3 Dividend Investing Tips That Could Earn You Thousands

Looked at from the highest level, a dividend is simply a return of cash to shareholders. The dividend yield largely encapsulates this aspect of dividends. But there's so much more information for income investors in this stockholder disbursement. Here are three tips to help you truly harness the power of dividends and become a better income investor.

1. Speaking through dividends

The most important feature of dividends is the information they help convey. A painful example here is a dividend cut, which is usually a warning sign that business isn't going well (see below for more on this topic). But at the other end of the spectrum is a company like Procter & Gamble, which has increased its dividend annually for over six decades. Maintaining a streak like that shows business success, and every year added to the streak is a statement on management's confidence in the future.

Image source: Getty Images.

Even companies with long annual streaks like this can cut their dividend, however, so this isn't the only factor to look at. But when a company has a long streak of annual dividend increases, management is trying to send a signal to shareholders and potential shareholders. Income investors should pay attention and focus on companies that have a long history of rewarding shareholders with regular dividend hikes. It quickly cuts the list of potential investment candidates down to a manageable level. The best part is that you can get this information free from the DRIP Investing Resource Center.

On this website you will find a downloadable spreadsheet listing companies that have increased their dividends for five to nine years, 10 to 24 years, and 25 or more years. If you are interested in dividend stocks, this is the place to start your search. It will home you in on companies that have a clear bias toward rewarding shareholders and, depending on the list you look at, long histories of success. For most investors, and especially for those with a conservative bias, this list should be reviewed before you even consider a stock's yield.

2. Yield can tell you more than you think

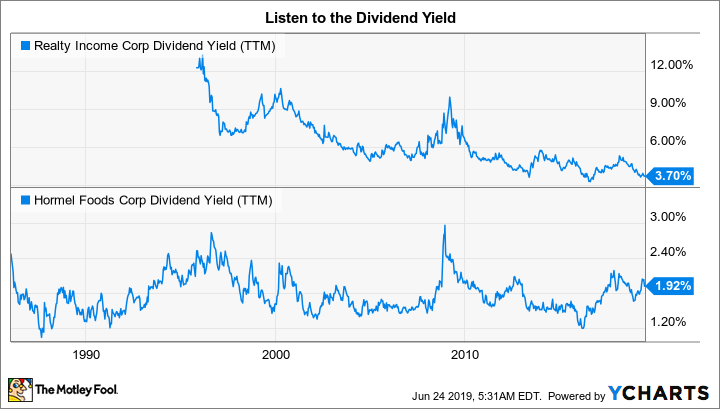

Once you're focused on companies with impressive dividend histories, it is time to consider yield. Most look at the absolute value here, but that only tells you half the story. On an absolute level, a 3.7% yield from a financially strong company sounds good if the S&P 500 Index is offering only around 2% or so. But what if that yield is backed by Realty Income (NYSE: O), an iconic real estate investment trust (REIT)?

In this case, the yield is actually near the lowest levels in the REIT's history. Far from an attractive entry point, the yield actually suggests Realty Income looks rather expensive today. That view is confirmed by its lofty ratio of price to adjusted funds from operations (similar to P/E for industrials), which is 22. That's rather high for a slow-growing company specifically intended to throw income off to investors.

O Dividend Yield (TTM) data by YCharts.

Meanwhile, Hormel Foods (NYSE: HRL) offers a yield of around 2%, roughly what the S&P offers. But if you look back at this packaged-food company's yield history, that's toward the high end of its historical range. Suddenly a yield that income investors might overlook because it appears low on an absolute basis starts to look a lot more attractive.

Put simply, a historical look at yield levels can help you find companies that are more attractive in valuation. This isn't a fail-safe tool, and it needs to be used with care (an extremely high yield can be a sign that the dividend is at risk). But it provides valuable information that you might miss if all you look for is large yields.

3. The business matters

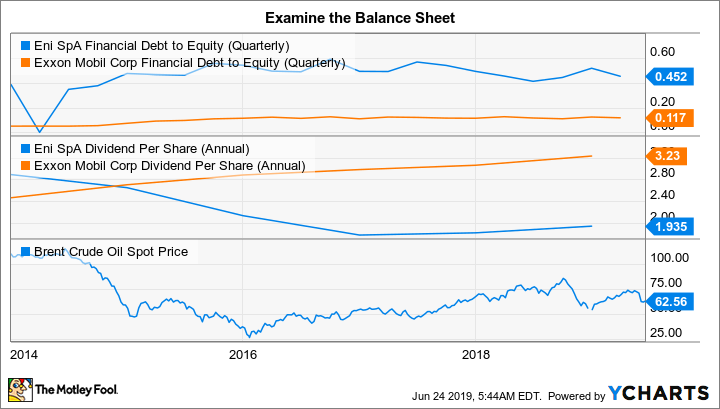

It might seem obvious, but the company backing a dividend can't be overlooked. There are two big factors to consider here: financial strength and the business model.

Companies with a lot of leverage are far more likely to cut a dividend than a company with very little leverage. For example, ExxonMobil (NYSE: XOM) has over three decades of annual dividend increases behind it. The integrated energy giant also happens to have a long history of being fiscally conservative, highlighted by one of the strongest balance sheets in the industry. To put a number on that, long-term debt makes up less than 10% of its capital structure. When the oil market cratered in mid-2014, Exxon was able to add debt to keep funding its capital investments and dividend (long-term debt peaked at a still-modest 15% or so of the capital structure, for reference). Industry peer ENI (NYSE: E) has historically made greater use of leverage, and it isn't a coincidence that it ended up cutting its dividend during that steep industry downturn.

E Financial Debt to Equity (Quarterly) data by YCharts.

In addition to a strong financial foundation, you also need to consider the long-term business model. Look back at Hormel for a second. The company sells food, something we all need. It has a long history of adjusting to shifting consumer tastes as well. Right now, the yield is relatively high because consumers are, once again, shifting gears. Hormel is adjusting its portfolio (selling less-desirable brands and buying ones that resonate more, like Wholly Guacamole). This is a difficult period, but not one that is likely to derail the company. (Hormel also happens to have a very low level of debt, which is another plus.)

Now consider GameStop (NYSE: GME), which in recent years was offering a mid- to high-single-digit yield. This brick-and-mortar retailer of video games and game systems, however, is facing a fundamental change in the way consumers buy video games and equipment. More and more shoppers are buying online and, equally important, going direct to the game developers. GameStop, a middleman, is being forced out of the equation, and there's little it can do to stop the trend. It shouldn't be too surprising that GameStop ended up eliminating its dividend in mid-2019. While it may not have needed to cut the dividend, financially speaking, the company's historical business model no longer looks sustainable. The high yield, when couched in the deteriorating business outlook, was really a warning sign here.

Putting it all together

Looked at together, these three dividend tips can help create the foundation of an investment approach. They are simple in some ways, but hugely powerful for dividend investors when put together. Essentially you want to find companies with long histories of rewarding investors with increasing dividends, that are also yielding more than normal historically, and that have the financial strength and business models to keep paying (and increasing) through thick and thin. If all you look at is the absolute yield, you will miss a massive amount of information. If you use these dividend tips, however, you can not only earn thousands, but perhaps also avoid painful losses.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil, Hormel Foods, and Procter & Gamble. The Motley Fool owns shares of GameStop. The Motley Fool is short shares of Procter & Gamble and has the following options: short July 2019 $8 calls on GameStop. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance