Time to Buy the Dip in These Top-Rated Retail Stocks

Three more retail sector stocks have made their way onto the Zacks Rank #1 (Strong Buy) list this week and now looks like an ideal time to invest considering their favorable outlook.

Better still, here’s a look at why these new additions to the strong buy list may be poised for a sharp rebound.

Signet Jewelers SIG

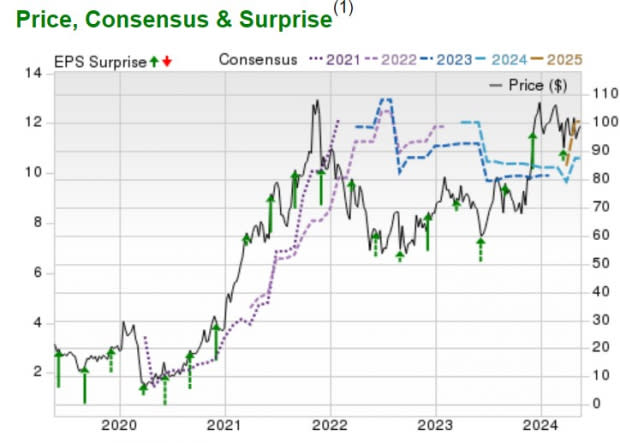

April's better than expected CPI (Consumer Price Index) data is a nod to the notion that the strong price performance of Signet Jewelers stock could resume. Despite dipping -6% year to date, Signet Jewelers stock has still soared +40% over the last year. Dropping -8% from its 52-week high of $109 in early April, the recent dip in SIG looks like a buying opportunity considering the company’s steady growth and reasonable valuation.

Trading at just 9.2X forward earnings, Signet Jewelers' EPS is expected to rise 2% in its current fiscal 2025 and is projected to jump another 14% in FY26 to $12.06 per share. More tempting is that the leading diamond jewelry retailer has surpassed the Zacks EPS Consensus for 25 consecutive quarters dating back to March of 2018.

Image Source: Zacks Investment Research

The Gap GPS

Sharing a similar scenario to Signet Jewelers in terms of its price performance, buying the pullback in The Gap’s stock could certainly pay off. Trading just over $20 a share and 25% from its 52-week high of $28 in March, The Gap’s stock is still up +2% YTD and has skyrocketed +169% over the last year.

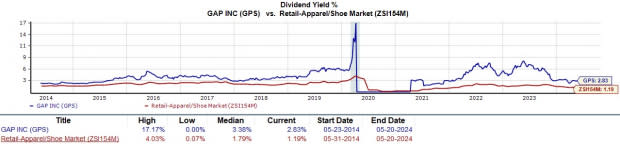

Image Source: Zacks Investment Research

International expansion fueled by strong apparel brands including Old Navy, and the Banana Republic outside of its namesake brand have been the major catalysts here. The Gap’s annual earnings are projected to dip -4% in its current FY25 but are projected to rebound and rise 11% in FY26 to $1.52 per share. More reassuring is that earnings estimate revisions have remained higher for both FY25 and FY26 over the last 60 days. Plus, GPS trades at a reasonable 15.6X forward earnings multiple with its annual dividend yield currently at 2.83%.

Image Source: Zacks Investment Research

The ODP Corporation ODP

Buying the dip in The ODP Corporation’s stock looks tempting considering ODP is trading at 52-week lows of $39 a share. To that point, ODP looks cheap in terms of its P/E valuation and this is accompanied by sound bottom line expansion with the company having a strong portfolio brand of office supply stores including Office Depot and OfficeMax.

Making the possibility of a sharp rebound look more apparent is that earnings estimate revisions are noticeably higher in the last 30 days with ODP Corporation’s annual earnings now projected to be up 7% this year and forecasted to climb another 29% in FY25 to $7.81 per share. Furthermore, ODP trades at 6.7X forward earnings and at a significant discount to the benchmark and its Zacks Retail-Miscellaneous Industry average of 17.7X with noteworthy peers in the space including Bath & Body Works BBWI and Dick’s Sporting Goods DKS.

Image Source: Zacks Investment Research

Bottom Line

Buying the dip in these top-rated retail stocks is very enticing as in addition to their strong buy ratings they each have an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The ODP Corporation (ODP) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Bath & Body Works, Inc. (BBWI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance