Toyota (TM) to Report Q4 Earnings: Here's What to Expect

Toyota Motor Corporation TM is slated to release fourth-quarter fiscal 2024 results on May 8, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $2.91 per share and $67.21 billion, respectively.

For the fiscal fourth quarter, the consensus estimate for TM’s earnings per share has moved down by 58 cents in the past 90 days. Its bottom-line estimates imply a decline of 5.21% from the year-ago reported number.

The Zacks Consensus Estimate for revenues suggests a year-over-year decline of 8.28%.

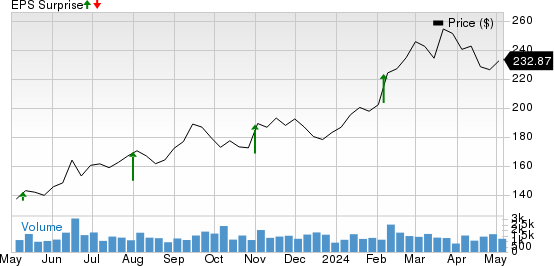

TM surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 67.55%. This is depicted in the graph below:

Toyota Motor Corporation Price and EPS Surprise

Toyota Motor Corporation price-eps-surprise | Toyota Motor Corporation Quote

Q3 Highlights

In third-quarter fiscal 2024, Toyota posted adjusted quarterly earnings of $6.81 per share, surpassing the Zacks Consensus Estimate of $3.66. This compares to an adjusted earnings of $3.78 per share reported a year ago. Toyota posted revenues of $81.5 billion, outpacing the Zacks Consensus Estimate of $73.7 billion and rising from $69.16 billion in the year-ago quarter.

Things to Note

Toyota is struggling with labor cost inflation, which might have weighed on its margin in the fiscal fourth quarter. The automaker planned to spend around ¥1.24 trillion in research and development (R&D) expenses in fiscal 2024, the same as the amount spent in 2023. High R&D expenses are expected to have hurt fiscal 2024 operating income by ¥20 billion.

The Japan-based automaker estimates fiscal 2024 capital expenditure to be ¥1.97 trillion, indicating an increase from ¥1.60 trillion spent in 2023. High capex and R&D expenses are likely to have hindered the company’s margins and cash flow.

Given the suspension of shipments of Daihatsu, Toyota expects sales in Japan to decrease. The company lowered the fiscal 2024 vehicle sales projection to 9.45 million units from the prior forecast of 9.6 million units. The decline in unit sales is likely to have impacted the company’s fiscal fourth-quarter top line.

Here's a sneak peek at the firm’s key revenue projections for the to-be-reported quarter.

Our estimate for quarterly revenues from Japan, which has the highest contribution to the company’s revenues, is pegged at $4.55 billion, suggesting a decline from $4.81 billion recorded in the prior-year quarter. Our estimate for revenues from North America is pegged at $3.65 billion, indicating a rise from $3.38 billion recorded in the year-ago quarter.

Our estimate for revenues from Europe is pegged at $1.17 billion, indicating a fall from $1.21 billion recorded in the year-ago period. Our estimate for quarterly revenues from Asia is pegged at $1.86 billion, indicating a decline from $1.91 billion reported in the year-ago quarter. Our estimate for revenues from Other is pegged at $865.8 million, indicating a rise from $828.7 million recorded in the year-ago quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Toyota this time around, as it does not have the right combination of the two key ingredients. A positive Earnings ESP, combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of an earnings beat. This is not the case here.

Earnings ESP: TM has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Toyota currently carries a Zacks Rank #4 (Sell).

Earnings Whispers for Other Auto Stocks

Lucid Group, Inc. LCID has an Earnings ESP of -8.00% and a Zacks Rank #3 at present. It is scheduled to post first-quarter earnings on May 6. The Zacks Consensus Estimate is pegged at a loss of 25 cents per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

LCID missed estimates in each of the trailing four quarters, the average negative surprise being 7.96%.

Rivian Automotive, Inc. RIVN has an Earnings ESP of -0.52% and a Zacks Rank #3 at present. The company is slated to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of $1.13 per share.

RIVN surpassed earnings estimates in each of the trailing four quarters, the average surprise being 13.82%.

Nikola Corporation NKLA has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. The company is scheduled to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of 9 cents per share.

NKLA surpassed earnings estimates in three of the trailing four quarters and missed once, the average negative surprise being 11.24%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance