2 Top-Rated Stocks to Buy After Earnings This Week

After reporting their quarterly results this week, Albertsons Companies (ACI) and The Greenbrier Companies (GBX) are two stocks that are sticking out so far this earnings season.

Let’s take a look at these two top-rated Zacks stocks following their strong earnings reports.

Brief Overview

Out of the Zacks Consumers Staples sector, supermarket operator Albertsons is one of the largest food and drug retailers in the United States. Having a robust local and national presence, Albertsons offers grocery products, general merchandise, health and beauty care products, pharmacy products, and fuel among other items and services.

Albertsons stock currently sports a Zacks Rank #2 (Buy) with its Consumer Products-Staples Industry in the top 29% of over 250 Zacks industries.

Image Source: Zacks Investment Research

Pivoting to the Zacks Transportation sector, Greenbrier is a leading supplier of transportation equipment and services to the railroad and related industries. Greenbrier’s manufacturing segment produces double-stack intermodal railcars, conventional railcars, and marine vessels, and also performs repair and refurbishment activities for both intermodal and conventional railcars.

Illustrating its dominance, Greenbrier stock is currently sporting a Zacks Rank #1 (Strong Buy) although its Transportation-Equipment & Leasing Industry is not among the top-rated Zacks industries at the moment.

Image Source: Zacks Investment Research

Albertsons Quarterly Review

Albertsons reported its fiscal fourth quarter results yesterday and impressively beat top and bottom line expectations despite advising of a more difficult environment for consumers.

Still, Albertsons stated they are prepared for the challenging operating conditions going forward and blasted its Q4 EPS expectations by 14% with earnings at $0.79 per share. This was a 5% increase from the prior year quarter. Sales slightly topped quarterly estimates at $18.26 billion, also up 5% year over year.

More impressive, Albertsons has now beaten earnings expectations for 12 consecutive quarters and topped sales estimates in eight straight quarterly reports.

Greenbrier Quarterly Review

What stood out in Greenbrier’s most recent fiscal second-quarter report on Monday was the company’s bottom line. Greenbrier crushed earnings expectations by 62% with EPS at $0.99 compared to estimates of $0.61 per share.

Overall, earnings soared 168% YoY compared to EPS of $0.38 in Q2 2022. On the top line, sales were up 64% YoY to $1.12 billion. The higher revenue and bottom-line growth were largely attributed to rail car deliveries increasing 58% year over year to 7,600 units compared to 4,800 units in Q2 2022.

Furthermore, Greenbrier stated they have a new rail car backlog of 25,900 units which is estimated at $3.1 billion.

Performance & Valuation

Albertsons stock is virtually flat year to date Vs. Greenbrier’s -3% with both underperforming the S&P 500’s +7%. However, over the last three years, Greenbrier’s stock has climbed +88% to top the benchmarks +49% with Albertsons +34% trailing the broader market.

Image Source: Zacks Investment Research

Judging from the price-to-earnings valuations of both companies there could be some nice upside in Albertsons and Greenbrier stock from current levles.To that point, Albertsons trades at 6.7X forward earnings which is well below its industry average of 17.4X and the S&P 500’s 19X.

At 14.3X forward earnings, Greenbrier stock also trades nicely beneath the benchmark’s P/E average and is on par with its own industry average.

Growth & Outlook

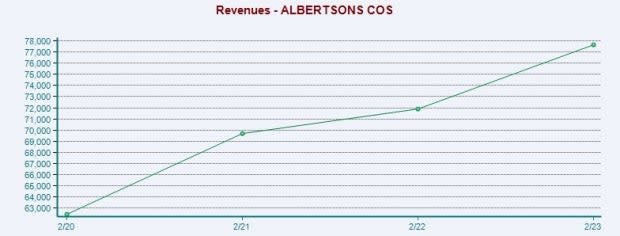

Based on Zacks estimates, Albertsons earnings are projected to dip -8% in its fiscal 2024 but stabilize and rise 3% in FY25 at $3.20 per share. Earnings estimate revisions have slightly gone up over the last quarter.

On the top line, sales are forecasted to be up 2% in FY24 and rise another 1% in FY25 to $80.29 billion. Fiscal 2025 would also represent 32% growth from pre-pandemic levels with 2019 sales at $60.53 billion.

Image Source: Zacks Investment Research

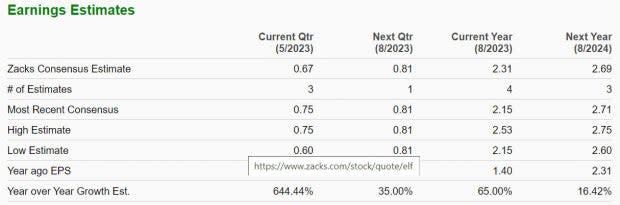

Turning to Greenbrier, earnings are forecasted to soar 65% in the company’s FY23 at $2.31 per share compared to EPS of $1.40 in 2022. Plus, fiscal 2024 earnings are expected to climb another 16%. Earnings estimates have started to trend higher again over the last 30 days.

Greenbrier’s sales are projected to jump 13% this year and rise another 4% in FY24 to $3.52 billion. Fiscal 2024 would be 16% above 2019 pre-pandemic sales of $3.03 billion.

Image Source: Zacks Investment Research

Takeaway

The strong quarterly results help justify more upside in Albertsons and Greenbrier stock, especially with earnings estimate revisions remaining higher at the moment. On top of this at $20 and $34 per share respectively, Albertsons and Greenbrier's attractive P/E valutions may be more intruiging to investors considering their solid bottom lines.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance