2 Stocks to Double Up on While They’re Insanely Cheap

Written by Kay Ng at The Motley Fool Canada

Here are a couple of stocks that are worth doubling your shares in.

One insanely cheap energy stock

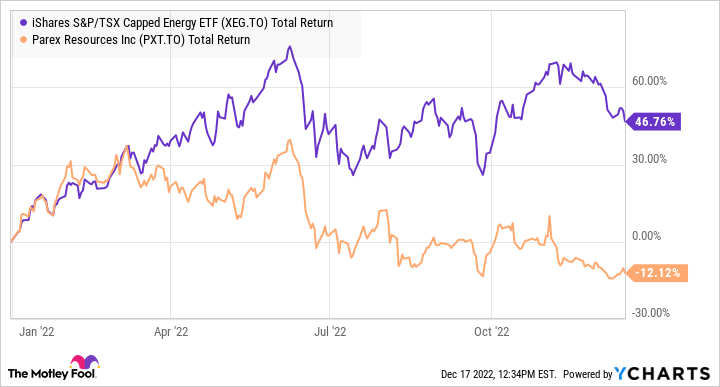

The market has favoured energy stocks this year, but not Parex Resources (TSX:PXT). The energy sector, using iShares S&P/TSX Capped Energy Index ETF as a proxy, delivered about 47% total returns year to date versus the oil stock’s -12%.

XEG and PXT Total Return Level data by YCharts

Colombia-based Parex blames the underperformance to the adverse election result, localized blockades leading to production misses, and government tax reform. So, the energy stock is experiencing a country-risk discount.

At $18.25 per share at writing, it trades at an insanely cheap valuation of below two times this year’s expected cash flow and about three times this year’s estimated earnings. Even the most bearish analysts think upside of +32% is possible over the next 12 months.

Brian Madden, chief investment officer at First Avenue Investment Counsel, remained bullish on the low-cost energy stock last month:

“Parex produces 55k barrels of oil a day in Colombia. It has political risk, but tax changes would have to be cataclysmic to affect Parex. It is one of the lowest-cost producers on the TSX and profitable at sub-$30 oil. It’s growing production with a recent return on equity of 36%… It has no debt, lots of cash on balance sheet, and is buying back stock.”

Additionally, with the free funds flow the company generates, it can continue to pay a nice and growing dividend that currently yields approximately 5.5%.

Despite the weakness in the stock this year, Parex stock’s long-term returns have been fabulous versus the energy sector. In the past 10 years, it delivered more than 13% per year, which was way better than the sector.

XEG and PXT Total Return Level data by YCharts

Another undervalued stock for solid growth

You may be more inclined to invest in renewable energy rather than cyclical fossil fuel. If so, Brookfield Renewable Partners L.P. (TSX:BEP.UN) may be a better choice. It also seems to be insanely cheap.

Most stocks on the TSX have been negatively impacted by higher interest rates this year. Brookfield Renewable is no exception. Specifically, the dividend stock is down about 19% year to date.

BEP is a quality and diversified pick in the renewable space for its predictable, contracted cash flows. Its operating portfolio is diversified across different technologies including hydro, wind, solar, and distributed energy and sustainable solutions. Management has shown its devotion to its cash distribution, which it has increased for about 12 years. In the last 10 years, it increased its payout by 5.7% per year.

Through 2027, BEP anticipates it will experience a funds-from-operations-per-unit (FFOPU) growth rate of 7-12% from inflation escalation, margin enhancement, and its development pipeline. Acquisition opportunities aren’t counted in this estimation range! So, FFO growth can healthily increase its payout by 5-9% per year while supporting growth. Because of the timing of projects and acquisitions, the business can have lumpy growth, as reflected in its historical stock price chart.

According to Scotia Capital’s analyst, Robert Hope, who’s also a chief financial analyst, the undervalued stock trades at a substantial discount of 30%. This is actually a tad more conservative estimate than the 12-month analyst consensus price target of US$39.16 per unit across 11 analysts, which suggests a discount of 32%. In other words, the insanely cheap dividend stock has the potential to climb about 47% over the near term to US$39.16.

The post 2 Stocks to Double Up on While They’re Insanely Cheap appeared first on The Motley Fool Canada.

Free Dividend Stock Pick: 7.9% Yield and Monthly Payments

Canada’s inflation rate has skyrocketed to 6.9%, meaning you’re effectively losing money by investing in a GIC, or worse, leaving your money in a so-called “high interest” savings account.

That’s why we’re alerting investors to a high-yield Canadian dividend stock that looks ridiculously cheap right now. Not only does it yield a whopping 7.9%, but it pays monthly!

Here’s the best part: We’re giving this dividend pick away for FREE today.

Claim your free dividend stock pick * Percentages as of 11/29/22

More reading

4 TSX Dividend Stocks Offering Big Income in a Bearish Market

Just Released: The 5 Best Stocks to Buy in November 2022 [PREMIUM PICKS]

The 3 Best Dividend Stocks to Buy in November 2022 [PREMIUM PICKS]

Fool contributor Kay Ng has positions in Brookfield Renewable Partners and Parex Resources. The Motley Fool recommends Brookfield Renewable Partners and Parex Resources. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance