Three Solid Dividend Stocks In Canada With Yields Starting At 3.4%

Amidst a backdrop of resilient economic growth and a tech-driven recovery in major indices like the S&P 500 and TSX, Canadian investors are witnessing a dynamic market environment. With corporate earnings showing strength and central banks poised to adjust monetary policies, conditions are becoming increasingly favorable for equities. In this context, dividend stocks emerge as particularly compelling, offering potential stability and steady income streams in an otherwise volatile market landscape.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.59% | ★★★★★★ |

Bank of Nova Scotia (TSX:BNS) | 6.66% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.77% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.45% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.87% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.12% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.05% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.94% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.76% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

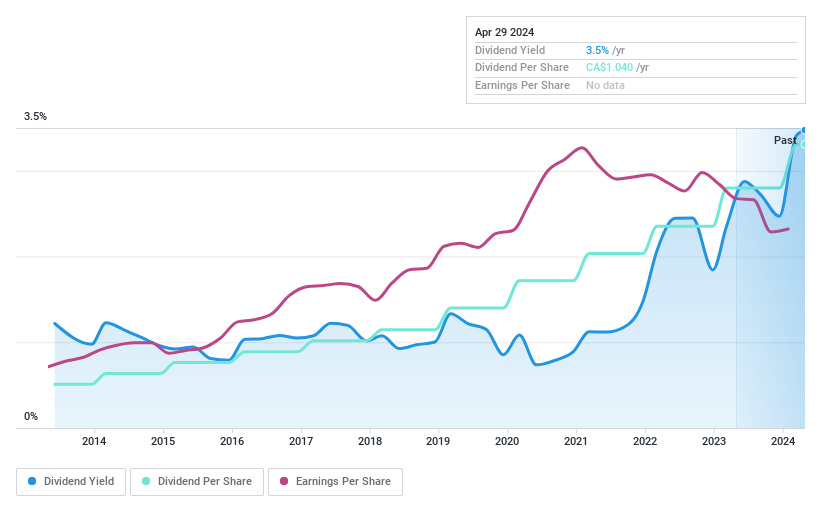

Enghouse Systems

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited is a global provider of enterprise software solutions with a market capitalization of approximately CA$1.66 billion.

Operations: Enghouse Systems Limited generates its revenue primarily through two segments: the Asset Management Group, which brought in CA$184.48 million, and the Interactive Management Group, contributing CA$283.60 million.

Dividend Yield: 3.5%

Enghouse Systems, trading significantly below its estimated fair value, offers a modest dividend yield of 3.47%. Despite this lower yield relative to top Canadian dividend stocks, its dividends are well-supported with a payout ratio of 69.3% and cash payout ratio of 55%, indicating sustainability from both earnings and cash flow perspectives. The company has demonstrated reliability in its dividend payments, showing consistent growth over the past decade. Recently, Enghouse announced an 18.2% increase in its quarterly dividend to CA$0.26 per share, effective May 31, 2024.

Navigate through the intricacies of Enghouse Systems with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Enghouse Systems' share price might be too pessimistic.

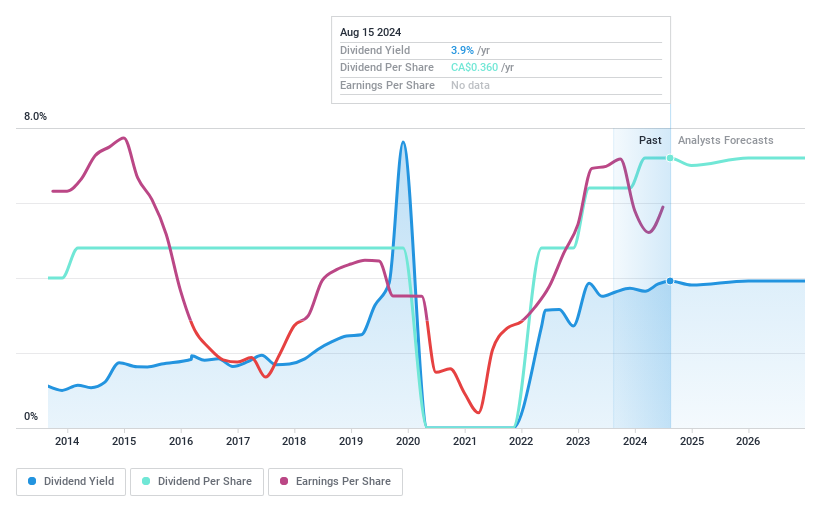

Total Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company with operations mainly in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$403.52 million.

Operations: Total Energy Services Inc. generates its revenue from four primary segments: Well Servicing (CA$102.51 million), Contract Drilling Services (CA$287.33 million), Compression and Process Services (CA$417.65 million), and Rentals and Transportation Services (CA$84.91 million).

Dividend Yield: 3.6%

Total Energy Services, with a dividend yield of 3.56%, falls below the top quartile of Canadian dividend payers. However, its dividends are well-supported by a 31.1% payout ratio and a 20.3% cash payout ratio, indicating sustainability from both earnings and cash flows. Despite this stability, the company's dividend history has been marked by volatility over the past decade. Recently, Total Energy reported an annual net income increase to CA$41.63 million in 2023 from CA$38.01 million in 2022 and raised its quarterly dividend by 13% to $0.09 per share for Q1 2024.

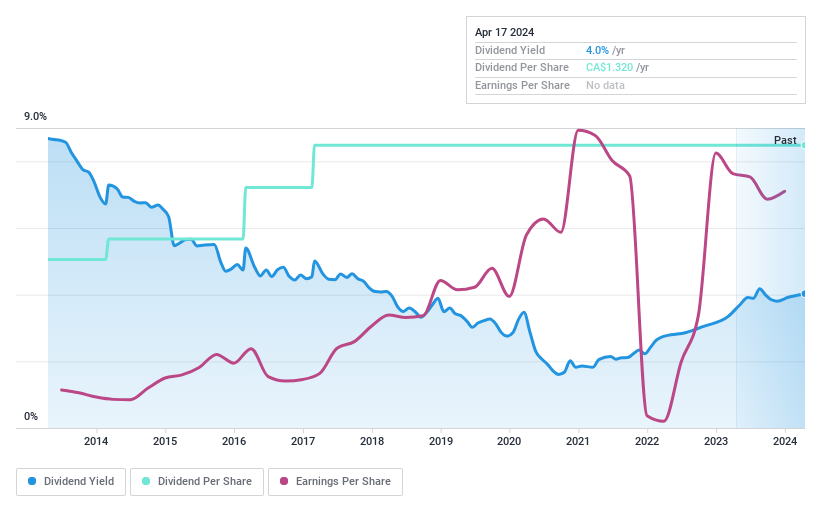

Richards Packaging Income Fund

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, operating in North America, specializes in the design, manufacture, and distribution of packaging containers and healthcare supplies with a market capitalization of CA$357.02 million.

Operations: Richards Packaging Income Fund generates CA$425.93 million in revenue primarily through its wholesale distribution of miscellaneous packaging and healthcare products.

Dividend Yield: 5.2%

Richards Packaging Income Fund offers a 5.16% dividend yield, lower than the top Canadian dividend payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 37.2% and 22.9%, respectively, indicating sustainability. The fund has maintained stable and growing dividends over the past decade, demonstrating reliability in its distributions to shareholders. Recent affirmations include a monthly cash distribution of CA$0.11 per unit for April 2024, consistent with previous months.

Where To Now?

Gain an insight into the universe of 34 Top Dividend Stocks by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ENGHTSX:TOT TSX:RPI.UN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance