SandRidge Energy Inc. Reports Q1 2024 Earnings: Steady Income Amidst Operational Adjustments

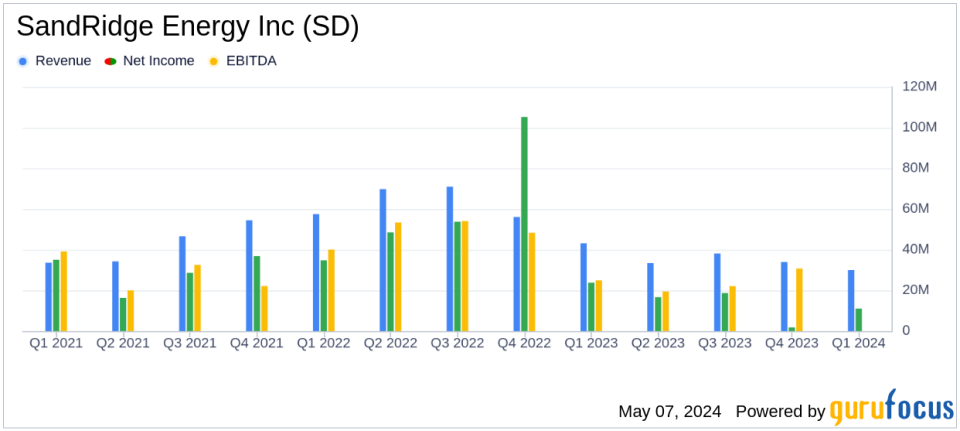

Net Income: $11.1 million for Q1 2024, with earnings per share at $0.30.

Adjusted EBITDA: Reported at $14.7 million for the first quarter of 2024.

Free Cash Flow: Generated $14.5 million in Q1 2024, representing a 99% conversion rate relative to adjusted EBITDA.

Cash Dividend: Declared a $0.11 per share cash dividend payable on May 31, 2024.

Revenue: Total revenue of $30.3 million for the quarter, with oil contributing 51%.

Cash Position: Held $208.5 million in cash and cash equivalents as of March 31, 2024.

Production Levels: Produced 1,376 MBoe during the quarter, with a daily production rate of 15.1 MBoed.

SandRidge Energy Inc (NYSE:SD) disclosed its financial and operational results for the first quarter ended March 31, 2024, through its 8-K filing on May 7, 2024. The U.S.-based oil and natural gas company, which focuses on the exploration, development, and production of crude oil, natural gas, and natural gas liquids, particularly in the Mid-Continent region of Oklahoma and Kansas, has declared a $0.11 per share cash dividend amidst a period of strategic operational enhancements.

Financial Performance

For Q1 2024, SandRidge reported a net income of $11.1 million, or $0.30 per basic share. Adjusted for specific items, the adjusted net income stood at $8.4 million, or $0.23 per basic share. The company demonstrated robust financial discipline, evidenced by $14.5 million in free cash flow, which aligns closely with its adjusted EBITDA of $14.7 million, marking a 99% conversion rate.

Operational revenues were reported at $30.3 million, with oil, natural gas, and NGLs contributing 51%, 20%, and 29% respectively. The realized pricing for oil stood at $75.08 per barrel, natural gas at $1.25 per Mcf, and NGLs at $23.65 per barrel.

Operational Highlights and Challenges

During the quarter, SandRidge produced a total of 1,376 MBoe, with daily production averaging 15.1 MBoed. The production mix included 15% oil, 58% natural gas, and 27% NGLs. Despite the challenges posed by seasonal cold weather, which impacted production activities, the company managed to maintain stable projected long-term decline rates through continuous production optimization efforts.

Lease operating expenses (LOE) were reported at $10.9 million or $7.92 per Boe, and general and administrative expenses were $3.3 million, or $2.42 per Boe. These figures reflect SandRidges ongoing focus on cost efficiency and operational excellence.

Strategic Initiatives and Outlook

SandRidge continues to prioritize high-return projects and capital discipline, adapting to the fluctuating commodity price landscape. The company's strategic initiatives include optimizing artificial lift systems and pursuing other capital-efficient workovers. With approximately $1.6 billion in net operating losses (NOLs), SandRidge is well-positioned to leverage these for future tax benefits, potentially enhancing shareholder value.

The company also remains committed to its ESG goals, notably achieving over 95% of produced water transportation via pipeline and maintaining no routine flaring of natural gas.

Liquidity and Capital Resources

As of March 31, 2024, SandRidge boasted a strong liquidity position with $208.5 million in cash and cash equivalents, and no outstanding debt. This financial stability supports the companys operational strategies and dividend payments, which totaled $59.7 million for the quarter, including a significant one-time dividend payout.

Investor Considerations

While SandRidge navigates through operational and market challenges, its focus on cost management, operational efficiency, and strategic capital allocation positions it as a resilient player in the oil and gas sector. Investors and stakeholders may find the companys commitment to returning value through dividends and maintaining a strong balance sheet particularly reassuring in the current economic climate.

For more detailed information, stakeholders are encouraged to review the full earnings report and attend the upcoming conference call scheduled for May 8, 2024.

Explore the complete 8-K earnings release (here) from SandRidge Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance