Scalps Favor Selling Rallies in EURAUD Post Head and Shoulders Break

Talking Points

EURAUD Breaks below weekly & monthly opening ranges- Bearish

Broader head and shoulders break shifts medium-term outlook lower

Event risk on tap from Europe and Australia heading into month end

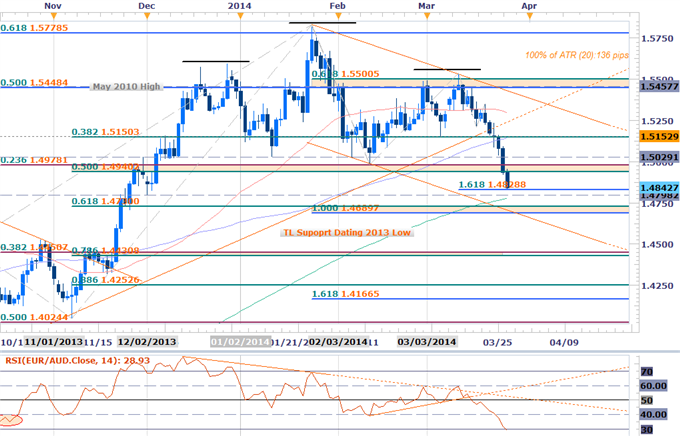

EURAUD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

EURAUD breaks below March opening range low 1.5150- Bearish

Key support break at 1.4940/78 puts Head and Shoulders formation in play

Support objectives at 1.4829, 1.4690-1.4730, 1.4430/50, 1.4253

Bearish below 1.5030, 1.5150- Bullish Invalidation

Daily RSI hold at 60 & subsequent 40 break- Bearish

RSI signature at lowest level since March of 2013

Event Risk: German CPI & Eurozone Confidence data tomorrow and RBA Interest Rate Decision on Tuesday

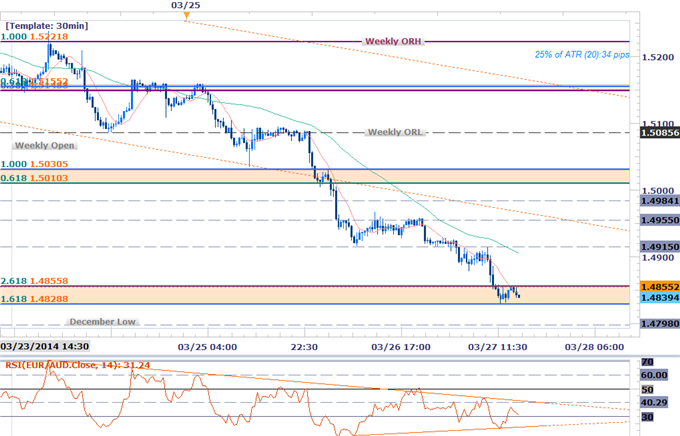

EURAUD Scalp Chart

Notes: The EURAUD has made an impressive move this week with the pair breaking below the March opening range defined by the 38.2% retracement of the November advance at 1.5150. A weekly opening range break below 1.5085 further supported our near-term bias with the immediate focus remaining on the short-side below this level.

Bottom line: The pair has now completed a 1.618% extension off the decline from the monthly high and although this may offer some interim support, we’ll look to sell rallies / breaks of support while below 1.5030 with only a breach above this week’s high challenging our broader outlook. Note that a larger head and shoulders formation on the daily chart is in play here with longer-term objectives eyed around 1.4250.

Stay nimble heading into Eurozone data tomorrow morning with the RBA interest rate decision early next week likely to fuel added volatility in the pair. Keep in mind that the close of the month and quarter is upon us with the April and weekly opening range likely to offer further guidance on our near-term scalp bias. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Significance |

Resistance Target 1 | 30min | 1.4915 | Soft Resistance / Pivot |

Resistance Target 2 | 30min | 1.4955 | Soft Resistance / Pivot |

Resistance Target 3 | Daily / 30min | 1.4978/84 | 23.6% Retracement / February Low |

Bearish Invalidation | Daily / 30min | 1.5010/30 | 61.8% & 100% Extension(s) |

Break Target 1 | 30min | 1.5085 | Weekly ORL |

Break Target 2 | Daily / 30min | 1.5148/55 | 61.8% Ext / 38.2% Retrace / 100DMA / March ORL |

Break Target 3 | Daily / 30min | 1.5221 | 100% Ext / Weekly ORL |

Support Target 1 | Daily / 30min | 1.4829/55 | 1.618% & 2.618% Ext(s) |

Support Target 2 | Daily / 30min | 1.4798 | December Low / Pivot |

Support Target 3 | 30min | 1.4774 | 200DMA |

Bullish Invalidation | Daily / 30min | 1.4690 – 1.4730 | 61.8% Retracement / 100% Ext |

Break Target 1 | Daily / 30min | 1.4550 | October High |

Break Target 2 | 30min | 1.4502 | 2.618% Extension |

Break Target 3 | Daily / 30min | 1.4430/50 | 78.6% & 38.2% Retrace(s) / August Low |

Break Target 4 | Daily / 30min | 1.4253 | 88.6% Retrace / H&S Objective |

Daily (20) | 136 | Profit Targets 31-34pips | |

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

GBPUSD Setup Targets Key Support- Scalp Bias Constructive Above 1.6469

Key Reversals on USDOLLAR, Gold Post FOMC- March Range at Risk

NZDUSD Rallies Into Key Resistance on RBNZ- Bearish Below 8580

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Monday through Thursday mornings next week on DailyFX Plus (Exclusive of Live Clients) at 12:30GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance