RBA Resumes Rate-Hike Talk on Renewed Inflation Concerns

(Bloomberg) -- Australia’s central bank resumed a discussion of interest-rate hikes at its May policy meeting before deciding that the case to stand pat was stronger as it aims to avoid “excessive fine tuning.”

Most Read from Bloomberg

One Dead After Singapore Air Flight Hit By Severe Turbulence

ASML and TSMC Can Disable Chip Machines If China Invades Taiwan

Hims Debuts $199 Weight-Loss Shots at 85% Discount to Wegovy

Jamie Dimon Says Succession at JPMorgan Is ‘Well on the Way’

Iran State TV Says ‘No Sign of Life’ at Helicopter Crash Site

Minutes of the Reserve Bank’s May 6-7 gathering showed the board discussed two options when it left the key rate at 4.35%, noting the risks around its economic forecasts were still “balanced” despite stronger-than-expected data in the run-up to the meeting.

The board “seems focused on looking through the ‘short‑term variation in inflation to avoid excessive fine‑tuning’,” said Belinda Allen, an economist at Commonwealth Bank of Australia. “As a result the hurdle to hike again seems high and instead the risks sit to a later start to the easing cycle than our base case” of November.

The minutes reinforced a widely-held view that rates are set to stay higher-for-longer, with Australian government bonds holding declines and sending the policy sensitive three-year yield rising for a third straight day. Swaps traders now see the RBA staying on hold until mid-2025.

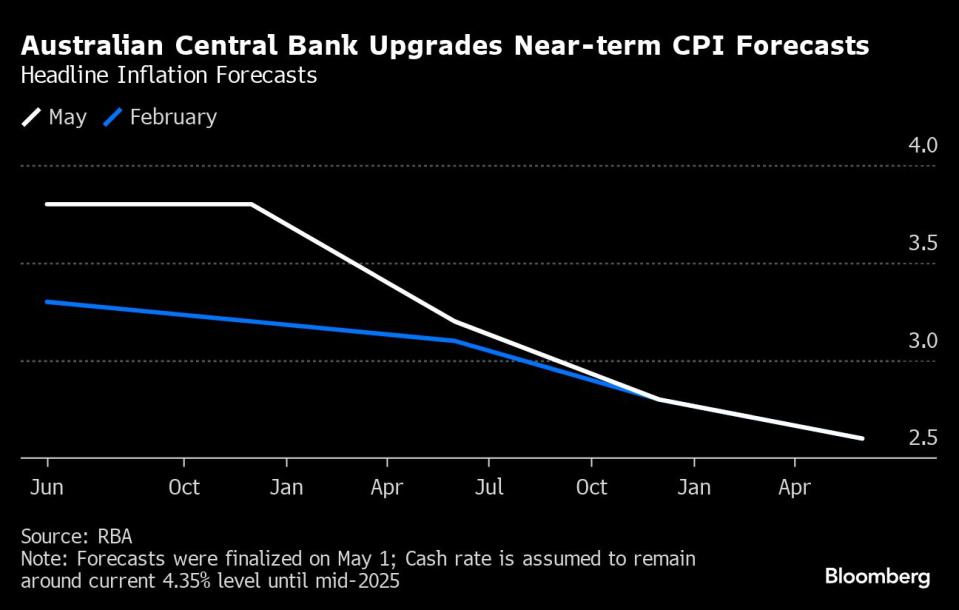

The central bank, which upgraded its near-term inflation forecasts, expects consumer prices to return to its 2-3% target in late-2025, from 3.6% in the first three months of this year. The updated outlook used a technical assumption of no change in rates until mid-2025.

“Members agreed that it was important to convey that recent data and other information had signaled that the risks around inflation had risen somewhat,” Tuesday’s release showed. “It was difficult either to rule in or rule out future changes in the cash rate target.”

The minutes showed the rate-setting board had “limited tolerance” for inflation returning to target later than 2026. ANZ Bank’s Adam Boyton said that line implies the board might be prepared to endure above‑target consumer prices for a little longer than previously anticipated.

“We continue to think that the economy is softening enough to deliver in target inflation and hence retain our view that the next move in the cash rate is down,” Boyton said. He expects a modest easing cycle of three cuts, starting in November.

Read more: RBA Retains Neutral Policy Bias as Key Rate Held at 12-Year High

Governor Michele Bullock has previously suggested the RBA won’t need to wait for inflation to be inside the band before cutting. Even so, she has repeatedly pushed back against speculation over near-term easing, reflecting the RBA’s forecasts that inflation will only return to target late next year.

Data recently has indicated that Australia’s economy is broadly slowing with GDP contracting on a per-person basis, while tepid retail sales reflect downbeat household sentiment.

A private report released earlier Tuesday showed consumer confidence edged lower this month over worries that persistent inflation will prompt the RBA to hike again.

Read more: Australia’s Consumer Confidence Edges Lower on Inflation Fears

At the same time, the labor market remains resilient, giving policymakers optimism that they can engineer a soft landing — bringing down inflation while holding onto the enormous job gains of recent years.

The minutes showed that raising the cash rate could be appropriate if:

The board formed a view that the judgments underpinning the staff forecasts risked being overly optimistic about disinflationary forces

If consumer spending picked up somewhat more rapidly, labor market outcomes remained benign, real household disposable income recovered and household balance sheets remained relatively strong. That together with further growth in public demand and business investment could delay inflation’s return to target

If trend productivity growth turned out to be weaker than assumed

--With assistance from Garfield Reynolds.

(Adds economists’ comments, market reaction.)

Most Read from Bloomberg Businessweek

Millennium Covets Citadel-Size Commodities Gains, Just Not the Risk

Netflix Had a Password-Sharing Problem. Greg Peters Fixed It

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance