This 10.5% Dividend Stock Pays Cash Every Month

Written by Kay Ng at The Motley Fool Canada

The first place Canadian investors can investigate for monthly income is real estate investment trusts (REITs). They could pay even better income than rental properties because there’s no debt leverage on the part of the investor.

Here’s an example of a Canadian REIT that offers an eye-popping cash distribution of close to 10.5%. This is more than double the income of the best GIC rate, which stands at 5%. What’s the catch? Why is its distribution yield so high?

A cash flow generator

Real estate generally produces durable income. This is the case for NorthWest Healthcare Properties REIT (TSX:NWH.UN), which is a globally diversified REIT with a high-quality portfolio of healthcare properties. Regular investors don’t have access to the kind of properties that are in this REIT’s portfolio, an international portfolio that has a weighted average lease expiry (WALE) of approximately 16 years and 98% indexation to minimize inflation impacts. Its properties include hospitals and medical office buildings.

NorthWest’s overall portfolio consists of assets of 18.6 million square feet across about 233 properties, over 2,100 tenants, and eight countries. It has a WALE of almost 14 years with a high occupancy of 97% and 83% of rents indexed to inflation. More than 70% of its portfolio is in gateway cities like Toronto, Phoenix, Sydney, London, Berlin, and Sao Paolo.

Its funds from operations (FFO) payout ratio was over 100% in 2022, which suggests the cash distribution may be in danger. However, in the trailing 12 months, NWH.UN generated almost $197.5 million in free cash flow, leading to a payout ratio of about 78% based on free cash flow. While generating substantial cash flows every month, the stock has also sold off significantly.

An undervalued stock

The global healthcare property REIT stock price has declined about 41% in the last 12 months. The decline has pushed up its cash distribution yield for buyers of the stock today, as it has maintained its cash distribution so far.

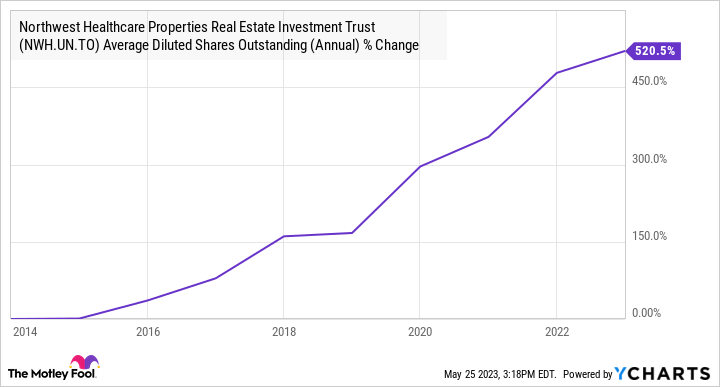

Rising interest rates globally and the fact that the REIT has been making global acquisitions, while increasing its share count, have been a drag on results and weighing on the stock. For example, from 2021 to 2022, its interest coverage ratio dropped from a solid 3.5 times to a more unsettling coverage of 2.3 times. Furthermore, in 2022, its FFO per unit declined 18% year over year to $0.71, which suggests dilution of existing unitholders. Over the last three years, its share count increased by almost 37%. In fact, in the last decade, the stock pretty much never stopped increasing its share count (arguably, it may be beneficial when its stock price is high or overvalued.)

NWH.UN Average Diluted Shares Outstanding (Annual) data by YCharts

That said, the stock might have fallen too much too quickly. With analysts having a consensus 12-month price target of $10.50 per unit, at $7.63 at writing, it would imply an undervalued stock with a discount of 27%. Still, it feels like catching a falling knife. The stock likely won’t bottom until interest rates are turning south again, the REIT reduces its debt levels, or it improves its FFO per unit. It would also be good if NorthWest avoids increasing its share count while the stock is cheap.

Investor takeaway

There’s no doubt the high-yield stock is a high-risk investment in today’s higher interest rate environment. However, the stock appears to have sold off materially, which could make it a plausibly satisfying total return investment.

Even if the REIT were to cut its cash distribution by 40% to reduce its FFO payout ratio, buyers today would still be getting a cash distribution yield of close to 6.3%. Additionally, analysts think it can climb about 38% over the next 12 months. If the price gains took three years and the stock paid out a 6.3% cash distribution yield, buyers today would pocket returns of about 17.5% per year over the period.

Also, note that REITs pay out cash distributions that are like dividends but are taxed differently. Seek advice from a tax professional for details.

The post This 10.5% Dividend Stock Pays Cash Every Month appeared first on The Motley Fool Canada.

Should You Invest $1,000 In NorthWest Healthcare Properties?

Before you consider NorthWest Healthcare Properties, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in May 2023... and NorthWest Healthcare Properties wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 23 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 5/24/23

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends NorthWest Healthcare Properties Real Estate Investment Trust. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance