The 10 Biggest IPO Stocks

It's possible that 2019 will be remembered as "The Year of the IPO" -- short for "initial public offering." When companies have their IPO, average investors like you and I can buy shares in the company on stock exchanges for the first time. And while the absolute number of IPOs is strong, it's the size of the companies going public that's really astounding.

To get an idea, check out the 10 biggest IPO stocks of the 2019, as of mid-July.

Company | What It Does | Current Valuation |

|---|---|---|

Uber (NYSE: UBER) | Ridesharing and delivery | $72.1 billion |

The We Company* | Parent to shared workspace company WeWork | $47.0 billion** |

Airbnb* | Online lodging and events marketplace | $38.0 billion** |

Zoom Video (NASDAQ: ZM) | Video teleconferencing | $23.8 billion |

Slack*** (NYSE: WORK) | Enterprise messaging software | $18.6 billion |

Lyft (NASDAQ: LYFT) | Ridesharing | $18.4 billion |

Pinterest (NYSE: PINS) | Visual idea discovery | $14.1 billion |

CrowdStrike (NASDAQ: CRWD) | Cybersecurity | $12.8 billion |

Chewy (NYSE: CHWY) | E-commerce pet food and supplies | $12.7 billion |

Beyond Meat (NASDAQ: BYND) | Plant-based meat alternatives | $9.5 billion |

Data source: Yahoo! Finance. Valuations as of June 26, 2019. *Not yet public -- is expected to go public. **Valuations are based on estimates and private funding rounds. ***Technically not an IPO, but a direct listing.

Why are there so many big IPOs this year?

With the stock market entering year 10 of an unprecedented bull run, the sheer number of IPOs isn't surprising. When there's a rising tide, it's a good time to jump into the water -- or so the thinking goes.

And, traditionally, taking your company public is seen as a badge of honor; you've "made it."

But there's more happening here than meets the eye. Of course, the ability to raise funds -- especially in capital-intensive industries like telecommunications or manufacturing (ahem, Tesla) -- is a crucial factor in going public.

Unlike decades past, however, there's no shortage of funding available to companies from private equity firms. As Collaborative Fund partner (and former Motley Fool contributor) Morgan Housel recently explained, the VC landscape has changed dramatically: "The VC and private equity industry has grown enormously. It's literally trillions of dollars in which 20 years ago it was a fraction of that, which has made it so that private companies can stay private for longer."

IPOs today simply have more time to grow their valuations than in years past.

And there's a second interesting anomaly at play: Many of these companies are unprofitable -- with no clear path to profitability. How could this be? Again, from Housel:

Today these companies are staying private for a long time and they're backed by venture capital funds and private equity funds. Those types of investors tend to have much more tolerance for the companies losing money.

...

Therefore, by the time these companies go public ... these companies are a big, established 10-year-old decabillion-dollar companies. But in terms of their internal financials -- their operating losses -- they're looking like brand new start-ups that are just bleeding money all over the place.

So where do the 10 biggest IPOs of 2019 stand? And should you consider buying them for your own portfolio? Let's dive into the dynamics for each one below by looking at three key aspects of each company: financial fortitude, valuation, and sustainable competitive advantages.

Beyond Meat

Beyond Meat -- more than any other recently public company -- has capitalized on a food movement. The public is hungry for an alternative to the standard American diet. Beyond Meat is happy to offer one up.

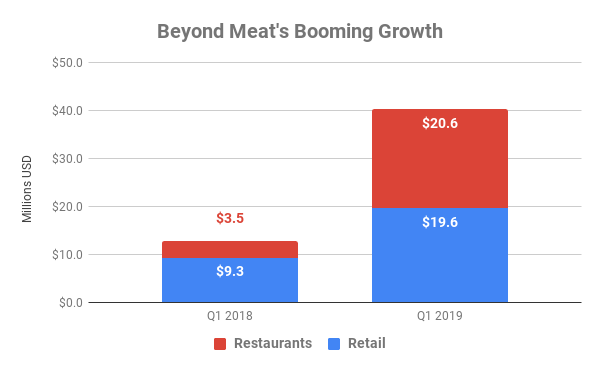

The company makes meat alternatives (think: burgers, brats, sausages). Those products are sold in grocery stores (retail) and also at restaurants. As you can see below, the real story right now is Beyond Meat's incredible popularity at restaurants.

This helps explain why the company has seen its shares increase fivefold since going public in early 2019. And there are plenty of other meat-based products to replace in our diets.

But investors should beware of Beyond Meat for two big reasons. First, the company has been bleeding cash. For the trailing 12 months ending March 2019, the company lost $70 million in free cash flow. That's a serious concern, because Beyond Meat had just $35 million in cash and investments on hand, and $30 million in long-term debt. It's highly likely management will pursue a secondary offering -- a good option at today's elevated prices -- which will dilute shareholders.

The larger long-term concern, however, has to do with the lack of a moat. Right now, Beyond Meat is benefiting from being one of the first-movers and top dogs in its industry. But there are many companies hot on its heels; Impossible Foods is the most obvious, but several traditional food purveyors are coming out with their own meat alternatives.

That means the only real advantage Beyond Meat has is its brand. If you believe that brand is worth buying a stock that as of mid-2019 was trading over 50 times sales -- go for it. Otherwise, I think there are better places for your IPO-related cash.

Chewy

In 2017, PetSmart bought a fast-growing e-commerce company focused on pets. Chewy sends pet owners food, medicine, and other pet-related products in the mail.

Just two years later, PetSmart decided to spin off the e-commerce operation while still retaining 75% of the company's shares. It's not hard to see why PetSmart was willing to pay $3.35 billion for Chewy: As of mid-2019, PetSmart's stake in Chewy was worth over $10 billion.

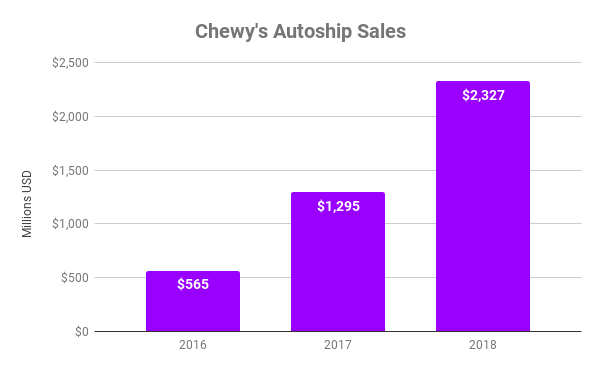

Of all the metrics worth watching at Chewy, I think the most important is the amount of Autoship sales. As the name implies, anything sent on Autoship means that pet owners have decided to get regularly scheduled deliveries of products. There's no need to sign-on or pay.

This is as close to a subscription as you can get without actually being a subscription. Like subscriptions, this business model is also very sticky: Because it's so automatic, it would take a terrible customer experience -- or exorbitant prices -- to get someone to switch away from Chewy.

As you can see below, the sales under the Autoship umbrella boomed from 2016 through 2018.

Early 2019 results showed the trend continuing: Autoship sales grew 56% to $744 million during the first quarter.

As of March 2019, Chewy's was still burning through cash: $58 million in negative free cash flow over the past 12 months. But it also has a stellar balance sheet: $88 million in cash and investments, no debt, and a deep-pocketed primary shareholder in PetSmart.

While it would be nice to see the company producing positive free cash flow, a stock that's trading at just 3.6 times sales makes me believe Chewy could end up being a long-term winner from this year's IPO class.

CrowdStrike

CrowdStrike will be the first of many companies covered here that focus on the software-as-a-service (SaaS) business model. In this model, a company spends lots of money up front to develop and market a software solution that helps other businesses.

Once those initial investments are made, the leverage really shows up: Customers are often locked in via high switching costs and network effects. And there's virtually zero cost associated actually giving someone access to the software. Over time, there are plenty of chances for up-selling to new products as well.

CrowdStrike's specific focus is on cybersecurity. The company's Falcon platform uses artificial intelligence (AI) and machine learning (ML) to thwart cyberattacks in the cloud. There are currently 10 different cloud modules customers can choose to use within their own organizations.

In its prospectus, CrowdStrike did a great job of laying out both customer retention (on an absolute basis) and net retention. The latter figure is the most important: It takes the entire cohort of customers from one year to the next, and compares how much subscription revenue they are spending. By filtering out the effect of new customers, we get a better idea for whether or not existing customers are spending more over time.

These are very solid numbers, which lead me to believe that CrowdStrike definitely has high switching costs embedded in its business model. Just as important, however, is the fact that the company gets stronger as its AI/ML get stronger. That means the data that each additional customer brings on board makes the overall service better for all users.

Like the other IPOs mentioned thus far, CrowdStrike has been bleeding money: It lost $47 million in free cash flow over the trailing 12 months ending in March 2019. That said, the combination of dual moats, a cash hoard of $192 million in March 2019, and zero long-term debt make me believe this company could be on to something.

Investors should beware, however: Shares aren't cheap. Trading at over 50 times trailing earnings as of mid-2019, there are clearly high expectations baked into the stock. If you want to buy shares, I suggest initiating a small starter position now, and adding to it at better value points (read: lower price-to-sales ratios) over time.

Pinterest is an enormously popular site for DIYers across the globe. The company has set up a social media platform that allows users to visually tag appealing projects, products, and presentations. Users can click on those pictures -- which eventually leads back to an original website with more information.

It might seem like an odd business model: help people tag pictures of things they like? How does that make money? The answer is: advertising.

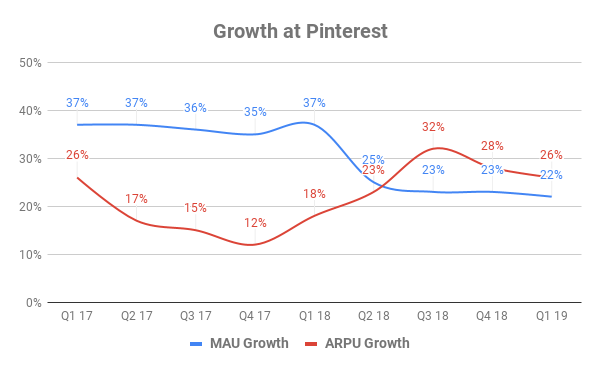

The most important metrics for new investors to watch at Pinterest are growth in monthly active users (MAUs) and average revenue per user (ARPU). The former tells you whether service is remaining popular, while the latter lets you know that Pinterest can actually collect money from advertisers.

While it would always be nice to see both the blue and red lines going up and to the right, there's context worth noting here. There's almost no way for MAUs to continually grow at faster rates -- the bigger the initial base is, the harder that is to accomplish. The same can be said for ARPU: Pinterest wants to grow revenue, but not at the expense of the customer experience on the website.

In general, the chart above is a positive one, showing ARPU picked up when MAUs dipped. At the end of March 2019, the company was on solid financial footing, with $643 million in cash versus $162 million in long-term debt. And while it was technically still losing money on a free-cash-flow basis -- losing $19 million over the past year ending in March 2019 -- it seemed close to reversing that trend.

Overall, however, I'd proceed with caution here. I've become somewhat wary of business models where the users (people using Pinterest) aren't the customers (advertisers). Conflicting priorities can arise, which can hold back growth.

Pinterest may very well become a stellar company -- and stock -- over the next 10 years, but I will be watching from the sidelines.

Slack

If you've never used Slack's enterprise collaboration software, think of it this way: Its functionality is similar to what AOL Instant Messenger was 20 years ago, but with a lot smoother design and business-based tools. The real goal of Slack is to increase productivity and eventually replace email as the main communication tool at organizations.

Technically, Slack never had an IPO. It had a direct listing. What does that mean? Basically, the company didn't raise any money when its shares went public. Instead, a path was opened for insiders and early investors to trade their shares on the public market. Based on the market's reaction -- the stock jumped over 40% during the first week of trading -- investors believe in the long-term potential here.

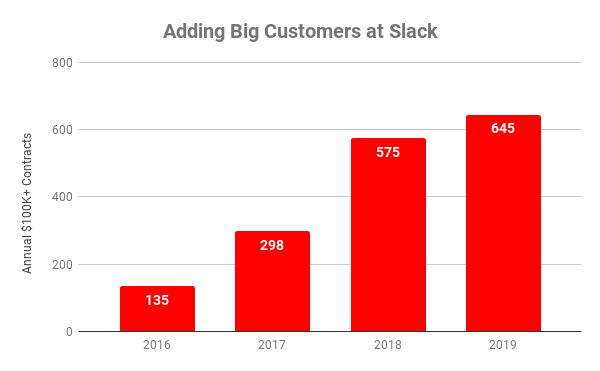

And why shouldn't they? This SaaS company has shown itself adept at growing big customers -- namely, those with annual contracts of over $100,000.

It's worth noting that Slack didn't experience a big slowdown in 2019. It's just that as of this writing, there were only had three months of data for the year.

When companies begin using Slack, they may just sign on for a few users. A standard package costs $6.67 per month per user, while a "Slack Plus" package runs $12.50 per month per user. But as these companies see how much friction Slack eliminates -- and how much productivity it unleashes -- they sign on more users.

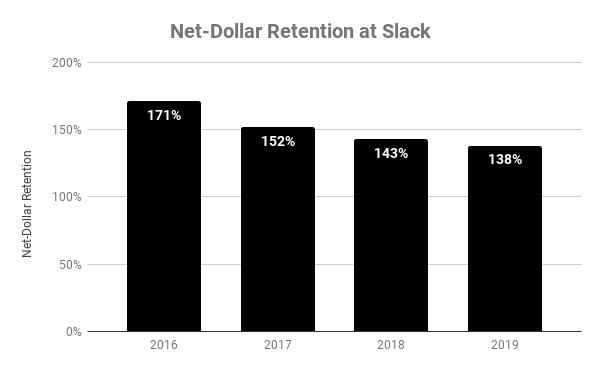

That's evident in the company's net-dollar retention rate. As we discussed with CrowdStrike, this lets investors see how much existing customers increase spending each year while filtering out the impact of new customers.

While net retention has slowed, anything above 120%-plus is still very impressive. Because businesses come to rely on Slack as the lifeblood for daily communication, switching costs become very high and protect the company from competition.

In general, Slack is on very solid financial footing as well. As of March 2019, the company had $808 million in cash and absolutely no long-term debt. It was still losing a good chunk of change via free cash flow -- $117 million over the 12 months ending in March 2019 -- but given the cash hoard and moves toward positive cash inflows, that shouldn't be a huge problem.

While shares aren't cheap -- they trade for over 40 times sales -- I think Slack could be a long-term winner. While I don't own shares myself, I've given the stock an outperform rating on my CAPS profile, and have put it on my watch list for a real-life purchase.

Lyft

Now we begin getting into the companies that virtually everyone knows about. Unless you live in a remote, rural area of America, you're no doubt familiar with ride-hailinf services like Lyft and Uber (more on Uber below) that are disrupting traditional taxi services around the world.

The business model is impressive: Lyft doesn't have to buy or maintain any cars. It simply offers an app that connects drivers and passengers, then takes a cut of each transaction.

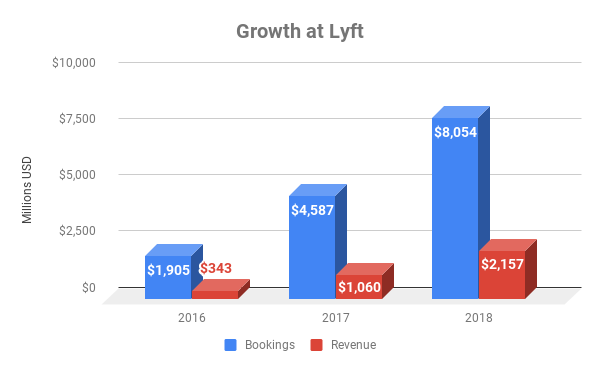

Two of the best ways to measure how the business is doing is by looking at bookings and revenue. Bookings represents the total amount of money -- not including tip -- that someone pays their driver. Revenue represents the slice of the booking that goes to Lyft.

Both figures have shown remarkable growth.

The real key here is to check the company's take rate, or the amount of money Lyft keeps from bookings. The take rate was 18% in 2016 -- for every dollar I paid for my Lyft ride in 2016, the driver kept $0.82 and Lyft got $0.18. Over the next two years, the take rate increased to 23%, then 27%.

But I'm decidedly not a fan of Lyft -- even though it has scorching growth and few capital expenditures to worry about. That's because the company doesn't have much of a moat at all. If Lyft disappeared tomorrow, I think people would just move toward Uber -- or another as-of-yet popular ridesharing service -- to meet their needs.

Because it is so easily replaced, I don't think Lyft has any real pricing power. The company lost $377 million over the past 12 months ending in March 2019. It won't be able to keep that up for long, as it had a net cash position (cash minus long-term debt) of $776 million on the same date.

Perhaps most disappointingly, management has decided to stop sharing the bookings figures moving forward, making it impossible to know if the take rate is moving in a direction that supports a sustainable business model.

I think it's worth taking a pass on Lyft.

Zoom

Next we have Zoom Video Communications. The company was started by Eric Yuan, who was once an employee at Cisco. While at his former job, Yuan noticed that video teleconferencing solutions available to most businesses were underwhelming. Picture quality was poor, connectivity could be fickle, and it was very hard to share information real-time in a meaningful way.

So he set out to create his own video solution, using the SaaS business model. Companies can test trial runs for free, then add a dizzying number of solutions -- based both on the number of users and the type of functionality (think: video webinars, enhanced audio, etc).

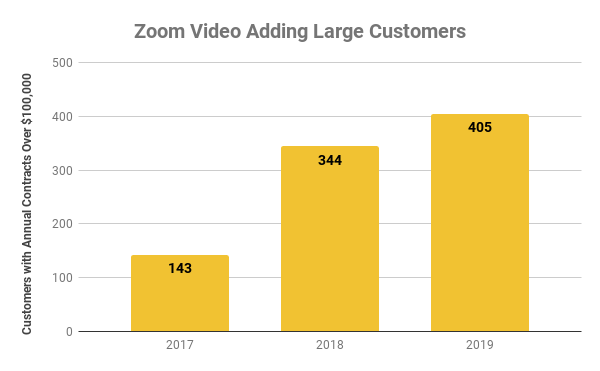

That approach -- and the quality of the core product -- has been winning over lots of customers. The number of businesses willing to fork over a minimum of $100,000 per year has shown steady growth.

That 2019 figure will only continue to grow, as it only includes additions made in the first three months of the year.

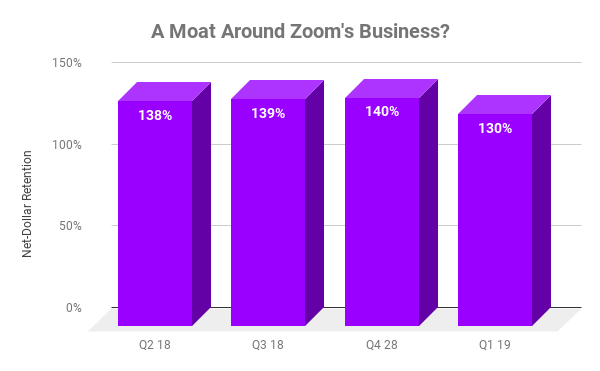

Some have been skeptical about Zoom's moat. Would it really be that hard to find a replacement video service at a cheaper cost? If the stock's performance in its first three months out of the IPO gate are any indication, there might be more of a moat than Zoom's doubters believe. One of the key metrics to watch moving forward is Zoom's net-dollar retention. The company only started monitoring this one year ago, but it has consistently been over 130%.

In other words, even if Zoom didn't add a single new customer over the past year, revenue would still have been over 30% higher thanks to existing customers staying on and buying new subscriptions.

Importantly, Zoom is actually making money. The company produced $49 million in free cash flow over the trailing 12 months ending in March 2019. It also had a solid balance sheet at the time: $737 million in cash and investments versus only $46 million in long-term debt.

That said, I'm still sitting on the sidelines for this one. I'm not one to usually quibble on price, but at over 60 times sales, the stock's just too expensive for me.

Perhaps I'm just not acquainted well enough with the technology to appreciate the moat Zoom has around it. That being said, I think it's worth watching, and several investors have already made a bundle off of shares, which have more than doubled from their original IPO price.

Airbnb

Airbnb has completely upended the lodging industry -- and in short order. The company was barely on anyone's radar 10 years ago. Today, it is the go-to spot if you want to book an affordable place to stay that isn't a traditional hotel. Perhaps that's why its estimated valuation hovers near $40 billion.

Because Airbnb has yet to announce official plans to go public or submit a prospectus for investors, we only have limited information on the company. But here's what we do know:

The company has been profitable in each of the past two years.

During the third quarter of 2018, Airbnb had over $1 billion in revenue.

It passed 500 million arrivals earlier this year. Previously, it passed 400 million in September 2018. This represents impressive growth.

The company has expanded outside of lodging to include experiences (hosted events), adventures (multiday trips), and restaurants.

Overall, Airbnb would be a compelling investment -- at the right price, and given there aren't any huge surprises in the prospectus (the long document the company must provide to investors before going public).

The company clearly benefits from a powerful network effect: People with houses to offer up know they'll get access to customers by listing on Airbnb. That draws in more customers, which draws in even more houses. It's a virtuous cycle.

And Airbnb has shown a knack for expanding its offerings outside of lodging, which could be a very big deal over the long run. For the time being, we're in wait-and-see mode. Keep your eyes peeled for more details as the year progresses.

WeWork

Our economy is changing at a core level -- long gone are the days of being a "company man" (or woman). People change jobs with incredible regularity, and many are deciding to strike out on their own as self-employed persons.

But not everyone can successfully conduct business from home or the local coffee shop. People need places to work, gather, and be a part of something. Enter WeWork -- which technically renamed itself The We Company recently.

The business works like this: The company offers up office space for entrepreneurs, start-ups, and the self-employed. But there's more than just nice office space -- members have access to health insurance products, an internal social network, and social events. Members can also use the company to take care of things like payroll, benefits, and other HR-related functions.

Truly, for those looking for it, WeWork offers up something of a community of like-minded people.

The We Company has officially filed an IPO prospectus, but it has done so confidentially, so investors have yet to read through the details. People who follow the company say the valuation of an IPO could peg the company as worth close to $47 billion.

It is virtually impossible to know just how appealing We Company's business model is without a look at its prospectus. One the one hand, there are clear network effects that come with the company: Some might use it to gain access to like-minded individuals, and -- up to a point -- each additional user clearly adds to the value of membership. Switching office space isn't easy, so there are moderately high switching costs at play as well.

On the other hand, it's very difficult to tell how easy or hard this would be for a competitor to replicate. And without greater visibility into the business unit economics, it's tough to know how sustainable this model is.

In due time, we'll get those details. In the interim, we wait.

Uber

Finally, we have one of the largest IPOs in history: ride-hailing service Uber. The company was valued at over $70 billion in July 2019.

Crucially, Uber doesn't stop at ridesharing. The company differentiates itself from Lyft by having two other lines of business:

Uber Eats, a food delivery service.

Uber Freight, which connects people with shippers using the company's technology.

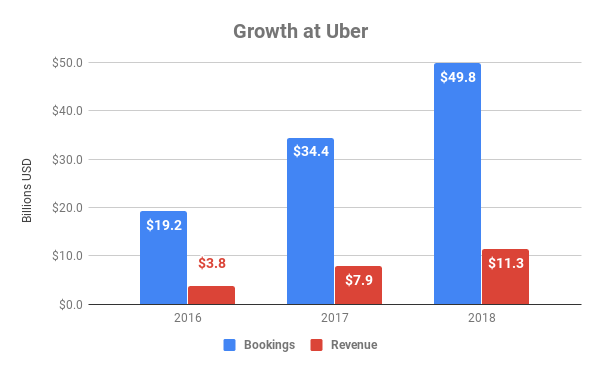

Averaged out across all three segments, here's where Uber's bookings and revenue stand.

The take rate at Uber clocked in at 23% at the end of March 2019. That's not quite where Lyft's was at the end of last year, but this isn't an apples-to-apples comparison; Lyft doesn't have the same food and freight programs.

Like Lyft, however, Uber is still bleeding cash: It has lost $2.56 billion over the year ending in March 2019. That's enormous. It's a good thing the company has a net cash position of over $9 billion, but even that could be in danger if such losses continue.

Uber also had to deal with one of the worst PR disasters of a pre-IPO company ever: The company was publicly called out for fostering a sexist environment in corporate headquarters and founder (and then-CEO) Travis Kalanick was caught on camera berating one of his own drivers. Kalanick then took a leave from the company and hasn't been back in the C-suite since.

Overall, I think Uber has a better chance of surviving and thriving than Lyft. It has more market share, an equally strong brand, and differentiated revenue streams. At the same time, however, I'd stay away from shares, because there's simply too little of a moat to justify buying such a money-losing company.

A final word on large IPOs

Remember, there's a universe of thousands of stocks out there to choose from. Those that have been around for a while have years' worth of annual reports to read through, valuations that have largely stabilized, and stocks that are far less volatile.

If you want to buy into a recent IPO, I highly suggest allocating how much you wish to buy, and then devoting just one-third of that amount to start with. If the stock goes down, you'll be glad for the smaller allocation and will have the option to reevaluate your thesis. If it goes up, you'll be glad you bought some at all.

Overall, I'm bullish on the prospects for Chewy, CrowdStrike, Slack, and Airbnb. I'm on the fence when it comes to Pinterest, Zoom, and The We Company. And I'm decidedly bearish on Lyft, Uber, and Beyond Meat. I've made CAPScalls corresponding to these thoughts on my own profile. Time will tell how they shake out.

No matter how that happens, it will be fascinating to see how 2019's class of huge IPOs fare in the years ahead.

More From The Motley Fool

Brian Stoffel has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends TSLA and Zoom Video Communications. The Motley Fool owns shares of Pinterest and Slack Technologies. The Motley Fool recommends Uber Technologies. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance