2 Depressed Gold Stocks to Buy Now

Written by Kay Ng at The Motley Fool Canada

Since the peak in March, the gold spot price has declined about 16% to US$1,713 per ounce at writing. Gold is supposed to be a safe haven for maintaining purchasing power. Since we’re experiencing high inflation, gold prices should be higher.

But it’s not. Instead, gold prices have been depressed this year due to the strength in the U.S. dollar. At writing, CA$1.373 equates to US$1 versus CA$1.26 a year ago. There are different reasons for the strong U.S. dollar relative to other currencies and gold. Increased global economic uncertainties such as due to the Russia-Ukraine war and the Federal Reserve taking a hawkish stance in ruthlessly increasing interest rates faster than other major countries to curb high inflation are some of those reasons.

Investors taking a contrarian view can shop for value in gold stocks. Here are a couple of depressed gold stocks you can consider buying now.

Agnico Eagle Mines

Agnico Eagle Mines (TSX:AEM) is about 28% below its 52-week high and sits at about 8% below the mid-point of its 52-week trading range. It is a large-cap gold miner with a market cap of close to $28 billion. In the long run, the gold miner has outperformed the shiny metal and gold stocks. So, it could be a good idea to buy shares after a meaningful selloff.

The company is focused on growing gold production on a per-share basis. It expects to produce about 3.3 million ounces of gold this year. It has also increased its cash flow from operations per share at a compound annual growth rate (CAGR) of 12% from 2005 to 2022. Unfortunately, gold prices have weakened in the last six months, and operating costs have been climbing, partly from high inflation resulting in higher labour costs and transportation costs. This is a scenario that’s common across all gold miners.

The consensus 12-month price target of $101.81 per share across 13 analysts suggests the stock provides a sufficient discount of close to 40%. At $61.01 per share at writing, the undervalued stock could potentially appreciate 67% over the next 12 months. Additionally, investors get a dividend yield of about 3.5% as bonus.

Franco-Nevada

If you don’t mind paying a premium for a surer investment in gold, you can consider shares in Franco-Nevada (TSX:FNV). Franco-Nevada is such a high-quality gold stock that some investors own shares as a core holding.

The company is a gold-focused royalty and streaming company. Its portfolio also consists of other streams, including silver, platinum group metals, and diversified assets, such as oil, gas, and iron ore. Its portfolio consists of 413 assets, of which, 113 are producing, 43 are in advanced stages, and 257 are in exploration. In other words, FNV has immense growth potential.

Now is a rare opportunity to buy Franco-Nevada stock on the dip. 16 analysts have an average 12-month price target that represents 24% near-term upside potential from the recent quotation of $171 per share.

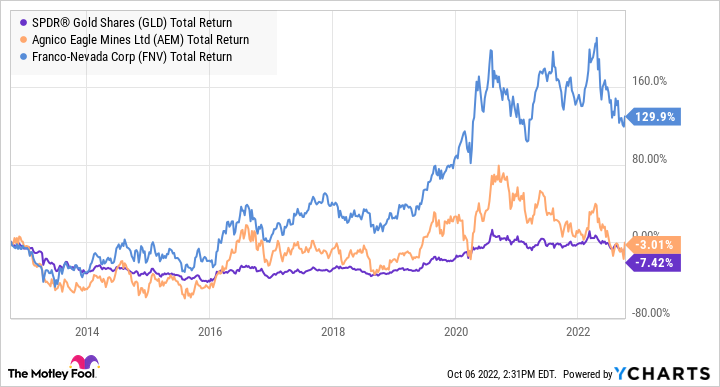

Franco-Nevada has outperformed gold in the last one, three, five, and 10 years. Below is a 10-year total return graph. Because the SPDR Gold Shares ETF is in USD, I displayed the gold stock returns on the NYSE versus the TSX.

FNV, AEM, and GLD Total Return Level data by YCharts

As a bonus, Franco-Nevada provides a yield of about 1%. The gold stock is a Canadian Dividend Aristocrat that has increased its dividend every year since 2008. For reference, its five-year dividend-growth rate is 5.9%.

The Foolish investor takeaway

Gold stocks are out of favour due to a strong USD. Gold miners are also experiencing high operating costs. Since gold stocks have sold off, it may be time to pick up some cheap gold stocks.

The post 2 Depressed Gold Stocks to Buy Now appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Agnico-Eagle Mines Limited?

Before you consider Agnico-Eagle Mines Limited, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in September 2022 ... and Agnico-Eagle Mines Limited wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 21 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 9/14/22

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2022

Yahoo Finance

Yahoo Finance