2 of the Most Undervalued Canadian Stocks to Buy in August

Written by Daniel Da Costa at The Motley Fool Canada

Throughout 2022, Canadian investors have had many opportunities to buy undervalued stocks and improve their long-term portfolio performance. These opportunities don’t come around often, so it’s crucial to take advantage of the current downturn to find the best companies possible trading at the lowest prices.

In recent weeks, though, we have seen the market slowly start to bottom. In addition, many of the cheapest Canadian stocks have rallied from their lows.

So if you’re worried about missing the bottom or just have cash today that you’re looking to put to work, here are two of the most undervalued Canadian stocks that are still worth a buy in August.

One of the best undervalued Canadian stocks to buy in August

Stocks across the board lose value when markets hit headwinds such as the economic uncertainty we face today. However, while almost all stocks are losing value, typically, growth stocks with a significant premium see some of the biggest sell-offs and therefore offer some of the best bargains.

That’s why if you’re looking to buy undervalued stocks during August, I would strongly consider high-quality growth stocks such as InterRent REIT (TSX:IIP.UN) before they get any more expensive.

InterRent is a residential REIT that’s grown exceptionally well over the last decade. The REIT is constantly expanding its portfolio and investing in renovations, which drives up not only the value of its properties for investors but also the cash flow these assets generate.

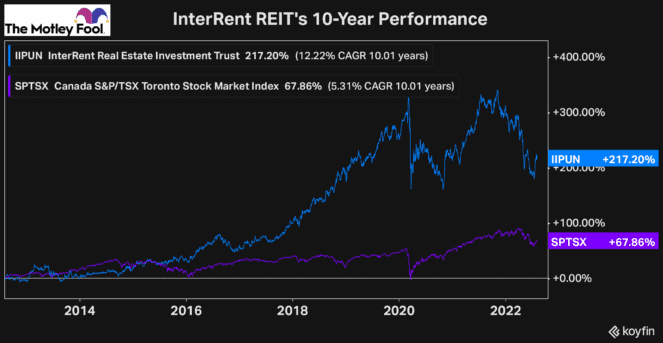

Therefore, it’s no surprise that InterRent has been one of the top-performing growth stocks to buy in any industry, let alone the residential real estate industry, which is one of the most promising sectors you can invest in for the long haul.

As you can see above, even with the massive pullback seen this year, the InterRent REIT has still achieved an impressive gain over the last decade and massively outpaced the TSX.

So with InterRent trading at 22.6 times its expected next 12-month funds from operations, that’s the cheapest it’s been since 2018. Furthermore, the stock trades at just 0.8 times its expected net asset value. At the start of the year, it was trading closer to 1.1 times its expected net asset value.

Therefore, while this exceptional growth stock trade’s cheap, it’s not just trading without its growth premium; it’s actually one of the most undervalued Canadian stocks that you can buy in August.

A lesser-known Canadian stock that’s perfect for long-term investors

In addition to InterRent, another high-potential stock trading under its intrinsic value that you’ll certainly want to buy in this environment is Andrew Peller (TSX:ADW.A). Andrew Peller is a producer and marketer of alcoholic beverages across Canada.

For years the company has grown both organically and by making value accretive acquisitions to gain a large chunk of market share among domestic wines and other alcoholic beverages. In addition, its vertically integrated operations have given the company a tonne of advantages, including its own line of retail stores where it can launch new products and gauge how they resonate with consumers.

Furthermore, in addition to the fact that it has high-quality and vertically integrated operations, Andrew Peller also operates in an industry that’s highly defensive. And because it has a massive line of products, which include many more affordable options, its sales should remain robust.

Therefore, while the stock is temporarily struggling with profitability due to short-term supply chain issues, it’s an excellent opportunity to buy the stock for ultra-cheap.

In Andrew Peller’s recent earnings report released this week for its first quarter of fiscal 2023, CEO John Peller mentioned that the company is already seeing short-term supply chain challenges start to ease. Plus, the company managed to report significant growth in sales, which came in 5.7% higher than they were in the same quarter last year.

Therefore, with its business starting to turn around, now is the time to buy a growing Canadian beverage stocks while it’s still undervalued. And right now, you can buy Andrew Peller and lock in a dividend yield of 4%. That’s significant because, over the last five years, the stock’s dividend yield has averaged just 2%.

So while this reliable and high-quality Canadian stock is undervalued, there’s no question that it’s one of the most intriguing stocks to buy now.

The post 2 of the Most Undervalued Canadian Stocks to Buy in August appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Andrew Peller?

Before you consider Andrew Peller, we think you’ll want to hear this.

Our nearly S&P/TSX market doubling Stock Advisor Canada team just released their top 10 starter stocks for 2022 that we believe could be a springboard for any portfolio.

Want to see if Andrew Peller made our list? Get started with Stock Advisor Canada today to receive all 10 of our starter stocks, a fully stocked treasure trove of industry reports, two brand-new stock recommendations every month, and much more.

See the 10 Stocks * Returns as of 4/14/22

More reading

Fool contributor Daniel Da Costa has positions in INTERRENT REAL ESTATE INVESTMENT TRUST. The Motley Fool has no position in any of the stocks mentioned.

2022

Yahoo Finance

Yahoo Finance