3 Cheap Dividend Stocks to Buy and Hold

Written by Kay Ng at The Motley Fool Canada

Are you thinking of investing in stocks by putting in little time and effort? Then you’ll want to research stocks that you can invest in passively or hold for a long time. Here are three cheap dividend stocks from diverse industries you can buy today and consider holding for a long time. You’ll earn passive income along the way while waiting for price appreciation.

A cheap tech stock

Enghouse Systems (TSX:ENGH) is a tech stock that has grown by acquisitions with high returns on equity (ROE). Its five-year ROE is approximately 19.4%, which is above average. It also earns excellent returns on its assets. Its five-year return on assets (ROA) was 12.6%, which almost doubled the benchmark’s ROA, according to Morningstar.

The dividend stock has been shareholder friendly with a track record of dividend increases. Specifically, it’s a Canadian Dividend Aristocrat with 15 consecutive years of dividend increases. Its five-year dividend-growth rate is 17.9%. It last increased its regular quarterly dividend by 18.5% in March 2021.

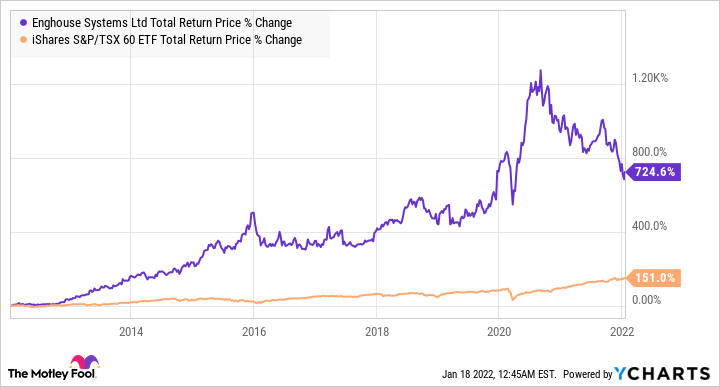

ENGH vs XIU Total Return Price data by YCharts

A low yield of 1.4% and a high dividend-growth rate imply it’s a high-growth stock. This is verified by it outperforming the benchmark in the last decade — illustrated in the graph above. However, its short-term growth can be bumpy because acquisitions are a big part of its growth. For example, when it cannot find suitable acquisitions that will make a meaningful impact on its bottom line, the stock will underperform, as it has in the recent past.

The tech stock is undervalued now. Analysts estimate it can appreciate roughly 30% over the next 12 months.

A dividend stock

Restaurant Brands International (TSX:QSR)(NYSE:QSR) is another dividend stock that will likely continue raising its dividend. It is an indirect holding company for Tim Hortons, Burger King, and Popeyes. The latest brand addition is Firehouse Subs. By employing franchise business models across its brands, the dividend stock is able to generate substantial cash flow with low capital spending to support its growing dividend.

At writing, Restaurant Brands stock yields a decent 3.7%. It is a Canadian Dividend Aristocrat with seven consecutive years of dividend increases. Its three-year dividend-growth rate is 5.6%. According to Yahoo Finance, the analysts’ average 12-month price target on the stock is $97.07, which represents 34% upside potential.

A cheap dividend stock

Manulife (TSX:MFC)(NYSE:MFC) is a cheap dividend stock that may surprise investors. It has been depressed, trading at a lower multiple than its peer group for years. The undervalued stock trades at about eight times earnings and offers a juicy yield of 5%. It is a Canadian Dividend Aristocrat with a dividend-growth streak of eight years. Its 10-year dividend-growth rate is approximately 8%. Over the last decade or so, the life and health insurance company has grown its earnings per share in the long run. Its rising dividend can be the key to drawing more value for shareholders in the long run, as a higher (and still healthy) dividend should lead to a higher share price in time.

Across 13 analysts, Manulife has a 12-month price target that represents about 17% upside potential. However, it could potentially fill the valuation gap vs. its peer group over the next five years, especially if its anticipated higher-growth markets in Asia do well. The business generates about 38% of its revenues there.

The post 3 Cheap Dividend Stocks to Buy and Hold appeared first on The Motley Fool Canada.

Should you invest $1,000 in Manulife Financial Corporation right now?

Before you consider Manulife Financial Corporation, you may want to hear this.

Motley Fool Canadian Chief Investment Advisor, Iain Butler, and his Stock Advisor Canada team just revealed what they believe are the 10 best stocks for investors to buy right now... and Manulife Financial Corporation wasn't one of them.

The online investing service they've run since 2013, Motley Fool Stock Advisor Canada, has beaten the stock market by over 3X. And right now, they think there are 10 stocks that are better buys.

More reading

The Motley Fool owns and recommends Enghouse Systems Ltd. The Motley Fool recommends Restaurant Brands International Inc. Fool contributor Kay Ng owns shares of Enghouse Systems Ltd., Manulife, and Restaurant Brands International Inc.

2022

Yahoo Finance

Yahoo Finance