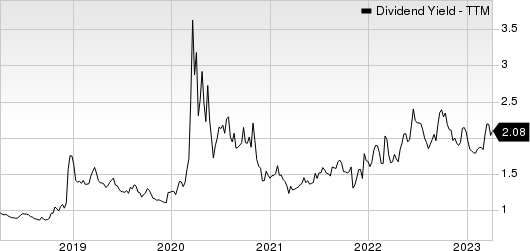

GATX: Headquartered in Chicago, IL, GATX operates as a railcar leasing company in the United States, Canada, Mexico, Europe, and India. GATX pays out a quarterly dividend of 55 cents ($2.20 annualized) per share, which gives it a 2.00% yield at the current stock price. This company’s payout ratio is 34%, with a five-year dividend growth rate of 4.36%. (Check GATX’s dividend history here).

GATX, which has been paying regular dividends since 1919, holds an impressive record with respect to dividends and buybacks. In January 2023, this Zacks Rank #2 (Buy) company raised its quarterly dividend by 5.8% to 55 cents per share. Its commitment to reward shareholders despite coronavirus-related disruptions is encouraging. Notably, 2023 marks the 105th consecutive year of GATX paying out dividends.

GATX Corporation Dividend Yield (TTM)

GATX Corporation dividend-yield-ttm | GATX Corporation Quote

Air Lease: Headquartered in Los Angeles, CA, Air Lease operates asan aircraft leasing company engaged in the purchase and leasing of commercial jet aircraft to airlines worldwide. AL pays out a quarterly dividend of 20 cents ($0.80 annualized) per share, which gives it a 2.06% yield at the current stock price. This company’s payout ratio is 18%, with a five-year dividend growth rate of 13.78%. (Check AL’s dividend history here).

Air Lease Corporation Dividend Yield (TTM)

Air Lease Corporation dividend-yield-ttm | Air Lease Corporation Quote

We are impressed by Air Lease’s endeavors to reward its shareholders. This Zacks Rank #3 (Hold) company has an impressive dividend payment history. In November 2022, the company’s board approved a dividend hike of approximately 8.1% to 20 cents per share (annually: 80 cents). This marked the company’s 10th dividend increase since February 2013, when it began distributing dividends. The company is also active on the buyback front. Steady growth in its fleet is driving Air Lease’s top line (up 11% year over year in 2022). The company purchased 60 new aircraft in 2022. As of Dec 31, 2022, Air Lease’s fleet included 417 owned and 85 managed aircraft. As of Dec 31, 2022, AL had commitments to purchase 398 aircraft from Boeing and Airbus for delivery through 2029.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance