Warren Buffett Shows Changes to International Stocks: Tesco, Munich Re, Sanofi, POSCO

Warren Buffett (Trades, Portfolio) reported the holding changes at Berkshire Hathaway (BRK.A)(BRK.B) last month, but he did not include his foreign stocks, as he is not required to by the SEC. Once a year, in his annual letters, however, he gives a glimpse of his international dealings by reporting the status of all his equity positions exceeding $1 billion in value. The latest letter, reported last week, revealed some notable changes in his international holdings.

Chart of Warren Buffett (Trades, Portfolio)'s portfolio changes of international stocks from 2012 to 2013:

(Courtesy Vera Yuan)

Sanofi (SNY)(SNY)

At the end of 2012, Buffett owned 25,848,838 shares of Sanofi, or 2% of the company. He had not changed the position since the end of 2011 and enjoyed a 17.61% increase in its value. Then, in 2013, he reduced the position to 22,169,903 shares, or 1.7% of the company.

Over the past 12 months, Sanofi's share price increased 7%. In the past five years, it gained 102%. Buffett still has a profit on the position overall, having paid $1.75 billion for it when it ended 2013 with a market value of $2.35 billion.

France-based Sanofi is the world's fourth-largest pharmaceutical company by prescription sales. In fourth quarter 2013, Sanofi reported its first profitable quarter of the year, with EPS rising 30.8% from the previous quarter to ?1.37. Sales also increased 6.5% from the previous year to ?8.46 billion, though sales for the year did not rise from the previous year, down 0.5% to ?32.95 billion. Sales had declined for the first eight months of the year due to a patent cliff, and returned to growth in the last four months.

The company continued to increase its dividend for the 20th consecutive year to ?2.80 for 2013, and repurchased ?1.6 billion of its shares in total for the year. Further, it reduced its debt level by ?1.7 billion to ?6.0 billion.

GuruFocus data also shows that the company's gross margin has been in long-term decline and its operating margin has been in five-year decline.

Tesco Plc (TSCO.L)

In his 2013 letter, Buffett reported owning 301,046,076 shares of this British grocery company, equating to 3.7% of its shares outstanding. It was the only position of his top 15 on which he had a paper loss: It was purchased for $1.699 billion and was worth $1.666 billion at year-end.

Buffett also cut the position by 37.55% last year. At Dec. 31, 2012, he reported owning 415,510,889 shares, or 5.2% the company. In 2012, he had increased his stake in Tesco when its price fell by approximately 16% in January after it issued its first profit warning in 20 years.

Tesco's share price history:

Tesco has been a major Buffett shareholding since 2006. At 324.84 pence a share on the London exchange on Thursday, Tesco's price is 2% below its price at the start of 2006, 331.50 pence, though it went higher by the end of that year. He bought it around a four-year high price.

In October 2013, Tesco reported its interim results for the period ended Aug. 24, 2013, including a 2% year-over-year increase in sales to �35.58 billion, led by a 7.7% increase in Asia. Its trading profit slid by 7.6% to �1.59 billion, due primarily to economic conditions in Europe and regulatory restrictions in Korea.

For its full-year outlook, the company said it expects that the limited profitability due to conditions in Europe to offset partially the effect of its turnaround efforts in the UK for the full year.

GuruFocus data shows that Tesco has maintained consistent top-line growth, while its gross margin and operating margin have been in long-term decline. Tesco currently trades at a one-year low P/B ratio of 1.6 and 10-year low P/B ratio of 0.41. Its TTM P/E is 217.80.

Other Stocks

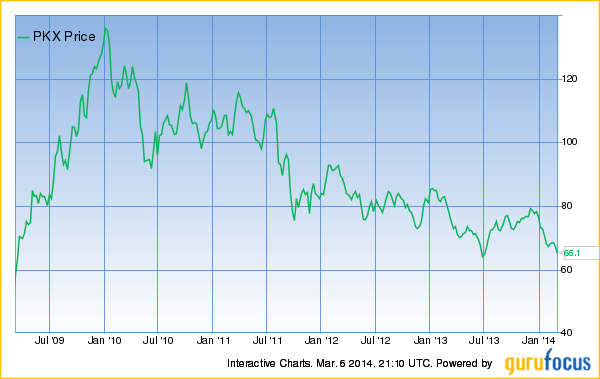

POSCO (XKRX:058430)(PKX)

One of Buffett's stocks, Korea-based steel manufacturer POSCO, no longer appears on his shareholder letter's largest holdings list this year.

GuruFocus analyst Vera Yuan explains the reason: "It is unlikely that Berkshire sold out the shares. The possible reason that POSCO is off the list is that the stock price changed or the currency exchange rate changed, which makes POSCO's market value less than 1 billion."

Last year, the holding was grazing the low-end of the cut-off value of $1 billion, having a market value of $1.295 billion at the end of 2012. Buffett at that point owned 3,947,555 shares, giving him 5.1% of the company. He paid $768 million for the POSCO stake.

In the past year, POSCO's share price came down almost 18% to close at $66.21 on Thursday.

POSCO's share price history:

POSCO's chief executive, Chung Joon-yang, resigned from his position in November 2013 as steel prices continued to fall for the second straight year.

For the fourth quarter, POSCO reported $15.49 billion in revenue, up from $14.13 billion a year prior. Its net income declined to $243 million from $484 million a year earlier.

The company has also seen its gross margin and operating margins decline for the last five years. It trades with a P/B ratio of 0.52 and P/S ratio of 0.36, which are near their respective 10-year lows. The P/E ratio of POSCO is 13.5.

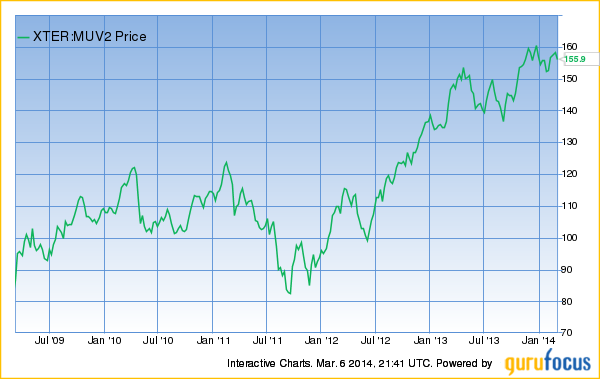

Munich Re (XTER:MUV2)

Last, Buffett made no change to his Munich Re holding. He continued holding 20,060,390, of 11.2% of the company, He paid $2.99 billion for this stake which was valued at $4.415 billion at Dec. 31, 2013. This marks the second year he neither bought nor sold shares of Munich Re, the world's leading reinsurance company.

In the past 12 months, Munich Re's share price rose 12%. In five years, its price gained almost 91%. It closed for ?155.30 a share on Thursday.

Munich Re's stock price history:

Munich Re has a 5.3% per-share revenue growth rate and 8.4% book value per share growth rate for the past five years. For the same period, its EBIT declined at a rate of 3.8% and free cash flow declined at a rate of 8.2%.

Its price is close to a 10-year high, and its P/S ratio at 0.43 is close to a three-year high. It has a P/E ratio of 10.8.

See Warren Buffett (Trades, Portfolio)'s portfolio here. Not a Premium Member of GuruFocus?Try it free for 7 days here!

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance